The start of a new year always bring with it a sense of hope and optimism about what’s ahead. That’s as true of the stock market as it is of anything else, and given the turbulence of 2022, it shouldn’t be too surprising that the broad market is starting the year looking to build new bullish momentum.

Whether that momentum can be maintained depends, of course on a lot of different factors that contributed to last year’s uncertainty. Rising interest rates, war in Ukraine, and increasing costs on both the corporate and consumer level all seem unlikely to see much relief in the near future, which reasonably suggests they will continue to act as headwinds this year. I’ve also noticed an increasing number of analysts turning pessimistic about whether the Fed will be able to achieve the “soft landing” it is targeting, and that are suggesting that a deeper economic drawback to legitimate recessionary conditions will be necessary.

Uncertain economic conditions tend to shift the way investors think about sectors of the economy and the industries that define them. While broadly bearish conditions affect most sectors negatively, the flip side is that for some industries, those same conditions create more in interesting long-term opportunities. One area where I think that’s true right now is in the Energy sector. There are a lot of dynamics at play at any given time that make the sector pretty volatile, and that is certainly true right now. Russia’s invasion of Ukraine is an excellent example, as major portions of energy production transportation, storage run through both countries in that region is just one reason that energy prices peaked in mid-2022.

Prices have also moderated significantly from that peak as of this writing, which has been both a positive and a negative for the companies that make up the sector. Negative, as declining crude and natural gas prices cut into profit margins, but also positive as they help to stimulate demand. In any event, the stability of energy prices through 2023 will certainly continue to impact not only the profitability of companies in the industry, but also the movement of their stock prices.

Devon Energy Corp (DVN) is an interesting company in the Oil & Gas industry. With prices currently running around $73, DVN’s model has historically been built to be profitable at significantly lower prices. From its own peak in November at around $80, the stock has dropped nearly -30% to its current level at around $59. Are the stock’s fundamentals strong enough to support the idea the stock should be higher, and is there a useful value proposition in place? Let’s find out.

Fundamental and Value Profile

Devon Energy Corporation (Devon) is an independent energy company engaged primarily in the exploration, development and production of oil, natural gas and natural gas liquids. Devon’s operations are focused onshore in the United States with five core areas: the Delaware Basin, Eagle Ford, Powder River Basin, Anadarko Basin and Williston Basin. Its Delaware Basin operates approximately eight rigs that offers exploration and development opportunities from geologic reservoirs, including the Wolfcamp, Bone Spring, Leonard and Delaware formations. The Eagle Ford operations are located in DeWitt county, Texas. The Powder River Basin asset is focused on oil opportunities targeting several oil objectives, including Turner, Parkman, Teapot and Niobrara formations. The Company’s Anadarko Basin is located primarily in Oklahoma’s Canadian, Kingfisher and Blaine counties. The Williston Basin is located entirely on the Fort Berthold Indian Reservation consisting of approximately 85,000 net acres.DVN has a current market cap of about $38.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by nearly 102%, while revenues also increased by nearly 57%. In the last quarter, earnings declined by almost -16% while sales slid -3.45% lower. The company operates with a robust margin profile that is showing signs of strength. Over the last twelve months, Net Income as a percentage of revenues were 33%, and increased to 34.85% over the last quarter.

Free Cash Flow: DVN’s free cash flow is a sign of strength, at a little under $3.5 billion over the last twelve months. This is an improvement over the past year, when Free Cash Flow was a $2.9 billion, but also a significant decrease over the last quarter, from $5.5 billion. Its current level translates to a Free Cash Flow Yield of 9.13%.

Debt/Equity: DVN carries a Debt/Equity ratio of .56. This is a generally conservative number that suggests management applies a conservative approach to leverage. Their balance sheet shows $1.3 billion in cash and liquid assets against about $6.2 billion in long-term debt. It is worth nothing that in the prior quarter, cash was nearly $3.5 billion.

Dividend: DVN’s annual divided is $5.17 per share, which translates to an impressive yield of about 8.9% at the stock’s current price. The company’s payout is a little over 50% of their earnings per share for the past year, however their healthy operating profile and generally healthy Free Cash Flow suggests that maintaining the dividend shouldn’t be a problem. I do think that continued, extended drawdowns of cash could force management to decrease their dividend payout.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target a little below $65 per share. That means the stock is modestly undervalued, with about 11% upside from the stock’s current price, and a practical discount at around $52 per share.

Technical Profile

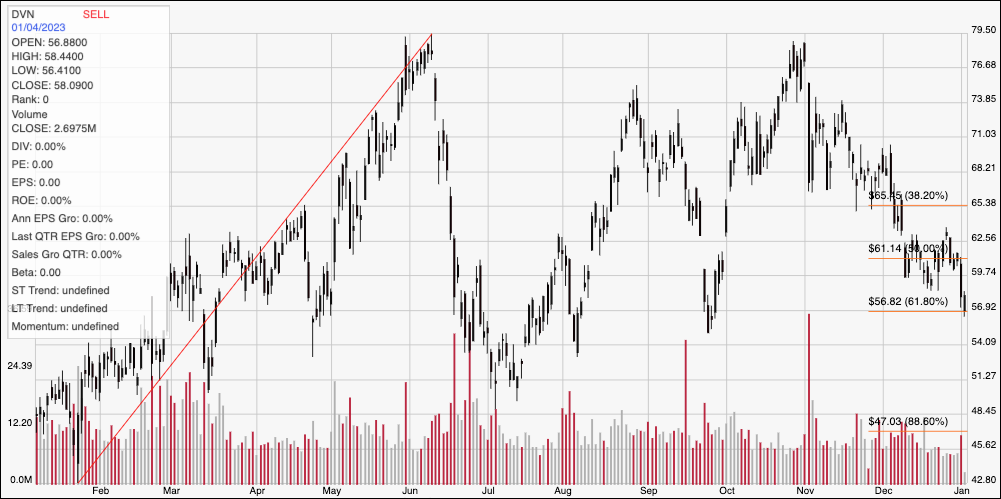

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal, dotted red line traces the stock’s upward trend from its low in January of last year at around $43 to its peak in May at around $79.50. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. DVN revisited that high in late October, but has fallen sharply to its current level at around $58 per share. Current support is at around $57, where the 61.8% retracement line lies, with immediate resistance expected at about $62.50. A push above $62.50 should find next resistance at around $67, a little above the 38.2% retracement line, while a drop below $57 should see downside to about $54 before finding next support.

Near-term Keys: The stock’s trend and momentum right now is strongly bearish, implying that looking for a short-term, bullish trade right now is aggressive, and even speculative. A drop below $57 would be a good signal to consider shorting the stock or buying put options, with $54 acting as a useful near-term exit target. If you are wiling to be aggressive, a push above $$62.50 could offer an interesting short-term opportunity with call options or buying the stock outright with an exit target at around $67 per share. What about value? I like DVN’s fundamentals, but do see declining liquidity as a risk element that I think warrants taking a conservative approach right now.