No matter what current market conditions are at any given time, the point of value-oriented investing is to find stocks that offer attractive long-term upside.

For my approach, that means using a combination of valuation, fundamental strength, and technical analysis to filter through the thousands of stocks that are available. That puts a big emphasis on stocks that are currently sitting at or near historical lows. In a bull market, these are stocks that have diverged from the rest of the market, and so most investors tend to shy away from these kinds of stocks. That’s why value investing can sometimes be a bit of a contrarian approach, especially at the long end of a bull market. In bearish market conditions, the number of stocks trading well below their bullish highs increases, which means that the pool of useful, value-oriented opportunities starts to increase. The caveat, for me is that a low price isn’t enough; I also need to see enough fundamental strength to make me believe the stock should be higher than it is right now.

International Paper Company (IP) is a good example of the kind of company that was forced to absorb a big impact at the early stage of the pandemic, and to find ways to navigate the broader economic climate ever since. 2022 only made that more difficult, as companies in every sector have dealt with inflationary conditions that have raised consumer prices as well as interest rates. IP is one of the biggest companies in the Containers & Packaging industry of the Materials sector, and their conservative management approach enabled them to build a healthy balance sheet leading up to 2020 that took the initial force of the pandemic-drive downturn pretty well. It has also kept the company on solid operating ground throughout the past year, and out to the other side. After dropping to a yearly low in October of last year at around $30.50, the stock rallied to a February peak at around $41. The stock has dropped back from that point to stabilize at around $36.50. That pullback is enough that I think it could set up IP as a nice opportunity for a conservative bargain hunter.

Fundamental and Value Profile

International Paper Company is a paper and packaging company with primary markets and manufacturing operations in North America, Europe, Latin America, Russia, Asia, Africa and the Middle East. The Company operates through it four segments: Industrial Packaging, Global Cellulose Fibers, Printing Papers and Consumer Packaging. The Company is a manufacturer of containerboard in the United States. Its products include linerboard, medium, whitetop, recycled linerboard, recycled medium and saturating kraft. The Company’s cellulose fibers product portfolio includes fluff, market and specialty pulps. The Company is a producer of printing and writing papers. The products in Printing Papers segment include uncoated papers. IP has a current market cap of about $12.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased nearly 11.5%, while revenues dropped by about 0.92%. In the last quarter, earnings were nearly -14% lower, while sales dropped by -5%. The company’s margin profile is healthy, and is strengthening; Net Income as a percentage of Revenues was 7.11% over the last twelve months and rose to -6.2% in the last quarter.

Free Cash Flow: IP’s free cash flow is strong, at $1.25 billion. This number has dropped from a year ago, when it was $1.56 billion; but given the broader conditions over the last year, it also isn’t unexpected. It also worth noting that this number increased from $727 million from the last quarter. The current number also translates to a Free Cash Flow Yield of 9.59%, which remains healthy.

Debt to Equity: IP has a debt/equity ratio of .58. This is a conservative number that indicates management takes a conservative approach to leverage. IP currently has $977 million in cash and liquid assets (down from $3.6 billion a year ago, and $1.4 billion in the last quarter) against about $5.3 billion in long-term debt. It should be noted that long-term was more than $8.2 billion a year ago, which makes the decrease in leverage significant. The company’s operating profile, suggests servicing their debt shouldn’t be a problem; but the decline in liquidity is a concern that bears watching. Continued improvement in Net Income, along with a reversal of the downward Free Cash Flow pattern would be strong indications that liquidity should begin to improve.

Dividend: IP’s annual divided is $1.85 per share; that translates to an attractive yield of 5.02% at the stock’s current price. The company has maintained the dividend throughout the pandemic, with no current indications the dividend is in danger of being reduced or eliminated.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $46.50 per share. That means that even with the stock’s current upward trend and rise from its October low, the stock is significantly undervalued, with about 26% upside from its current price.

Technical Profile

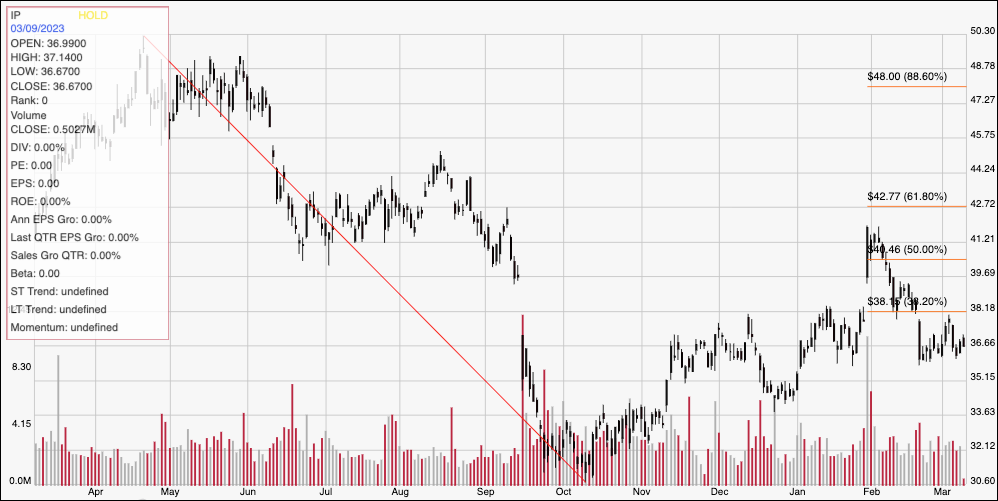

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red line on the chart above outlines the stock’s downward trend from a peak at around $50 in April to its October low at around $30.50; it also informs the Fibonacci retracement levels on the right side of the chart. From that bottom, the stock rallied hit $41 at the beginning of February, and then dropped back to find current support at around $36.50 a couple of weeks ago. Immediate resistance is at around $38, where the 38.2% retracement line sits. Current A push above $38 should see near-term upside to that recent peak around $41, while a drop below $36.50 should see the stock drop to about $34 before finding next support.

Near-term Keys: While there are some issues that bear watching – Net Income in particular – IP’s overall fundamental strength is more than enough to make the stock’s value proposition hard to ignore. If you prefer to focus on short-term trading strategies, you could use a push above $38 to buy the stock or work with call options, using $41 as a practical profit target on a bullish trade. A drop below $36.50 could be a signal to consider shorting the stock or buying put options, using $34 as the profit target on a bearish trade.