Cisco Systems Inc. (CSCO) is one of the most recognizable and established companies in the Technology sector.

With a market cap of more than $200 billion, and a clear position as a leader in the Technology sector, companies like CSCO are, without question, the standard against which all other business in their respective industries are measured and forced to compete with. No matter whether you’re talking about wired or wireless networking, CSCO is one of the companies that not only developed the standards and infrastructure the entire Internet is built on today, but that continues to lead the way into the future, including cloud-based computing and the next generation of technology in the so-called “Internet of Things” (IoT).

2022 saw a lot of volatility in the marketplace, which isn’t surprising given the global issues that have dominated investor’s attention. I also don’t think it’s all that surprising that most of those issues – inflation, supply chain concerns, rising interest rates, geopolitical uncertainty – have bled into the start of 2023. Those issues put the Tech sector, including networking companies, on the bleeding of the market’s broad downturn last year, and at the forefront of the market’s rally that started in the last quarter of the year, along with a nice run upward in January. Looking ahead, it’s reasonable to expect Technology stocks to continue to lead the market up or down as the tides of global economic activity continue to ebb and flow.

One of the most interesting stories of the past three years has been the pandemic-driven trend that saw corporate America shift to remote working models. While many businesses have begun moving back to in-office operations, more seem to be adopting a hybrid workforce approach that combines in-office with remote work. That further validates the need for cloud-based solutions that facilitate effective hybrid workforce models. CSCO may not be getting a lot of the buzz about their services in this area, but the truth is that this company has been providing these exact solutions and services for more than two decades, from Wide Area Networking to remote video and teleconferencing and more. CSCO is also a big player in the 5G, next-generation WiFi, and IoT world, which represents the next stage in remote connectivity in ways that we are really only beginning to experience and appreciate. Analysts are predicting a practically insatiable appetite from consumers and businesses alike for next-generation bandwidth, which bodes well for CSCO’s investments in those businesses, and should act as a headwind in the months, and even years to come.

While it hasn’t attracted the same kind of attention that other media-darling tech companies have seen, CSCO’s fundamental strengths, which are considerable, attracted a healthy amount of investor interest through 2021, driving the stock into a long-term upward trend from a low at around $35 in November 2020 to a high point at the end of 2021 at around $64. Like most companies, CSCO has absorbed its share of operating challenges, including a sales decline that was attributed primarily to COVID-driven spending cuts on enterprise spending on IT infrastructure. The company’s earnings reports over the last few quarters suggest that many of those enterprise-level end markets are beginning to recover, even while other of its cloud-based solutions (which help enable many of the remote working models described earlier) have continued to provide healthy revenue growth. CSCO is a company with a balance sheet that features outstanding liquidity, very low debt relative to liquid assets, Free Cash Flow that remained relatively stable despite the challenges of the past two years and has more recently begun to strengthen, and a healthy operating profile.

At the start of 2022, broad market uncertainty hit the Tech sector hard, pushing CSCO off of that $64 high and down to a 52-week low in early October at around $38.50. The stock has rallied strongly off of that low, pushing to its most recent peak above $51 last week. Do the company’s fundamentals, along with the latest price activity suggest it might not be too late to jump on the bandwagon, or has the best probability of success already passed by? Let’s find out.

Fundamental and Value Profile

Cisco Systems, Inc. (CSCO) designs and sells a range of products, provides services and delivers integrated solutions to develop and connect networks around the world. The Company operates through three geographic segments: Americas; Europe, the Middle East and Africa (EMEA), and Asia Pacific, Japan and China (APJC). The Company groups its products and technologies into various categories, such as Switching; Next-Generation Network (NGN) Routing; Collaboration; Data Center; Wireless; Service Provider Video; Security, and Other Products. In addition to its product offerings, the Company provides a range of service offerings, including technical support services and advanced services. The Company delivers its technology and services to its customers as solutions for their priorities, including cloud, video, mobility, security, collaboration and analytics. The Company serves customers, including businesses of all sizes, public institutions, governments and service providers. CSCO has a market cap of about $202.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by about -1.3%, while sales were about 6.9% higher. In the most recent quarter, earnings declined, also by -1.3% while sales growth was flat, but negative at -0.29%. CSCO has a very healthy operating profile, with Net Income running at 21.26% of Revenues over the last twelve months. In the last quarter, that number narrowed somewhat to 20.4%.

Free Cash Flow: CSCO’s free cash flow over the last twelve months is $15.5 billion. This is a number that the company has historically managed to maintain at very healthy levels, and marks a reversal of a year-long, modest quarter-by-quarter decline, increasing from $13.6 billion a year ago. It also marks an increase over the last quarter from $13.3 billion. The current number translates to a Free Cash Flow Yield of 7.61%.

Debt to Equity: CSCO has a conservative, manageable debt-to-equity ratio of .18. CSCO’s balance sheet shows $22 billion in cash and liquid assets (up from $19.7 billion in the quarter prior) against about $7.6 billion in long-term debt. Servicing their debt is not a concern, and liquidity to pursue additional expansion or return value to shareholders via stock buybacks or increased dividends is excellent. It is also worth noting that long-term debt decreased by a little more than $1.3 billion over the past year.

Dividend: CSCO currently pays an annual dividend of $1.56 per share (increased in 2021 from $1.44 per share, $1.48 at the start of 2022, and $1.52 before the last earnings report), which translates to an annual yield of about 3.14% at the stock’s current price. An increasing dividend is a strong sign of management confidence.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target a little above $50 per share. That means that at its current price, CSCO is fairly valued, with about 1.8% upside at its current price. It also puts the stock’s bargain price at around $40. It should be noted that in the first quarter of 2021, this same analysis yielded a fair value target at $41.50 per share, and $45 prior to the most recent earnings announcement.

Technical Profile

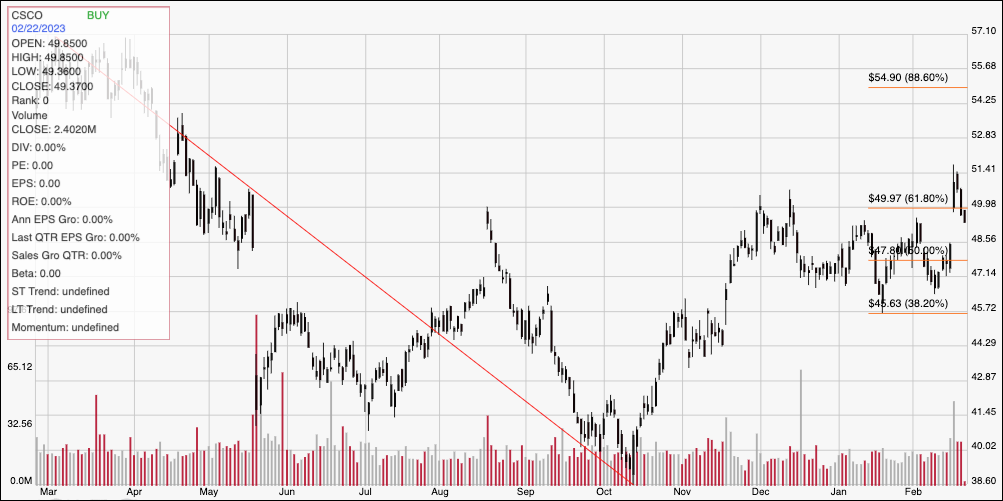

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The diagonal red line traces the stock’s downward trend from its high in March 2022 at around $57 to its low point, reached in October at around $38.50. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock’s rally from that low has pushed the stock into a new upward trend. After the latest earnings announcement, the stock pushed above a consolidation range that held from December through most of February, putting current support near the stock’s current price at about $50 and inline with the 61.8% retracement line. Immediate resistance is at last week’s pivot high at about $51.50. A push above $51.50 should see upside to about $55, based on the 88.6% retracement line and a lot of pivot activity a year ago in that price area, while a drop below $50 should find next support at around $47 based on pivot activity in that area in January and earlier this month.

Near-term Keys: Based on my traditional valuation metrics, I can’t call CSCO a value right now; but I do think there are a number of other elements – continued remote workforce services and solutions, 5G implementation over the next year or so, and continued improvement in corporate, enterprise spending on IT infrastructure, to name just a few – that aren’t being factored into my value analysis because of their forward-looking nature. If you’re looking for a way to work with a 600-lb gorilla in the Tech sector with a stable, attractive, and even increasing dividend, those elements, along with the stock’s current momentum could be good enough to make this an exception to the normal value-based argument. If you prefer to work with short-term trading strategies, a push above $51.50 could provide a signal for an aggressive, bullish investor to buy the stock or work with call options, with a short-term eye on $55 as a practical exit target. A drop below $50 could be a signal to consider shorting the stock or to buy put options, with a useful exit target at about $47 on a bearish trade.