In 2022, one of the sectors that experienced significant challenges was the Materials sector, experiencing a drop of about -30% from its mid-year high to its October 2022 low.

I find the Materials sector to be one of the more interesting sectors of the market, because it encompasses a pretty wide range of business types. It’s also an industry that the average consumer probably doesn’t think much about, I think primarily because as consumers we tend to be aware of just the finished goods and products that we use at any given time. Stocks in this sector, however, are usually the companies that provide the components that manufacturers use to create the products and goods we consume. That’s where the diversity of business types comes into play: the sector includes paper manufacturers and wood processors to chemical companies producing everything from plastics to fertilizers and more.

The shift over the past year from pandemic-driven restrictions to normalized business and social activities have coincided with significant increases in inflation, which have naturally prompted increases in interest rates. Which some market analysts are “hoping” that rates have plateaued, and might even start to come down in 2023, Fed governors so far have indicated an expectation for at least a couple more rate increases, followed by a period where they will be maintained at those peak levels until indications are clear they’ve had the constraining effect on indicators like employment and consumer demand to justify any kind of easing in monetary policy.

An interesting place to analyze the economy’s impact is on the demand for agricultural products like corn. Corn is a crop that is used for everything from the dinner on your plate to the production of ethanol, a fuel additive designed to make fuel consumption cleaner and more environmentally friendly. High corn demand also over to the Materials sector, specifically as it relates to the need for nitrogen fertilizers. In 2020, favorable weather in the U.S. during the first quarter gave farmers an opportunity to start planting early, which then contributed to oversupply issues on this commodity that began with the collapse of demand at the beginning of the pandemic.

In 2022, and going into this year, additional pressure has come from the Russia-Ukraine war and its impact on global grain as well as natural gas supply. Those acted as a drag on companies in the Materials sector like CF Industries Holdings Inc (CF). This is a mid-cap producer of nitrogen and phosphate fertilizer. That makes them highly dependent on natural gas and ethanol, and subject to the variances in prices of those commodities. From a peak in April of last year at around $91.50, the stock dropped to an October at around $67 before following the rest of the market higher into the end of 2022. The stock has picked up some bullish momentum since the start of the year, which could make it interesting for growth-oriented investors. What about bargain hunters? How does the stock’s current price activity, along with the company’s fundamentals, speak to its value proposition? Let’s find out.

Fundamental and Value Profile

CF Industries Holdings, Inc. manufactures and distributes nitrogen fertilizer, and other nitrogen products. The Company’s nitrogen fertilizer products are ammonia, granular urea, urea ammonium nitrate solution (UAN) and ammonium nitrate (AN). Its other nitrogen products include diesel exhaust fluid (DEF), urea liquor, nitric acid and aqua ammonia, which are sold primarily to the Company’s industrial customers, and compound fertilizer products (nitrogen, phosphorus and potassium or NPKs). The Company’s segments include ammonia, granular urea, UAN, AN and other. The Company’s ammonia segment produces anhydrous ammonia (ammonia), which is concentrated nitrogen fertilizer as it contains 82% nitrogen. The granular urea segment produces granular urea, which contains 46% nitrogen. The UAN segment produces urea ammonium nitrate solution. The Other segment includes DEF, urea liquor, nitric acid and NPKs. The Company’s primary nitrogen fertilizer products are ammonia, granular urea, UAN and AN.CF has a current market cap of about $17.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 165.6% (not a typo), while revenues were more than 71.4% higher. In the last quarter, earnings declined by -58.8% while sales were -31.5% lower. The company’s margin profile is healthy, but has weakened over the last three months; Net Income as a percentage of Revenues in the last quarter is 18.87%, from about 28.7% over the last twelve months.

Free Cash Flow: CF’s free cash flow is $4.3 billion, and has been increasing steadily over the past year, from about $2.36 billion a year ago. That translates to a Free Cash Flow of 25.22%, and provides a useful counter to the negative Net Income pattern described above.

Debt to Equity: CF’s debt to equity is .42, a conservative number that signals the company’s conservative approach to leverage. Their balance sheet shows cash and liquid assets were about $2.2 billion in the last quarter (an increase from $1.6 billion a year ago, versus $2.96 billion in long-term debt. Their free cash flow along with healthy operating margins, along with their healthy liquidity indicate that they have sufficient operating income to service their debt.

Dividend: CF’s annual divided is $1.60 per share, which translates to a yield of about 1.84% at the stock’s current price. It also noteworthy that the dividend increased from $1.20 per share a year ago, which I take as a strong indication of management’s confidence in their long-term approach.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $95.50 per share. That means that at the stock’s current price, it is somewhat undervalued, with about 19% upside from its current price, and a practical discount price at around $76.50.

Technical Profile

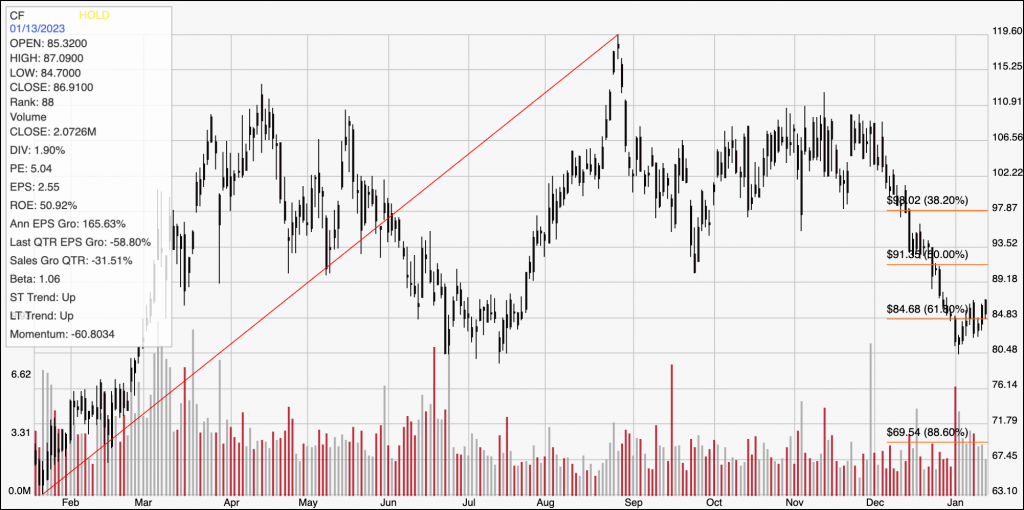

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s upward trend from January of last year to to its high point in October at around $120 per share. It also provides the baseline for the Fibonacci retracement levels shown on the right side of the chart. From that high, the stock has dropped, picking up bearish momentum in December to find support at a pivot low that occurred at the start of January at around $80.50. The stock has rallied from that low, pushing above the 61.8% retracement line as of this writing to mark current support at around $84.50 (previous resistance becomes new support). Immediate, next resistance should be seen at around $90 per share. A drop below $84.50 should find next support at last major pivot low, at around $80.50, while a push above $90.50 could see upside to about $98, where the 38.2% retracement line waits.

Near-term Keys: CF’s fundamentals have held up well during the last year, and are showing some signs of useful improvement. I do see the last quarter’s decline in Net Income compared to its trailing twelve-month number as a concern, however its other strengths are enough to suggest it could simply be a cyclical question. That said, the stock’s value proposition isn’t high enough to make a compelling case for the stock as a long-term investment at its current price. That means that the best probabilities for success lie in short-term, momentum-driven trading strategies. A drop below $84.50 would be a strong signal to consider shorting the stock or buying put options, using $80.50 as a useful and practical profit target on a bearish trade. The stock’s latest push above resistance at $84.50 could also act as a useful signal to think about buying the stock or working with call options, using $90 as a useful, initial profit target on a bullish trade, and $98 providing a secondary price target if buying activity intensifies.