Listening to talking heads and market news media can lead you to believe that the most effective investing methods are those that focus on growth, and on the stocks that you hear about the most on those channels. Value-oriented, contrarian-minded investors like me tend to think a little differently, and to look for opportunities in the areas of the market everybody else tends to ignore.

The Food Products industry is a good example. While this is pocket of the economy that I think makes sense to focus on when market conditions become more uncertain and broad volatility starts to increase, it’s also an industry that tends to get dismissed because it is “boring”, and just not sexy enough to generate a lot of buzz. I think that’s a short-sighted view to take, because the truth is that demand for food doesn’t go away, in any economic environment.

Consumer trends during periods of economic expansion and extended bull markets often tend to pull away from established, “traditional” names and brands we’ve all grown up with, but when economic uncertainty is high – and inflation starts to push prices for food products across the board higher, as we’ve seen throughout the past year – a lot of households find themselves gravitating back to those familiar, “traditional” brands. A big reason those brands have been around for so long is the simple fact that they offer good value when household budgets start to tighten. They may not be disruptive in their industry, or all that “sexy”, but they do make it easier for parents to keep their pantries stocked and their kids fed. That also means that these companies’ stocks often offer attractive values, even when the rest of the market becomes increasingly risky.

The last couple of years have seen a big shift to some of these stocks, like Campbell Soup Co. (CPB), as families responded to the pandemic crisis by stockpiling and building up food storage in their homes. That meant that prepackaged, easy-to-prepare food products that can be stored for extended periods and stay good were immediately more attractive than they had been in some time. In the last year or so, earnings reports show that most of the momentum from that early surge has faded and been replaced by pricing pressures from supply chain issues and rising prices – costs that have also trickled into consumer prices as companies are forced to pass their rising costs further down the line. Even so, demand for these products has remained relatively healthy.

In late 2018, CPB finalized the acquisition of snack food company Snyder’s-Lance, bringing into their brand portfolio products that are generally considered “comfort foods”, like Kettle brand potato chips, Goldfish crackers, and Pepperidge Farm cookies (check your pantry – I’ll bet that you have at least one of those three brands sitting on a shelf as I do). That has helped them broaden their appeal away from just the soup aisle to other areas of your grocery store that are likely to keep them relevant and important. I think it’s also a reason that, while most analysts would still call CPB’s stock “boring,” its price has bucked the broad market’s trend, rising about 27.5% over the past year while stocks in a lot of other industries have not only dropped to their own bear market levels, but continue to struggle to find any kind of upward momentum since. The stock has faded off of its most recent, 52-week high at around $58 about a week ago to its current price a little below $56. That’s a small drop, but even with the stock just a couple of dollars away from its yearly high, CPB still offers an attractive value proposition on the back of a generally healthy set of fundamental metrics. Let’s dive in to the numbers.

Fundamental and Value Profile

Campbell Soup Company (CPB) is a food company, which manufactures and markets food products. The Company’s segments include Americas Simple Meals and Beverages; Global Biscuits and Snacks, and Campbell Fresh. The Americas Simple Meals and Beverages segment includes the retail and food service channel businesses. The segment includes the products, such as Campbell’s condensed and ready-to-serve soups; Swanson broth and stocks; Prego pasta sauces; Pace Mexican sauces; Campbell’s gravies, pasta, beans and dinner sauces; Plum food and snacks; V8 juices and beverages, and Campbell’s tomato juice. The Global Biscuits and Snacks segment includes Pepperidge Farm cookies, crackers, bakery and frozen products; Arnott’s biscuits, and Kelsen cookies. The Campbell Fresh segment includes Bolthouse Farms fresh carrots, carrot ingredients, refrigerated beverages and refrigerated salad dressings; Garden Fresh Gourmet salsa, hummus, dips and tortilla chips, and the United States refrigerated soup business. CPB’s current market cap is $16.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased 14.6%, while revenues were 15.16% higher. In the last quarter, earnings rose by more than 82%, while sales were more than 29.5% higher. CPB’s operating profile is healthy, and is showing strength in the face of rising input costs; in the last twelve months, Net Income was 8.91% of Revenues, and increased to 11.53% in the last quarter.

Free Cash Flow: CPB’s free cash flow is healthy, at $870 million over the last twelve months. This is slight decline over the previous quarter, when Free Cash Flow was $939 million, as well as over the last year, from $919 million. The current number translates to a Free Cash Flow yield of 5.21%.

Debt to Equity: CPB has a debt/equity ratio of 1.15, which indicates the company is highly leveraged. This isn’t especially unusual for the industry, and most of the company’s debt load is attributable to the 2018 Snyder’s-Lance acquisition. Cash and liquid assets were $130 million versus $357 million a year ago, which is a concern. Long-term debt is around $4 billion – a number that was a little over $5 billion at the end of 2021, and has dropped even more significantly since the Snyder’s-Lance deal closed, when long-term debt stood at around $8 billion. The company’s operating profile and healthy cash flow are good indications that servicing their debt is not a problem, but limited liquidity is a concern that bears watching.

Dividend: CPB pays an annual dividend of $1.48 per year, which at its current price translates to an annual yield of about 2.65%. Management also increased the dividend from $1.40 per year at the beginning of 2021, reflecting their confidence in the business in the months and years ahead.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target a little below $70 per share. That means the stock is nicely undervalued, with about 25% upside from its current price. It is also worth noting that in the last quarter of 2022, this same metric yielded a fair value target at $57.50 per share.

Technical Profile

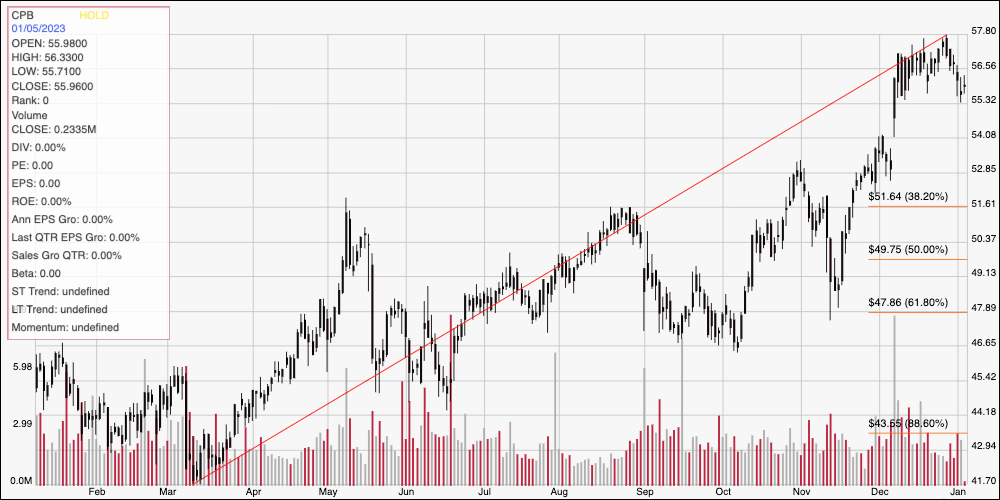

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s upward trend from a March low at around $42 to its recent peak at around $58 per share. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has dropped off of that high to mark immediate resistance at $58, and appears to have found current support at around $55 per share. Using the distance between current support and resistance suggests that a push above $58 should have about $3 of upside, to around $61 per share, while a drop below $55 should find next support at around $53, with additional downside to about $51.50, where the 38.2% retracement line waits to provide tertiary support.

Near-term Keys: CPB’s upward trend has been useful for growth investors in the past year. Even with the stock just off of its yearly high, the really interesting part for value seekers is that the stock still offers a very useful value proposition. If you prefer to work with short-term trading strategies, I think that the relatively limited downside makes a bearish trade a very low-probability prospect. However, a push above resistance at around $58 could offer an opportunity to buy the stock or to work with call options, with $61 providing a useful, short-term profit target on a momentum-based bullish trade.