The Tech sector has enjoyed the lion’s share of attention among all segments of the economy for a number of years. That’s been a good thing during bull markets, but it also means the sector really gets pummeled when uncertainty increases.

Since 2020, that attention – driven in no small part by the increasingly central role of cloud-based and remote networking solution providers in facilitating remote workforce solutions – motivated investors to buy Tech stocks enthusiastically. The flip side of that attention has reared its ugly head over the past year, as higher interest rates, war in Ukraine, and continued supply chain constraints that started with technology have rippled into multiple segments of the economy. A lot of Tech companies have seen their stock prices plunge this year into their own bear market levels. In just the last week, that uncertainty has increased with the collapse of Silicon Valley Bank, a leading venture capital bank for the Tech sector. That news has demonstrated a ripple effect, not only in the Banking industry, but also to the Tech sector as even the largest names have been dropping on an accelerated basis.

Since early 2020, companies that focus on the “enterprise” space – where most corporate tech spending has traditionally gone, for products like servers, computers, printers, and the tools to connect them all in a traditional network setting, for example – have struggled to keep up with demand for remote workforce solutions and cloud-based services. While I think that much of the work-from-home element of corporate operations will become a permanent part of business life, there are also signs that for many businesses, back-in-office is becoming an increasing expectation. My research into many of these companies suggests that while many of the companies that operate in the Enterprise space will continue to be pressured, revenues and earnings in many cases have also begun their own recovery. Current geopolitical, economic and market conditions haven’t entirely been reflected in some of those metrics as of yet, which implies that how elements play into the fortunes of companies in the Tech sector for the rest of this year is a risk element that could act as a longer-term headwind to economic health and growth.

That brings us to today’s highlight. Hewlett Packard Enterprise Co. (HPE) is a spin off of Hewlett Packard Corporation (HPQ), and a business that is among those companies that underperformed through most of 2020 but began to build positive momentum beginning in September of 2021, rising from a low at around $13 to a February 2022 peak at nearly $18. From that point, broader market fears pushed the stock into a new downward trend that found its bottom at around $12 in late September. The stock then staged a strong rally that peaked in January at around $17 before beginning a downward trend that has picked up bearish momentum in the last month. The last week’s worth of news has accelerated that pace even more, as the stock dropped below $15.50 to its current price just a little above $14. The real question, of course is whether the speed of the stock’s decline is just a market-driven reaction that is affecting stocks unilaterally. If HPE’s fundamentals are strong enough, the latest decline could just represent a new, useful opportunity to work with a good company at a nice price. Let’s dive in.

Fundamental and Value Profile

Hewlett Packard Enterprise Company (HPE) is an edge-to-cloud platform-as-a-service company. The Company’s segments include Compute, High Performance Compute & Mission-Critical Systems (HPC & MCS), Storage, Advisory and Professional Services (A & PS), Intelligent Edge, Financial Services (FS), and Corporate Investments. The Compute portfolio offers both general-purpose servers for multi-workload computing and workload-optimized servers. HPC & MCS portfolio offers workload-optimized servers designed to support specific use cases. FS provides investment solutions, such as leasing, financing, information technology (IT) consumption, and utility programs and asset management services, for customers that facilitate technology deployment models and the acquisition of complete IT solutions, including hardware, software and services from HPE and others. Corporate Investments include Hewlett Packard Labs, which is responsible for research and development. HPE has a current market cap of $18.2 billion.

Earnings and Sales Growth: Over the past year, earnings declined by -2.5%, while sales increased by 12.2%. In the last quarter, earnings were about 265% high, while sales growth was flat, but negative at -0.79%. The company operated with a narrow margin profile through 2020 that saw big improvements in 2021, but has seen some volatility over the past year. Over the last twelve months, Net Income was 2.92% of Revenues, and strengthened to 6.42% in the last quarter. The improvement is a reversal of a pattern of declining, negative Net Income in the quarter prior.

Free Cash Flow: HPE’s Free Cash Flow is modest, at $1.18 billion. On a Free Cash Flow Yield basis, that translates to 2.92%. A year ago, Free Cash Flow was $2 billion, a number that was roughly the same two quarters ago. The decline in the last quarter is a red flag that could be an aftereffect of declining Net Income that reversed itself in the last quarter.

Debt to Equity: HPE has a debt/equity ratio of .38, which is a conservative number. Their balance sheet shows about $2.5 billion in cash (compared to $4.1 billion a quarter ago) against a little over $7.5 billion in long-term debt. Their operating profits are adequate to service their debt, with health financial flexibility as well, however the latest quarter’s declines in Free Cash Flow and liquidity, if they continue to persist could threaten the company’s financial stability. It should be noted that a year ago, long-term debt was around $10.2 billion, meaning that the company has eliminated about $2.6 billion of long-term debt from their balance in that period.

Dividend: HPE pays a dividend of $.48 per share, which translates to an annual yield of about 3.35% at the stock’s current price. I think that it is also noteworthy that the company has not cut or reduced their dividend; in fact it remains a bit above the $.44 per share payout they maintained until the beginning of 2020, when management increased the dividend to its current level.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $16 per share. That suggests that the stock is undervalued, with about 12% upside from its current price and a useful discount at around $12.50. It is also worth noting that prior to the latest earnings report, this same analysis yielded a long-term target price at around $19.50 per share.

Technical Profile

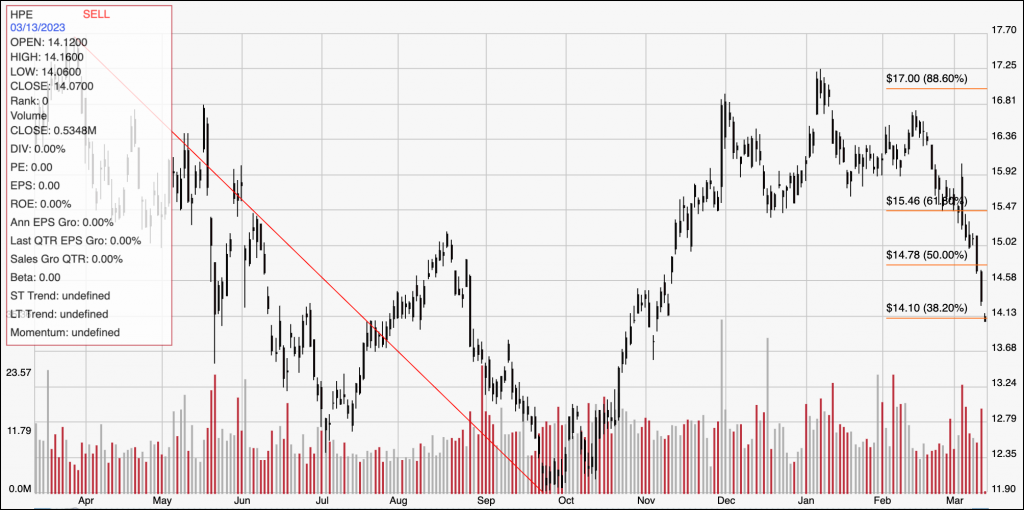

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price activity for HPE. The red diagonal line traces the stock’s downward trend from a high point in March of last year at around $18 to its low in September at around $12. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After rallying to a little above $17 to start 2023, the stock has dropped into a downward trend that began to accelerate about a month ago as the stock dropped below the 61.8% retracement line, with the pace really picking up in the last week. The stock gapped down to start this week, dropping below $14 where the 38.2% retracement line sits as of this writing. That puts immediate resistance at $14, with current support expected at around $13. A push above $14 has limited upside, with next resistance at around $15, while a drop below $13 should see the stock test its 52-week low at around $12.

Near-term Keys: HPE’s latest drop and seriously bearish momentum should give anyone that prefers short-term trading strategies to think twice about taking a bullish position. The latest drop below $14, however could be a signal to think about shorting the stock or buying put options, with an initial profit target at around $13, and $12 possible if selling pressure remains high. The stock’s value proposition is attractive, but not compelling enough to justify taking a long-term approach given the current bearish momentum. Look for the stock to stabilize before thinking about a long-term buying opportunity with HPE.