Over the last few weeks, the market has been looking for a bullish hook on which to hang its hat.

Speculation since the middle of March has centered around the theme that the Fed might finally be prompted to begin tapering the hawkish approach it’s been applying to monetary policy for most of the past year and a half. The mini-crisis in the Banking industry that started with the failure of two American banks as well as Swiss giant Credit Suisse has a lot of talking heads saying that a continued, aggressive approach to curb inflation could create more problems on a much wider scale. With new economic data for the month of March due later this week, contrasting viewpoints on the health of current market conditions are likely to keep investors guessing. To me, that means that looking for new investing opportunities requires a continued, conservative approach.

A good way to start making your investments more conservative is by reducing large positions that you might have been holding for extended periods of time – especially if you have unrealized gains in stocks in normally cyclical industries like the Technology or Industrial sectors. Locking in some gains now can free up cash to start looking for new, more conservative positions in stocks with less sensitivity to economic cycles, and stable, established revenue streams. Food stocks have always been an area I gravitate to that fits this description, and that includes some of the biggest names in the Beverages industry.

Coca-Cola Co (KO) is one of the most recognized brand names in the entire world. They’re so ubiquitous, in fact that for many the word “Coke” doesn’t actually refer to Coca-Cola itself, but to soda in general. That is just one of the reasons that I think KO Is an example of a company that is less sensitive to economic risk, even on a global scale, than many other stocks in the marketplace. Another reason is that, even when the economy turns sour, consumers not only still have to buy food, but they have also proven that there are “indulgences” that they won’t do without. Soda is one of them, and that is why I think the largest stocks in the Beverages industry could be a smart place to think about putting your money to work even as the market remains uncertain and unpredictable. KO also occupies an interesting place in its market, as its positioning as the soft drink maker of choice among most restaurants, theaters, and other venues that are starting to see rebounding demand could give it an extra headwind for as long as economic activity continues to strengthen.

Safety is one thing; value is another. From a low at around $54 in October of last year, KO rallied to a December peak at around $64 before dropping back into the beginning of March at around $59. The stock has rallied again since that point, and is now just a little below that December peak. The company boasts a balance sheet that, not surprisingly, for the most part, has remained a source of strength throughout the economic ebb and flow of the last few years. Does that mean that KO could be a smart bet, both from a fundamental and value perspective, or has the stock’s increase in price outpaced its improving fundamental metrics? Let’s dive in.

Fundamental and Value Profile

The Coca-Cola Company is a beverage company. The Company owns or licenses and markets non-alcoholic beverage brands, primarily sparkling beverages and a range of still beverages, such as waters, flavored waters and enhanced waters, juices and juice drinks, ready-to-drink teas and coffees, sports drinks, dairy and energy drinks. The Company’s segments include Europe, Middle East and Africa; Latin America; North America; Asia Pacific; Bottling Investments, and Corporate. The Company owns and markets a range of non-alcoholic sparkling beverage brands, including Coca-Cola, Diet Coke, Fanta and Sprite. The Company owns or licenses and markets over 500 non-alcoholic beverage brands. The Company markets, manufactures and sells beverage concentrates, which are referred to as beverage bases, and syrups, including fountain syrups, and finished sparkling and still beverages. KO has a current market cap of $270.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings growth was flat, at exactly 0%, while sales improved by nearly 7%. In the last quarter, earnings declined by roughly -35%, while sales also shrank by about -8.5%. KO operates with a very healthy margin profile that narrowed in the last quarter; in the last twelve months, Net Income was 22.19% of Revenues and declined to 20.06% in the last quarter.

Free Cash Flow: KO’s Free Cash Flow is generally healthy, but has been tapering consistently over the past year. Over the last twelve months, the company generated cash flow of $9.6 billion. That marks a decline from the quarter prior, when Free Cash Flow was about $10.1 billion, and $10.3 billion a year ago. The current Free Cash Flow translates to a modest Free Cash Flow Yield of 3.54% at the stock’s current price.

Debt to Equity: KO has a debt/equity ratio of 1.41, which is a bit high, but not unusual for stocks in the Beverages industry. Their balance sheet shows $11.6 billion in cash and liquid assets versus $36.3 billion in long-term debt. Cash has increased over the past year, from $10.3 billion, but also declined from $13.2 billion two quarters ago. Their operating profile and balance sheet together indicate that KO should have no trouble servicing its debt.

Dividend: KO pays an annual dividend of $1.84 per share, which at its current price translates to a dividend yield of about 2.94%. KO is considered a “Dividend King;” they increased their dividend in 2020 from $1.60, again at the end of the first quarters of 2021 and 2022, and finally after their last earnings announcement, marking 61 consecutive years of dividend increases. KO has paid a consistent dividend since 1920 and are a member of the S&P Dividend Aristocrats Index.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $55 per share. That suggests that KO is overvalued by about -12% from its current price, with a useful discount at around $44.

Technical Profile

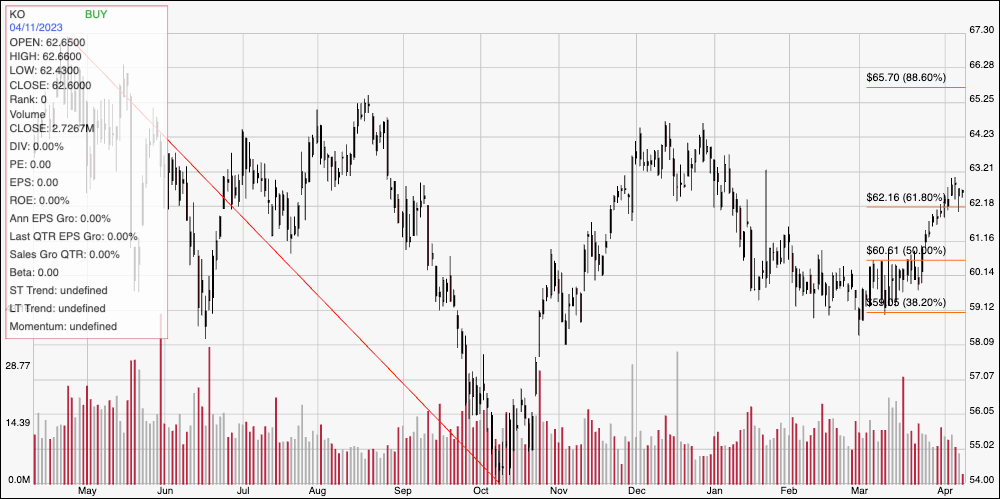

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the past year of price activity for KO. The red line traces the stock’s downward trend, from a peak a year ago at around $67 to its low in October of last year at around $54. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After surging to about $64 in December, and then dropping back again during the first quarter of 2023, the stock found strong support at around $59, using it as a springboard for the stock latest rally that pushed its price above the 61.8% retracement line (previous resistance) to mark current support at around $62 per share. Immediate resistance is at around $64, from that December high. A push above $64 should find next resistance at around $65.50, with additional upside to about $67 if buying activity increases. A drop below $62 should find next support between $60 and $59, where the last major pivot low appeared, and also in-line with the 38.2% retracement line.

Near-term Keys: From a long-term perspective, there really isn’t any way to think of KO as a bargain at its current price. That said, I think there could be some interesting opportunities to take advantage of changes in the stock’s current momentum and trading range with short-term trading strategies. A break above $64 could be an interesting opportunity to take advantage of buying the stock or working with call options with a short-term eye on $65.50 as an exit point, and $67 possible if bullish momentum remains strong. A drop below $62 could offer a useful bearish signal to consider shorting the stock or buying put options, with an eye on $60 to $59 as a reasonable, quick-hit profit target on a bearish trade.