(Bloomberg) — Goldman Sachs Group Inc.’s traders, on the way to posting their biggest revenue haul in more than a decade, are in for a surprise as cost pressures force the firm’s leadership to cut their year-end bonuses.

Executives in the firm’s global markets division were warned this week that its compensation pool will be slashed by a low double-digit percentage, according to people with knowledge of the discussions. That diverges with industrywide projections and the unit’s own outperformance. Goldman’s annual trading revenue is on track to top $25 billion, with analysts estimating it will eclipse last year’s mark by 15%.

The compensation discussions at this stage are the first salvo and could prompt further tinkering, the people said, asking not to be named discussing the internal deliberations. Already, the initial response has sparked a fresh round of back and forth to address some of the concerns.

A spokesperson for Goldman Sachs declined to comment.

Austerity is the new mood in the industry, with many veterans uncertain about the outlook for earnings in 2023. Investors are rewarding prudence and showing less patience for persistent expenses.

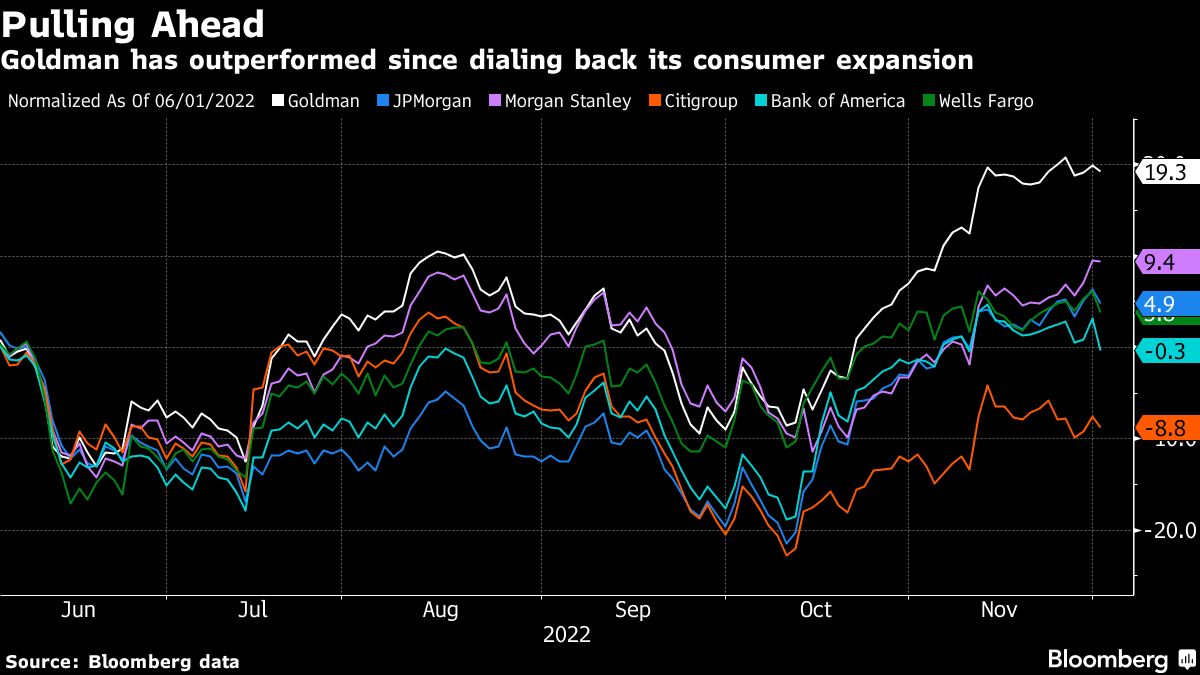

Goldman is in a unique position this year. Chief Executive Officer David Solomon and President John Waldron are trying to protect the firm’s profitability after a costlier-than-expected foray into consumer banking exacerbated the impact of a global slowdown in other business lines such as dealmaking. Solomon dialed back his Main Street aspirations in October, a move that was cheered by shareholders.

“Investor patience was wearing thin,” Bank of America analyst Ebrahim Poonawala wrote in a note. “Thankfully, David Solomon and team saw the light, made the pivot, and you have to assume that the decision has contributed” to the stock’s outperformance this quarter.

Goldman’s return on equity — a measure of profitability — stood at 12% for the first nine months. The company’s leaders are trying to prevent it from losing ground.

Getting Zeroed

Other major divisions will see even larger — albeit less surprising — cuts to bonus pools following slumps in those businesses.

The investment banking unit is bracing for a much steeper decline than the roughly 25% reductions it expects at competitors, the people said. And the number of bankers receiving zero bonus — or doughnuts in the industry’s parlance — could surpass 100, which would be an unusually large group.

A flurry of dealmaking set off by the Covid-19 pandemic in 2020, and a run-up in asset prices as governments stoked the economy, ended abruptly this year with slumping markets around the world. At Goldman, revenue from investment banking dropped 45% in the first nine months, while asset management generated 71% less.

Across Wall Street, bankers advising on M&A are likely to see their bonuses decline as much as 20% this year, while their counterparts in underwriting could see their incentive pay plunging as much as a 45%, according to a closely watched report from compensation consultant Johnson Associates last month.

A newly carved out Goldman division, dubbed Platform Solutions, is expected to post significant losses that will be disclosed to investors next month, the people said. The bank has already said it will need to scale that business to achieve pre-tax profitability. That unit includes the bank’s nascent credit-card operations and the installment-lending business GreenSky.

Technology costs and other expenses are also adding to the headaches, giving management little room for missteps.

©2022 Bloomberg L.P.