One of the first technical principles I learned more than two decades ago has become a primary reference point for helping me think about a stock’s current direction: “the trend is your friend.”

For bullish traders, this phrase means that if you can find a stock that is already going up, it is likely to keep going up – especially if the stock has broken above previous highs. It can also be applied to stocks in downward trends for the same kinds of traders, because downward trends generally act as warning flags for momentum-based, trend-driven investors to stay away for the time being or to consider bearish trading strategies.

All of the logic I just outlined gets turned on its head a bit when you start talking about principles that drive other, longer-term investing methods and approaches. The longer my investing career has lasted, the more I’ve gravitated to value-driven strategies. Being a value investor doesn’t automatically dismiss the idea of using trends, but it is a bit counter-intuitive to some at first, because it doesn’t shy away from stocks in downward trends – in fact, I’ve learned to sit up and take extra notice in these cases.

I’ve learned that the downward trends most people shy away from often provide the basis for many of the best value-based investments I’ve made. That’s because even as the market tends to overprice good news and its positive expectations into stocks, it also often over-punishes bad news or less-than-rosy expectations. In the negative case, that means downward trends often push stock prices further below the “fair” values a deeper analysis of the company reveals. If the company’s core fundamental strength is still in place, the downward trend can often simply be attributed to current market action. That implies the market will eventually recognize the stock’s deeply discounted status as well.

Value-driven analysis provides investors like me an opportunity to identify where those opportunities may lie before the rest of the market starts to jump onboard. Even better in my view are the cases where the stock has been following a downward trend, but begins to show strong technical signs of a reversal of that trend to bullish conditions. The early stages of that reversal can be thought of as the “sweet spot” for people like me that try to combine value-driven discipline with technical techniques, but are still ahead of the point where most growth-focused investors to start to jump on the bandwagon.

The caveat for any long-term investing method, however, lies in the fundamental data. If the company’s fundamentals are showing deterioration, over time or across multiple metrics, there is a stronger case to make for another common idiom technicians love to quote: “the market is always right.” That’s why using value investing concepts to drive investment decisions can sometimes be challenging.

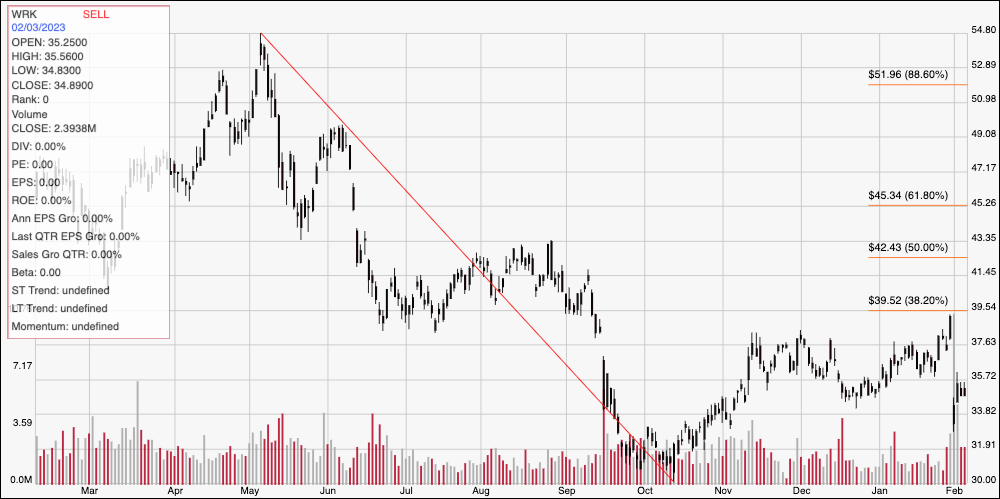

Westrock Company (WRK) is a stock in the Basic Materials sector that followed a downward trend for most of 2022, but saw the trend bottom in early October at about $30 per share. The stock held a consolidation range from November through January of this year between $37.50 and about $35. That range was broken on the downside following the company’s latest earnings report, with a big, overnight drop of more than -10% last week. Is the news really as bad is it might seem? Also, how has a new set of financial data impacted WRK’s value proposition? Could it offer a useful bargain-driven opportunity? Let’s dig in.

Fundamental and Value Profile

WestRock Company, incorporated on March 6, 2015, is a multinational provider of paper and packaging solutions for consumer and corrugated packaging markets. The Company also develops real estate in the Charleston, South Carolina region. The Company’s segments include Corrugated Packaging, Consumer Packaging, and Land and Development. The Corrugated Packaging segment consists of its containerboard mill and corrugated packaging operations, as well as its recycling operations. The Consumer Packaging segment consists of consumer mills, folding carton, beverage, merchandising displays, and partition operations. The Land and Development segment is engaged in the development and sale of real estate primarily in Charleston, South Carolina. WRK has a current market cap of $8.8 billion.

Earnings and Sales Growth: Over the past year, earnings decreased about -15.4%, while sales growth was flat, but negative at -0.6%. In the last quarter, earnings were -61.5% lower, while sales decreased almost -9%. Over the last twelve months, Net Income was 3.8% of Revenues, and weakened to 0.92% in the last quarter. That deterioration leaves little room for error, and can be considered a confirmation of some of the difficult conditions the company has dealt with over the last few months.

Free Cash Flow: WRK’s Free Cash Flow is healthy, at about $1.1 billion, and which translates to a healthy Free Cash Flow Yield of 12.07%. It does mark a decline over the last quarter, when Free Cash Flow was $1.2 billion.

Debt to Equity: WRK has a debt/equity ratio of .78, which is pretty conservative despite its rise from .66 in the last quarter. The company’s balance sheet shows limited, but improving liquidity, with cash and liquid assets of about $415 million in the last quarter (compared to $260 million two quarters ago) versus long-term debt of about $8.9 billion. The company focused for most of 2020 and 2021 on debt reduction, most of which came from the 2018 acquisition of KapStone Packaging. As of the second quarter of 2022, they had retired enough of that debt to reinstate stock buybacks.

Dividend: WRK pays an annual dividend of $1.10 per share, which at its current price translates to a dividend yield of about 3.15%. After cutting their dividend by 57% in 2020 to preserve cash during the early stages of the pandemic, management increased the dividend by 20% in May of 2021, again from $.96 at the start of 2022, and then again $1.00 in the fourth quarter. These are moves that signal management’s increasing confidence in the underlying strength of their business.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $45 per share. That suggests that WRK is undervalued by about 32% from its current price.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price activity for WRK. The diagonal red line marks the stock’s drop from its yearly high, reached in May of this year at around $55, to its 52-week, October low at around $30 per share. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After hovering between a high at around $37.50 and a low around $35 until the end of January, the stock dropped sharply below the bottom of its range to start February, hitting its latest pivot low at around $34 to mark current support, with immediate resistance how at around $35.

Near-term Keys: WRK’s drop below its previous trading range is a bearish signal for momentum-driven investors, but also makes the stock’s value proposition look pretty attractive. While declining Net Income is a concern, healthy Free Cash Flow, improving liquidity, and an attractive, increasing dividend are useful counters if you’re thinking about using the stock for a long-term opportunity. If you prefer to focus on short-term strategies, a push above $35 could provide an opportunity to think about buying the stock or working with call options, with $37.50 offering a reasonable, quick profit target for a bullish trade. A drop below $34 could be a reason to consider shorting the stock or buying put options, with a useful profit target between $32 and $30 per share on a bearish trade.