When you filter through all the noise about inflation, interest rates, and war, the main question for 2023 is whether the market will stage a recovery from 2022’s bear market.

That, of course begs the question, at least to me, of whether 2022’s economic headwinds – inflation, supply constraints, war, and rising interest rates that they all translated into – will abate this year.

While COVID has taken a back seat of late, the truth of course is that many of the questions and issues around it remain. While most of the business and social activities that were restricted, delayed, or deferred in 2020 and 2021 have resumed, COVID variants are still out there. That means that spikes in infections and hospitalizations continue to emerge and remain an area of focus for the healthcare community. While moving into an “endemic phase” may not demand the same kind of attention or level of resources on coronavirus it has up to now, I do think that the Health Care sector is going to continue to be an area that smart investors should keep their eye on. That includes stocks in the Pharmacy/Drugstore industry; these were names, like Walgreens Boots Alliance (WBA) and CVS Corporation (CVS), for whom the last three years have prompted major operational shifts, and significant capital investments in expanding the scope of health services and care they provide.

In the U.S., intense competition has spurred major consolidation, leaving just CVS and WBA standing among recognized national pharmacies and looking for ways to innovate to counter not only the competition from each other but also from other companies like Amazon, WalMart, and Costco, to name just a few. For both of these companies, evolution and transformation have become a primary theme over the last few years. Along with its merger with health insurer Aetna, CVS is actively renovating and remodeling local retail locations into combined pharmacy and health care service centers in the form of MinuteClinic and HealthHUBs. WBA isn’t standing pat either, investing heavily to roll out full-service primary care clinics as part of a partnership with VillageMD, and then going all-in late last year when they announced the outright acquisition of VillageMD into its corporate organization.

If you look at the overall market for the pharmacy space, it becomes pretty easy to see that long-term demographic trends are generally favorable for pharmacies. Continued aging of the Baby Boomer generation, with Generation X following not far behind in the next decade or two, means that demand for prescription drugs and related health care services is expected to only increase. When you add in other fundamental factors like WBA’s long-standing status as a dividend aristocrat (members of the S&P 500 Index that have paid a dividend for 25 consecutive years or more) and healthy Free Cash Flow, it is interesting to look at the stock’s price performance.

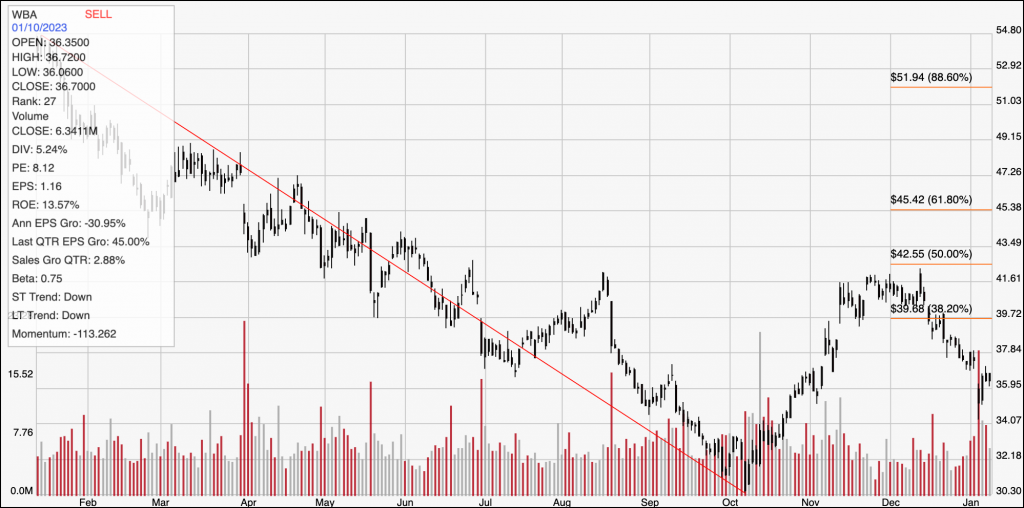

WBA has been following a downward trend since April 2021. That trend saw a temporary shift in the third quarter of 2022, as the stock rallied along with the rest of the market from a multiyear low at around $30 to peak in December at around $42 per share. The stock has faded back from that point, sitting a little below $37 as of this writing. Many of the pandemic-driven headwinds that had a positive impact on the company’s bottom line have faded, while management is also driving significant investment in accelerating the buildout of their VillageMD care clinics. Those are factors that I think have contributed to the stock’s underperformance so far, but also that could signal the stock’s useful long-term opportunity. Does that mean the stock’s value proposition is worth paying attention to?

Fundamental and Value Profile

Walgreens Boots Alliance, Inc. is a holding company. The Company is a pharmacy-led health and wellbeing company. The Company operates through three segments: Retail Pharmacy USA, Retail Pharmacy International and Pharmaceutical Wholesale. The Retail Pharmacy USA segment consists of the Walgreen Co. (Walgreens) business, which includes the operation of retail drugstores, care clinics and providing specialty pharmacy services. The Retail Pharmacy International segment consists primarily of the Alliance Boots pharmacy-led health and beauty stores, optical practices and related contract manufacturing operations. The Pharmaceutical Wholesale segment consists of the Alliance Boots pharmaceutical wholesaling and distribution businesses. The Company’s portfolio of retail and business brands includes Walgreens, Duane Reade, Boots and Alliance Healthcare, as well as global health and beauty product brands, including No7, Botanics, Liz Earle and Soap & Glory. WBA has a current market cap of $32 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by about -31%, while sales were -1.53% lower. In the last quarter, earnings improved by 45% while sales grew by 2.88%. The company’s margin profile is normally razor-thin, but is showing significant signs of deterioration; over the last twelve months Net Income was -2.24% of Revenues, and weakened even more in the last quarter, to -11.15%. I take the drop to negative Net Income over both periods as a clear reflection of the challenges associated with rising costs that have impacted every sector, but are most clearly seen in businesses tied to retail activity.

Free Cash Flow: WBA has free cash flow of $2.9 billion over the last twelve months. This number has declined from August of 2018, when it was about $6.9 billion as well as over the past year, when Free Cash Flow was about $4.5 billion. The current number also translates to a still-healthy healthy Free Cash Flow Yield of 9.22%.

Debt to Equity: the company’s debt to equity ratio is .32, which is a conservative number. Long-term debt has decreased, from about $11.2 billion a year ago to $7.7 billion in the last quarter. It is also noteworthy that the company retired about $2.9 billion in long-term in the last quarter. Liquidity is healthy, with about $4.2 billion in cash and liquid assets versus roughly $1.9 billion a year ago. Despite the decline, the company’s liquidity is still healthy and suggests debt management should not be a concern, however the decline and drop to negative Net Income are something to keep an eye on and could be a challenge if it persists in the quarters ahead.

Dividend: WBA pays an annual dividend of $1.92 per share, which translates to an annual yield of 5.23% at the stock’s current price. WBA also increased their dividend from $1.87 per share in 2021, and from $1.91 in 2022 – which is a sign of strength and a confirmation of the company’s status as a Dividend Aristocrat.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $38 per share. That means the stock is pretty fairly valued, with just about 3% upside from its current price, and a practical discount sitting at around $30 per share. It should also be noted that at the beginning of the fourth quarter of 2022, this same metric yielded a fair value target of $52.50.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price activity over the last year; the diagonal red line traces the stock’s downward trend from a high in January of last year at around $55 to its low, reached in October at around $30. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After rallying to a December peak at around $42, the stock has dropped back again, but recently saw a new pivot low to set up current support at around $35 per share. Immediate resistance is around $38, where the stock last saw pivot activity in July of last year. A push above $38 should have upside to about $40, where the 38.2% retracement should provide next resistance, while a drop below $35 could see the stock fall to about $32 before finding next support, with a retest of Octobers $30, multi-year low possible if selling activity accelerates.

Near-term Keys: While WBA’s fundamentals are generally solid, I do think that the company’s shift to negative Net Income is a significant red flag that should give even aggressive growth investors pause. It’s certainly enough to validate the argument in my mind that the stock doesn’t offer a useful value-driven opportunity right now. If you prefer to focus on short-term trades, you could use a drop below $35 as a signal to consider shorting the stock or working with put options, with an eye on an initial profit target at around $32. If the stock pushes above $38, there could be an interesting signal to buy the stock or work with call options, using next resistance at $40 as a useful, quick-hit, bullish profit target.