One of the most influential sources I’ve relied on for developing the investing method I like to follow is Warren Buffet.

Mr. Buffet is certainly one of the most successful investors in the entire history of the U.S. stock market, and arguably the most famous of our era. I’ve borrowed from the principles I’ve seen Mr. Buffett lay out in his annual reports to inform and refine my own approach to value identification. Snippets and quotes from Buffett’s writings and interviews can be found just about anywhere, but one of the most pertinent to a value-oriented investment approach is, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” That concept is something that has reinforced my approach to both fundamental and value analysis over the years and helped me refine my own system to what it is today.

One of the things that the last few years has made very clear, at least from an economic perspective, is the difference between “fair” companies and “wonderful” ones. It isn’t as simple as looking at the way a stock’s price has moved, no matter what talking heads and growth-oriented investors would have you believe. It isn’t even about finding sectors or industries that may not be as exposed to downside from difficult conditions, which seems especially appropriate under current economic and market conditions. The truth is that every sector of the economy has to find ways to adjust to the current economic climate – and that is often where the difference between “wonderful” and “fair” lies.

One of the sectors that has been really interesting to watch over the past two years is the Industrial sector. This segment is interesting because when economic activity picks up, a comparable increase in demand for many of the companies in this space is generally anticipated. A healthy real estate market with persistently high demand in multiple areas of the country in 2021, for example, meant that home builders could keep new projects going. That is usually is good news for Machinery stocks like Paccar Inc. (PCAR). Real estate and construction is hardly the only place PCAR operates, of course, which is good news when interest rates are rising as they have over the last year. The real estate market showed signs of slowing last year, as and housing prices began to flatten. Despite that negative influence, PCAR’s leading position in the industry in battery-electric trucks attracted the interest of analysts last year. Forecasts continue to predict the company will benefit from increasing attention from the public and the government in charging station infrastructure to facilitate wider adoption of electric vehicles, even in heavy equipment and machinery.

PCAR’s stock underperformed for most of the last year, hovering between highs at around $59 and lows around $53 before finally starting a nice upward trend in late July 2022, rallying to its latest high at around $75 after the company’s most recent earnings announcement in late January. This is a company that has come through the last three years with a healthy balance sheet and operating profile, and with a leading position in the U.S. trucking market. Could the current wave of bullish momentum, along with those solid fundamentals, also translate to a useful opportunity to work with it on a long-term, value-oriented basis, or has the stock’s latest trend pushed it past the point of useful value? Let’s find out.

Fundamental and Value Profile

PACCAR Inc (PACCAR) is a technology company. The Company’s segments include Truck, Parts and Financial Services. The Truck segment includes the design, manufacture and distribution of light-, medium- and heavy-duty commercial trucks. The Company’s trucks are marketed under the Kenworth, Peterbilt and DAF nameplates. It also manufactures engines, primarily for use in the Company’s trucks, at its facilities in Columbus, Mississippi; Eindhoven, the Netherlands, and Ponta Grossa, Brazil. The Parts segment includes the distribution of aftermarket parts for trucks and related commercial vehicles. The Financial Services segment includes finance and leasing products and services provided to customers and dealers. Its Other business includes the manufacturing and marketing of industrial winches. The Company operates in Australia and Brazil and sells trucks and parts to customers in Asia, Africa, Middle East and South America. PCAR has a current market cap of about $38.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 79.6%, while revenues increased by 21.6%. In the last quarter, earnings grew by about 19.5%, while revenues were almost 15.2% higher. The company’s margin profile is strengthening; over the last twelve months, Net Income was 10.45% of Revenues, and increased to a little over 11.33% in the last quarter.

Free Cash Flow: PCAR’s free cash flow is generally healthy, at about $1.16 billion over the last year. That translates to a modest Free Cash Flow Yield of 4.65%. It does marks a decrease from the last quarter, when Free Cash Flow was almost $2 billion, and a little over $1.3 billion from a year ago.

Debt/Equity: The company’s Debt/Equity ratio is .55, which is a pretty conservative number for stocks in this industry. PCAR’s balance sheet shows about $6.16 billion in cash and liquid assets in the last quarter versus $3.3 billion a couple of quarters ago, against about $7.2 billion in long-term debt. Their operating profile indicates that profits are sufficient to service their debt, with excellent liquidity to provide additional flexibility.

Dividend: PCAR’s annual divided is $1.00 per share and translates to a yield of about 1.39% at the stock’s current price. Management decreased the dividend payout from $1.36 per share after the latest earnings report, but it should be noted that they also approved a one-time, special dividend payout of $2.80 per share in December of last year.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $82 per share. That means the stock is overvalued at its current price, by about -11%, with a useful value price down at around $65.60 per share. It is also worth nothing that prior to the last earnings report, this same analysis yielded a fair value target at around $79 per share.

Technical Profile

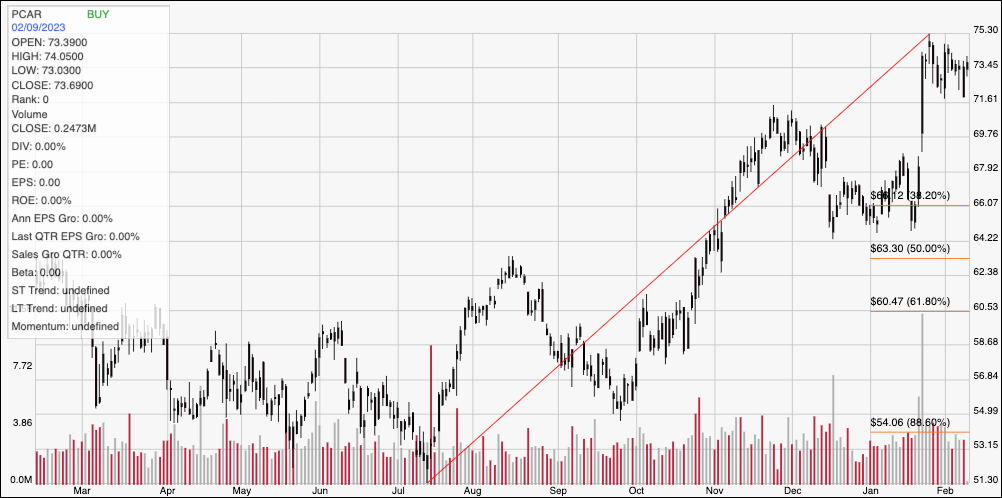

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the last year of price activity for PCAR. The red diagonal line traces the stock’s upward trend from its July low at around $51 to its high, reached last month at around $75. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock’s trend since July has pushed it above all of its major Fibonacci retracement lines, marking current support at around $70 based on pivot highs seen in late November 2022, and immediate resistance at the stock’s latest high at around $75. A drop below $70 should find next support at around $66, near to the 38.2% retracement line, while a push above $75 should give the stock about $5 up near-term upside to next resistance at around $75.

Near-term Keys: PCAR’s fundamentals are solid, with an improving balance sheet and increasing profitability. Despite these strengths, the stock’s latest rally has pushed past the point of compelling value, which means that the best possibilities lie on the short-term side, via momentum-based trades. A push above $75 could offer an interesting opportunity to buy the stock or work with call options, with an eye on $80 as a useful, near-term profit target. If the stock drops below $70, consider shorting the stock or buying put options, using $66 as a practical exit target on a bearish trade.