Every year begins in the stock market by investors, analysts and experts all trying to find the thread that will define economic and market activity for the next twelve months.

Trying to find that thread, of course is as much guesswork, at least in the early stages of the year, as anything else when it comes to predicting market action or direction. 2022 was filled with uncertainty in the marketplace. Inflation, rising interest rates and war were the biggest headlines that kept the markets on edge, pushing the market into a confirmed bear market that eventually found its bottom in October of last year.

Some have used the market’s rally from that low through the end of 2022 and into most of January as a sign that there are better times to come for the market in 2023. How long it might last – or whether larger concerns will finally take down the economy for real – is today’s version of the proverbial million-dollar question, that of course nobody can definitively predict (although lots of people are willing to try).

The market’s movements throughout the past year, and certainly over the last few months brings the concept of cyclicality back into focus. While everybody wants to keep the good times rolling and see long-term market rallies extend into infinity, the reality is that economies ebb and flow through cycles of prosperity to scarcity and back again. Cyclicality can also be seen in the stock market, as stock prices follow their own ebb and flow. Industries whose peaks and valleys tend to coincide with broad economic conditions are known as cyclical stocks.

Cyclical stocks are those that are expected to do well when economic conditions are generally healthy, and that will naturally struggle when the economy struggles. One of the core sectors of the economy that fits this very generalized description is the Transportation sector, which takes in a broad set of industries, including airlines, railroads, trucking and freight, overseas shipping, and so on. One of the major contributors to rising costs throughout the economy have been constraints on the supply chain, along with rising fuel prices. These are dynamics that generally work against stocks in the Transportation industry.

Uncertainty and volatility amid signs that the economy is struggling mean that you can often find stocks in these industries trading at pretty significant discounts to their not-so-distant highs. That makes them tempting fodder for a contrarian, value-oriented investor. I like to pay attention to these stocks, because their fundamentals can give me some useful clues about their ability to weather an economic downturn. These are also stocks that, like any other, can see big swings from high to low based on nothing more than the market’s expectation for what the economy might do in the near future.

CSX Corporation (CSX) is a good example of the kind of stock I’m referring to. As one of the four largest transportation companies in the oligopoly that is the U.S. Road & Rail industry, this is a stock that is very sensitive to a variety of economic dynamics, from commodity and fuel prices to interest rate fluctuations. The collapse of oil prices during the pandemic might have been taken as a good thing for this sector, since fuel costs should generally be lower; but as economy activity ground to a halt during the second quarter of 2020, so did the demand for transportation services. Rising interest rates and supply challenges for the past year have led to rising cost for practically every sector of the economy; but an interesting tailwind for Road and Rail stocks comes in the tragedy that is Russia’s war with Ukraine. That conflict has disrupted the supply of energy commodities from that region, which is crucial for all of Europe, and that has kept prices for crude as well as natural gas products elevated relative to pre-2022 levels. That disruption means that international demand for energy products from North America should remain high, I believe well into next year. That should provide a healthy boost for the Road & Rail industry that I think CSX stands to benefit from.

The sensitivity of stocks like CSX to the kind of pressures and dynamics I’ve just outlined is why it is important to take a critical look at the company’s balance sheet and overall fundamental strength. This is a company with a strong fundamental profile, and a balance sheet that has weathered the economic storms of the past three years remarkably well and still appears well positioned now. That is a positive sign that bodes well for the company in the long-term; for bargain hunters, the stock’s current trading price prompts the question of whether CSX represents a compelling enough value under current market conditions to justify taking its long-term opportunity seriously. Let’s dive in.

Fundamental and Value Profile

CSX Corporation is a transportation company. The Company provides rail-based freight transportation services, including traditional rail service and transport of intermodal containers and trailers, as well as other transportation services, such as rail-to-truck transfers and bulk commodity operations. The Company categorizes its products into three primary lines of business: merchandise, intermodal and coal. The Company’s intermodal business links customers to railroads through trucks and terminals. The Company’s merchandise business consists of shipments in markets, such as agricultural and food products, fertilizers, chemicals, automotive, metals and equipment, minerals and forest products. The Company’s coal business transports domestic coal, coke and iron ore to electricity-generating power plants, steel manufacturers and industrial plants, as well as export coal to deep-water port facilities. CSX has a current market cap of $63.2 billion.

Earnings and Sales Growth: Over the last twelve months, earnings were 16.67% higher, while sales increased more than 8.84%. In the last quarter, earnings declined -5.77% while sales were -4.24% higher. CSX operates with a healthy, robust margin profile that has been remarkably resilient, and has even strengthened; in the last twelve months, Net Income was a little over 28% of Revenues, and narrowed only slightly to 27.29% in the last quarter.

Free Cash Flow: CSX’ Free Cash Flow is healthy, at about $3.5 billion. That is somewhat lower over the past year, when Free Cash Flow was $3.9 billion, and from $3.8 billion in the last quarter. Their current Free Cash Flow number translates to a Free Cash Flow Yield of 5.5%.

Debt to Equity: CSX has a debt/equity ratio of 1.39. This indicates the company is highly leveraged; but this is also very typical of stocks in the Transportation industry. Their balance sheet shows $2.1 million in cash and liquid assets against about $17.9 billion in long-term debt as of the most recent quarter. The company’s operating profile suggests there should be no problem servicing the debt they carry.

Dividend: CSX pays an annual dividend of $.40 per share, which at its current price translates to a dividend yield of about 1.33%. Their dividend payout ratio is also conservative, at less than 25% of their earnings over the last year.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $32.50 per share. That means the stock is somewhat undervalued at its current price, with 7.7% upside from its current price, and a practical discount sitting at around $26 per share.

Technical Profile

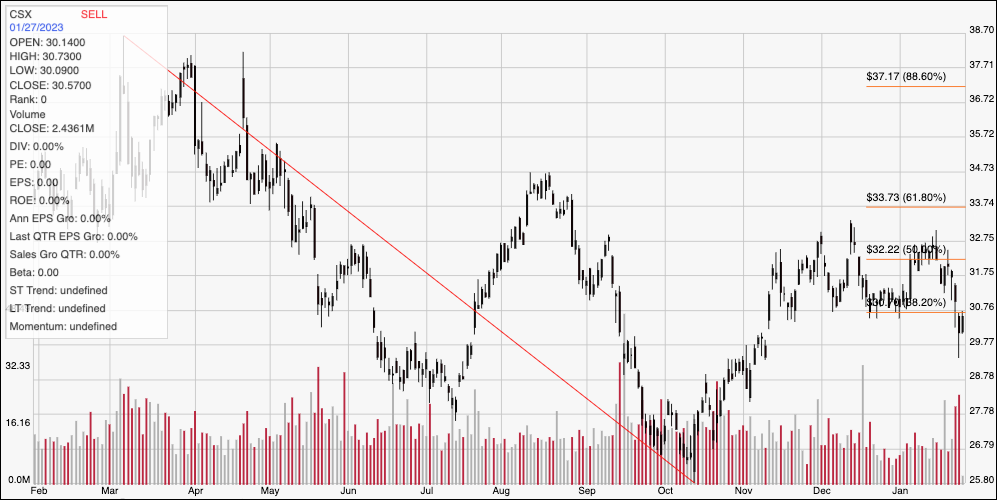

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the past year of price activity for CSX. The red diagonal line traces the stock’s downward trend from its March 2022 high at around $39 to its October 2022 low at around $26. It also provides the baseline for the Fibonacci retracement levels outlined on the right side of the chart. From its low, the stock rallied peak in December at around $33. It settled into a range between $33 and $31 until earlier this week, and has dropped below $31 to mark immediate resistance at that point, with current support expected at around $30. A drop below $30 could see additional downside to about $28 if selling pressure accelerates. A push above $31 will find next resistance at around $33.

Near-term Keys: CSX is a stock with healthy fundamentals, however the value proposition isn’t high enough for me to call the stock a good bargain at its current price. If you prefer to work with short-term, momentum-oriented trades you could use a push above $31 as a signal to consider buying the stock or working with call options, with a practical target price at around $33. A drop below $30 could be a signal to consider shorting the stock or buying put options, with a practical exit target at around $28 on a bearish trade.