Over the last few years, a big subject of focus in that sector has been the implementation and rollout of 5G infrastructure, and in the last year or so 5G adoption at the consumer level.

That’s because as 5G has been made available to consumers, the companies who have invested heavily in developing the technology that 5G relies, have been able to provide details about 5G adoption in their earnings reports.

Most of the market’s attention in 2022 was dominated by inflation, rising interest rates, and the ongoing, long-term effect of the war between Russia and Ukraine and the resultant, increasing political and economic isolation of Russia from the rest of the world. That was enough to keep the market at bear market levels throughout the year, and for Fed governors to signal their intention to keep interest rates high for most of 2023.

When it comes to 5G and the Internet of Things, all of the inflationary pressures I just described worked through 2021 and 2022 to keep supply shortages that Semi stocks were dealing with even prior to the pandemic in sharp focus. Those shortages have begun to moderate, which means that 5G capability and connectivity is becoming more broadly available – but that doesn’t mean issues don’t still exist.

Another interesting element is an undercurrent of nationalist fervor about chip manufacturing that has carried through the trade wars of 2018 and 2019 and the pandemic. That sentiment has put difficult barriers in place for Semiconductor companies relying on chip production out of China and other parts of Asia, which just adds a little more fuel to the already-burning fire. The anti-Asia production trend is strong enough, for example that Intel Corp (INTC) announced in 2021 that it would invest billions of dollars to build its own forge operations in Arizona and Ohio, creating a new business segment that stands not only to service INTC’s own needs, but also to potentially act as a production partner for the entire industry in the United States.

Skyworks Solutions (SWKS) is a company that specializes in radio frequency (RF) ships for smartphones and other “smart” technologies that make up the Internet of Things. Some of the broader economic headwinds I just described have been clearly reflected in the fundamental metrics I’ve come to rely on. Despite those headwinds, the company still boasts healthy operating margins a strong balance sheet, and an attractive dividend, Industry analysts also predict the company will continue to benefit from increasing 5G adoption as well as WiFi infrastructure improvements that will include SWKS RF solutions.

SWKS has followed a downward trend throughout the past year that found bottom in October at about $76 per share, and has rebounded to its current price at around $96. Despite that increase, the stock remains far below its 52-week high, at around $160 per share. For growth investors, that makes SWKS radioactive, and a stock to keep as far from an active portfolio as possible, but for a value investor, it begs the question of how the stock’s price movement relates to its fundamental profile. Has the stock dropped so far that the market discounted it too much? Does the stock’s current price offer a useful new long-term opportunity for both growth and value investors? If it does, SWKS could be a stock you should be paying attention to.

Fundamental and Value Profile

Skyworks Solutions Inc. designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company’s analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Its geographical segments include the United States, Other Americas, China, Taiwan, South Korea, Other Asia-Pacific, Europe, Middle East and Africa. It operates throughout the world with engineering, manufacturing, sales and service facilities throughout Asia, Europe and North America. It is engaged with key original equipment manufacturers (OEM), smartphone providers and baseband reference design partners. Its product portfolio consists of various solutions, including amplifiers, attenuators, detectors, diodes, filters, front-end modules, hybrid, mixers, switches, and modulators. SWKS has a current market cap of $15.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 15.3%, while sales rose by 7.33%. In the last quarter, earnings grew by 31.6%, while sales increased by 14.15%. SWKS operates with an impressive margin profile that has weakened somewhat; Net Income was 23.25% of Revenues over the last twelve months, and tapered in the last quarter to 21.48%.

Free Cash Flow: SWKS has healthy free cash flow of about $943 million over the last twelve months. This number has declined over the last year when it was $1.25 billion, as well as from the prior quarter, which was $983.5 million. The current number translates to a Free Cash Flow Yield of 6.17%.

Debt to Equity: While SWKS had zero debt on its balance sheets dating back to the beginning of 2015, the company took on a significant amount of debt at the beginning of 2021 to help bolster its balance sheet. Cash and liquid assets as of the last quarter were $586.3 versus about $1.7 billion in long-term debt (versus $2.1 billion in long-term debt a year ago). Their healthy operating profile and generally solid balance sheet gives the company more than adequate ability to service their debt.

Dividend: SWKS pays an annual dividend of $2.48 per share, which at its current price translates to a dividend yield of about 2.6%. It should be noted the company boosted its dividend in 2021 by 12%, and then again in August of 2022 to its current level – all of this following a raise in 2020 when a lot of other companies throughout the stock market were suspending or eliminating dividend payouts to preserve cash.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $126 per share, which means that SWKS is nicely undervalued, with about 30% upside from its current price.

Technical Profile

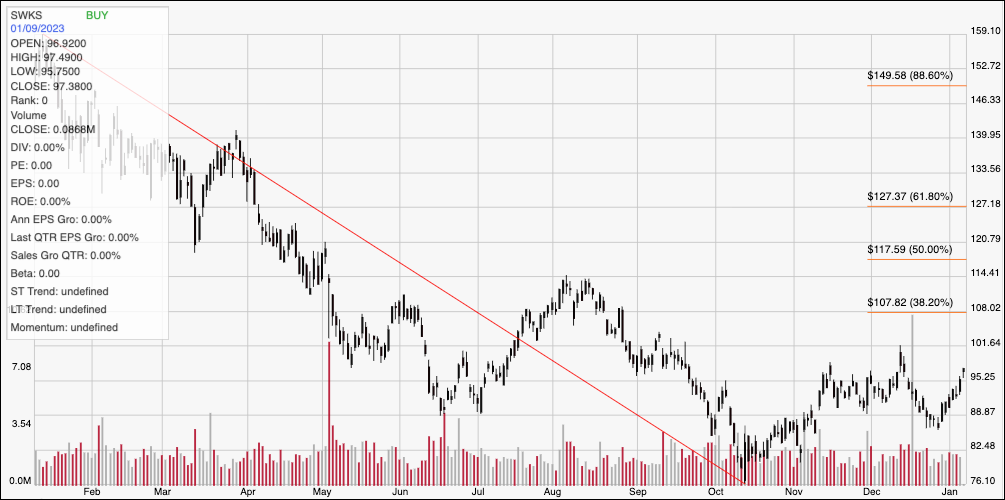

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price activity over the past year. The red diagonal line traces the stock’s downward trend from its starting point last January at around $159 to its October low at around $76. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that low, the stock is actually about $20 higher, but still remains significantly below all of its Fibonacci retracement lines. Immediate resistance is around $100, there the stock peaked in late December, with current support sitting at around $90. A drop below $90 should find next support somewhere between $80 and the stock’s 52-week low at $76, while a push above $100 could see upside to about $110 before finding next resistance.

Near-term Keys: SWKS’ long-term downward trend pushed the stock to the point where it’s value proposition was impossible to ignore at the end of 2022. The really interesting thing is that even with the stock’s rally since then, it still offers a compelling value opportunity. If you prefer to focus on short-term trading strategies, there could be some useful opportunities to work with the stock’s current price activity. A push above $100 could offer an interesting signal to buy the stock or work with call options, with $110 providing a useful bullish profit target. A drop below $90, on the other hand could be a signal to consider shorting the stock or buying put options, using $80 as a practical profit target on a bearish trade.