No matter what the economic or market cycle is, one of the things you can bet on is that the Technology sector will be on the bleeding front edge of the stock market’s direction.

In today’s world, it shouldn’t be that surprising to hear that Technology tends to lead the way in defining whether the market is going up, down, or sideways. That’s because, in one way or another, Technology has become more and more critical to every aspect of our daily lives. The dynamics of the last three years have really only reinforced that fact.

One of the interesting things about the Tech sector is the way that new, innovative names have a way of capturing investor’s attention for relatively short periods of time. That’s why stocks like Zoom Video Communications (ZM), ServiceNow (NOW), Slack (WORK) and others got most of the attention during the worst stages of the pandemic in 2020 and 2021. I’m not marginalizing these companies; in many ways the products and services they specialize in marked the beginning of what many economists are predicting is a permanent shift in the way daily business is done. That said, while many of these companies are using technology to provide innovative, enterprise-level and cloud-based solutions, they aren’t necessarily reinventing the wheel. Video conferencing and remote, web-enabled meetings are a good example, as there were a number of companies already operating in this space before ZM came along. In just about every part of the sector where you can find a sexy, new name, you’ll find some older, more familiar names that were already plowing that particular field in their own way.

Big Blue itself is a good example of what I mean. International Business Machines (IBM) operates in many of the same business areas as a lot of sexier names, but doesn’t generate the same kind of buzz or excitement. I think that’s partly a function of the fact they’ve been around for so long, and partly due to the challenges that large, established companies in any sector face to keep their business from getting stale. IBM hasn’t been the type of company to rest on its laurels, but it does mean that sometimes pushing new, innovative products and services into the market is a different kind of challenge for bigger companies, who are simultaneously managing existing, productive revenue streams. Smaller, more specialized companies with a more narrow focus, on the other hand are able to direct all of their collective, creative and productive energies into innovative products, services, and solutions.

In the case of IBM, a good example is the fact that estimates indicate that IBM’s IT services manage roughly 90% of credit card transactions and half of the world’s wireless connections. Not bad for a company most think about primarily about in terms of computers and server solutions. That’s the advantage of being a 600-lb gorilla, and all together it is a reason that IBM fundamentals have survived the last three years of pandemic-driven pressures as well as the various supply-related challenges that have been unique to the Tech sector since before 2020. The absence of “sexy,” however is one of the reasons that you don’t really hear a lot of about the stock. 2022 was a pretty unremarkable year for the stock, however it staged a big rally starting in October of last year from a yearly low at around $115.50 to a mid-December peak at above $150 per share. Since that point, the stock has faded back by about -12%, including a big overnight drop that could be accelerating bearish momentum after its latest earnings report. What do the company’s latest set of financial data say about the stock’s value proposition today? Let’s find out.

Fundamental and Value Profile

International Business Machines Corporation (IBM) is a technology company engaged in providing hybrid cloud and artificial intelligence (AI) solutions. It offers integrated solutions and products that use data and information technology (IT) in industries and business processes. Its segments include Software, Consulting, Infrastructure and Financing. Software segment consists of two business areas: Hybrid Platform & Solutions, which includes software to help clients operate, manage, and optimize their IT resources and business processes within hybrid, multi-cloud environments, and Transaction Processing, which includes software that supports clients’ mission-critical, on-premises workloads in various sectors. Consulting segment is engaged in business transformation, technology consulting and application operations. Infrastructure segment is engaged in hybrid infrastructure and infrastructure support. Financing segment is engaged in client financing and commercial financing business. IBM’s current market cap is about $122.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings improved about 7.5% while sales growth was flat, at -0.03%. In the last quarter, earnings increased nearly 99%, while sales were 18.3% higher. IBM operates with an operating that had been narrowing for most of 2022, as Net Income was 2.71% of Revenues over the last twelve months. The last quarter saw a big improvement, however, as Net Income increased to 16.24% of Revenues.

Free Cash Flow: IBM’s free cash flow is generally healthy; in the last quarter, it came in at about $8.6 billion, below the $9.6 billion level of a year ago, but above the $7.8 billion mark of the quarter prior. That translates to a Free Cash Flow Yield of about 7%.

Debt to Equity: IBM has a debt/equity ratio of 2.1. This is a high number and puts IBM among the Tech sector’s most highly leveraged companies. The company’s balance sheet indicates that operating profits are adequate to service their debt, with about $8.8 billion in cash and liquid assets (down from $10.7 billion a year ago) versus about $46.2 billion in long-term debt.

Dividend: IBM pays an annual dividend of $6.60 per share, which translates to a yield of 4.91% at the stock’s current price. IBM is one of the highest dividend payers among tech companies, which is attractive from the standpoint of thinking about using the stock to help generate passive income.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $84 per share. That means that IBM is significantly overvalued at its current price, with -38% downside right now, with a useful discount price at around $67 per share.

Technical Profile

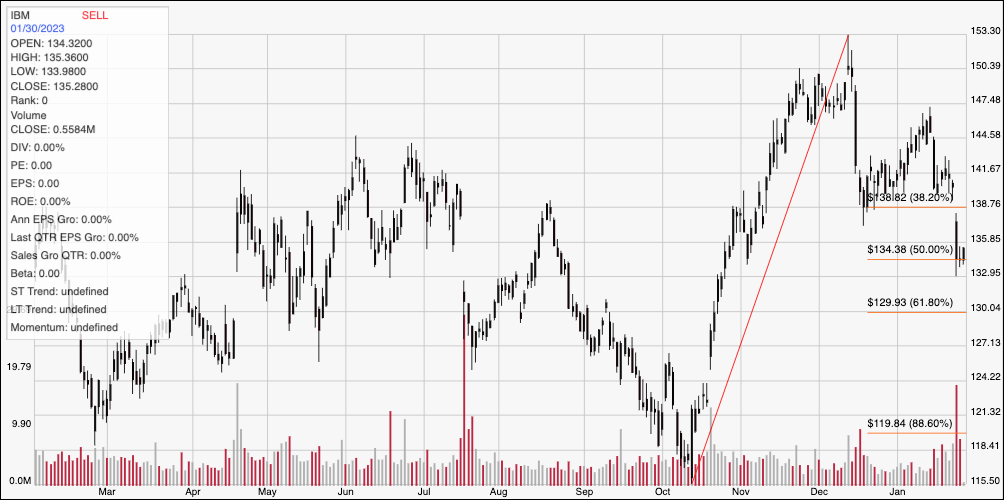

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price activity for IBM. The red diagonal line traces the stock’s upward trend from its October 2022 low at around $115.50 to its December above $153; it also provides the baseline for the Fibonacci retracement lines on the right side of the chart. From that peak, the stock has dropped back and appeared to be stabilizing in the $140 range until the most recent earnings report. The market has pushed the stock sharply lower again, where it seems to be finding new, current support at around $134. Immediate resistance is around $139 where the 38.2% retracement line lies. A push above $139 should have near-term upside to about $142, with $145 possible if buying activity accelerates, while a drop below $134 should find next support at around $130 where the 61.8% retracement currently sits.

Near-term Keys: IBM is an interesting company, with good Free Cash Flow, along with good liquidity from available cash and an improving operating profile. Even so, the stock is clearly overvalued, even with its latest drop, which means that the best probabilities for success with this stock lie in short-term trading strategies. A push above $139 would be a good signal to think about buying the stock or working with call options, with a near-term target price at around $142, and $145 if bullish momentum increases. A drop below $134 could be taken as a good signal to consider shorting the stock or buying put options, with an eye on $130 as a practical profit target on a bearish trade.