Market uncertainty can be a scary thing to do deal with. One of the things uncertainty does to a lot of investors is to make them more hesitant about taking on new positions, which makes some sense when it looks like the economy could be on the brink of a new recession.

The last couple of months have seen the market stage a rally that had some experts wondering what was going on. With a lot of questions out there about rising inflation on a global scale and a continued, hawkish stance from the Fed about interest rates, many seem to think it was nothing more than a “bear rally,” which is usually just a temporary period during an extended downturn where the major indices rally by 5 to 10% when investors find some reason for optimism about the economy, but is ultimately doomed to fall back in the direction of the longer market. I think there is some wisdom in the concept, because rather than diving “all in” as some investors might be tempted to do, recognizing a bear rally before it ends can keep you from making a poor decision at the worst possible time.

Economic uncertainty is a big reason that defensive-oriented stocks have remained an important part of my investing focus, and that is why one of the sectors that I have been paying the most attention to for most of the past four years (even before COVID became a thing) has been Consumer Staples. I like a number of industries in this sector, like Food Products and Grocery stores, which represent businesses that consumers still have to engage with even when times are difficult. That includes the so-called “sin stocks” – companies like TAP that provide alcoholic beverages along with other products that have historically continued to generate strong revenues even as consumers are forced to start tightening their belts. I think of this industry in a similar light as snack foods, where these products offer a “comfort factor” that consumers make a point to include in their household budgets.

Molson Coors Brewing Company (TAP) is a stock in this industry that offers a good example of the kind of resilience these companies can see in uncertain times. Despite ongoing pressures over the last three years that really only start with the pandemic, TAP has managed to maintain generally healthy free cash flow. That doesn’t mean they’ve been immune from the pandemic – the company suspended their dividend payout early in 2020 to help maintain that balance sheet strength, and were not able to reinstate it until the middle of 2021. Last year also saw the stock extend a downward trend from a June peak at around $61 to a November low at around $42, and hold in that lower end of its range through most of December. The new year saw the stock build a new upward trend that peaked in August at around $60, marking an increase of about 50% from its November 2021 low point. The stock dropped back sharply from that point to an October low at around $46.50, but rallied with the rest of the market to its latest peak at around $55 to start December. The real question at this stage, of course, is what does that latest move mean for the stock’s value proposition? And are the company’s fundamentals strong enough to support the stock as a useful, long-term value opportunity, or is this an example of a stock that could you to unnecessary risk at the worst time? Let’s find out.

Fundamental and Value Profile

Molson Coors Beverage Company is a holding company. It is engaged in brewing beverages. The Company operates through two segments: Americas and EMEA&APAC. The Americas segment consists of the production, marketing, and sales of its brands and other owned and licensed brands in the United States, Canada, and various countries in Latin and South America. It also has contract brewing agreements to brew, package and ship products. The EMEA&APAC segment consists of the production, marketing, and sales of its brands as well as several smaller regional brands in the United Kingdom, Central Europe, and various other European countries, along with certain countries within the Middle East, Africa, and the Asia Pacific. It also has licensing agreements and distribution agreements with various other brewers. The Company’s brands include Blue Moon, Carling, Coors Banquet, Coors Light, Miller Lite, Leinenkugel’s Summer Shandy, Creemore Springs, Hop Valley and more. TAP’s current market cap is $11.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings decreased by -24.57%, while sales were 2.36% higher. In the last quarter, earnings increased by about 11% while sales were flat, but 0.46% higher. TAP’s historically narrow margin profile turned negative during the pandemic, but turned positive at the end of 2021; more recently it is showing some new signs of strength. Net Income over the last twelve months was 3.85% of Revenues, but increased in the last quarter to 7.37%.

Free Cash Flow: TAP’s free cash flow is healthy, at $757.4 million for the trailing twelve month period. That translates to a Free Cash Flow yield of 6.59%. This number has declined over the last few quarters, from $1.07 billion a year ago.

Debt to Equity: TAP has a debt/equity ratio of .45, a relatively low number that indicates the company operates with a generally conservative philosophy towards leverage. The company doesn’t have great liquidity, with cash and liquid assets of about $525.2 million against $6.1 billion in long-term debt. It is worth noting at the end of 2020, cash was about $731 million while long-term debt was around $7.1 billion – meaning that while liquidity has dropped, long-term has also been reduced by a little over $1.2 billion. It is also true that since the end of 2018 the company has cleared more than $2.9 billion in long-term debt from their balance sheet – even while factoring in the difficulties of pandemic and other pressures over the last two and a half years.

Dividend: TAP pays a dividend of $1.52 per share, per year, and which translates to an annualized dividend yield of 2.87% at the stock’s current price. After reinstating its dividend in the final quarter of 2020, management increased its payout from $1.36 per share earlier this year. The reinstatement and the increase are a confirmation of management’s confidence.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $31 per share. That means that TAP is significantly overvalued, with about -41% downside from its current price and a practical discount price at around $25.

Technical Profile

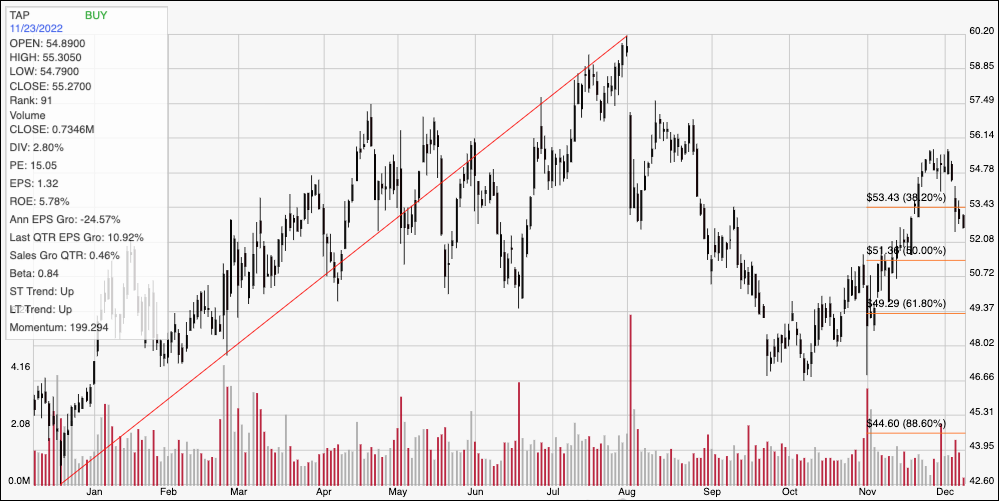

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price activity over the last year. The red diagonal line traces the upward trend from its December 2021 low at around $42.50 to its August peak at around $60. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After dropping to a temporary low at around $46.50 to start October, the stock rallied to about $55 at the beginning of this month, but has dropped back again to its current price at around $53. That marks immediate resistance at around $53.50 where the 38.2% retracement line sits, with current support at around $51 based on pivot low activity in April, May, June and September. A push above $53.50 will find next resistance around $55, with additional upside to about $57.50 if buying activity accelerates, while a drop below $51 should find next support at around $49 where the 61.9% retracement line waits. Additional downside exists to about $46.50 if selling momentum picks up.

Near-term Keys: With questions about the long-term health of the economy, including the chances the Fed’s current, hawkish tone will push economic activity straight into a recession, and the stock’s clearly overvalued status, I think this is a stock that falls into the category of a dangerous risk right now. Concerns about the company’s liquidity and declining Free Cash Flow are concerns. There are some useful strengths, including improving Net Income, declining long-term debt, but even with those in mind, I think this is a stock that is worth putting in a watchlist and coming back to If you prefer to work with short-term trading strategies, you could use a break above $53.50 could be a signal to buy the stock or to work with call options, using $55 as a useful, initial target price on a bullish trade. A drop below $51 could offer a signal to think about shorting the stock or working with put options, using $49 as a practical, quick-hit profit target on a bearish trade.