For most of the past year, the Basic Materials sector has offered some of the most interesting cases for value-based investing.

While a number of stocks in the sector have since surrendered most, or even all of the gains seen in their early-year rallies, their drops have continued to make them attractive targets of opportunity. Finding the balance between opportunity and risk is something that every investor has to find for themselves. Understanding when to hang on and let the market, and the stock, work its way through its inevitable ebbs and flows, and when to call a duck, a duck and simply move on can be based on strict, quantitative analysis, but is often also pretty subjective, making the entire exercise as much art as science.

That idea of finding useful “targets of opportunity” when the broad market is highly uncertain is one of the reasons I like to put so much emphasis not only on a stock’s valuation but also on its fundamental strength. The market’s momentum can and will effect every stock at some point, no matter what my fundamental and value metrics may say about what a stock’s price could be; but if the drop is coming from market momentum while solid fundamentals remain in place, the value proposition gets even more compelling. Eventually, the market is going to recognize the discount as well, and when it does it will push the stock back up again. The folks that will be best positioned to take advantage of that bullish reversal won’t be the ones that tried to time the reversal, but those that recognized the value proposition during the drop and weren’t afraid to start buying while it was there.

The Basic Materials sector is made up of industries, and companies that transform raw materials and chemicals into the components and goods that other industries use to create and produce the finished products that businesses and consumers use. That’s why I really like the sector as a barometer for broad economic conditions. The fact is that many of these companies produce goods that are needed and continue to see demand even during difficult economic times, which also makes the sector an interesting one to think about using when everybody else is running away from the market as fast as they can.

The smartest companies in this sector recognize the that exposure to the variability of costs in raw materials and commodities injects in their business and actively consider ways to minimize and manage those variances on a long-term basis. I think the intelligence many of these management teams have about how to run their business in every economic condition is just more reason that there are useful opportunities that can be found in this sector right now if you’re willing to take the time to dig into them.

Dow Inc. (DOW) is a stock that has only been traded publicly since early 2019, but is also a company with a long history behind it. Spun off into its own public entity from DowDupont, its primary subsidiary, Dow Chemical, is one of the three largest chemical producers on the planet. When DOW was spun off of DowDupont, the new company was immediately added to the Dow Jones Industrial Average. Even with the difficulties that have been associated with global conditions over the past three years, this is a company that has leveraged its position as a market leader, along with its economies of scale, to manage raw materials cost risks that many expect to extend through 2023. They also boast healthy free cash flow, a generally solid balance sheet, and a very attractive dividend. From the end of April 2022, this stock followed the sector, and the broad market almost -27% lower to an October 2022 bottom at around $43. The stock has rallied strongly from that low, picking up particular momentum since the start of the year to extend its rally from that bottom into a useful, new upward trend. While that’s interesting for a growth-focused investor, it begs the question of whether the stock has rallied past the point of useful value. Let’s dive in.

Fundamental and Value Profile

Dow Inc. is a holding company for The Dow Chemical Company and its subsidiaries (TDCC). The Company’s portfolio of plastics, industrial intermediates, coatings and silicones businesses delivers a range of science-based products and solutions for its customers in various market segments, such as packaging, infrastructure, mobility and consumer care. The Company’s portfolio is comprised of six global business units, which are organized into three operating segments: Packaging & Specialty Plastics, Industrial Intermediates & Infrastructure and Performance Materials & Coatings. Packaging & Specialty Plastics consists of two global businesses: Hydrocarbons & Energy and Packaging and Specialty Plastics. Industrial Intermediates & Infrastructure consists of two customer-centric businesses: Industrial Solutions and Polyurethanes & Construction Chemicals. Performance Materials & Coatings includes two global businesses: Coatings & Performance Monomers and Consumer Solutions. DOW has a current market cap of about $40.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by nearly -60%, while revenues shrank almost -5%. In the last quarter, earnings were almost -52% lower, while sales growth declined by about -10%. The company’s margin profile is stable, but weakening, with Net Income that was 9.6% of Revenues over the last twelve months, and 5.24% in the last quarter. I take the decline, along with the decline in earnings (and the fact this pattern has extended over the last two quarters) as indications of rising input costs that are a common theme in just about every sector of the economy right now.

Free Cash Flow: DOW’s free cash flow is very healthy. It was about $5.5 billion in the last quarter versus a little over $6.3 billion in the quarter prior. The current number also translates to an attractive Free Cash Flow Yield of 13.54%.

Debt to Equity: DOW’s debt/equity ratio is .69. This is generally a low number that indicates management takes a conservative approach to leverage. Their balance sheet shows $2.2 billion in cash and liquid assets (down from $3.1 billion about six months ago) versus about $12.9 billion in long-term debt. It should be noted the company has paid down a little over $1.2 billion in long-term debt over the last six months.

Dividend: DOW’s annual divided is $2.80 per share, which translates to a yield of 4.87% at the stock’s current price. It is worth noting that the company’s dividend has been consistent at this level since its spinoff from DowDupont, and did not change in 2020 when many companies throughout the marketplace were slashing or eliminating their dividends altogether.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. The fact that this company has existed as a publicly traded entity for less than three years provides a limited historical sample to work with, so I have also incorporated the company’s PEG ratio, which adds estimates for the company’s future growth to the mix. All together, these measurements provide a long-term target at about $70 per share. That suggests that even with the stock’s building upward trend, the stock’s value proposition remains attractive, with a 20% discount from its current price.

Technical Profile

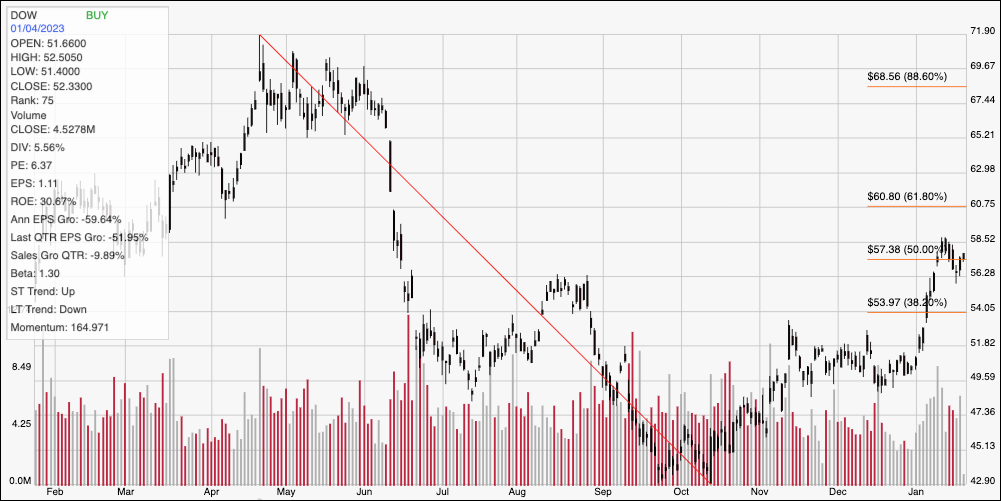

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s downward plunge from its high in April of last year at around $72 to its low, reached last October at around $43. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has been building bullish momentum off of that low, with immediate resistance at the latest pivot high at $58.50 and right around the 50% retracement line. Current support is around $56, at the stock’s most recent pivot low from last week. A push above $58.50 should have near-term upside to about $61 where the 61.8% retracement line waits, while a drop below $56 should find next support at around $53 around the 38.2% retracement line.

Near-term Keys: I think DOW’s fundamental profile in the face of the past three year’s worth of difficult economic conditions is a very interesting story, with a value proposition that continues to be useful. That doesn’t dismiss the reality of declines in free cash flow, net income and liquidity over the last six months; instead, I’m chalking them up to broader economic conditions that may persist and continue to challenge the company in the near term. I also think DOW is better positioned than most companies in its sector to navigate those difficulties which is why I think DOW is still a solid stock to consider as a long-term, value-based opportunity. If you prefer to work with short-term trading strategies, a push above $58.50 could be a good signal to think about buying the stock or working with call options, with a useful profit target at around $61. A drop below $56 could see downside to about $53 before finding next support, which could provide a good opportunity to think about shorting the stock or buying put options.