Being a value-oriented investor means that seeing stocks trading at or near historical lows tends to make a stock more interesting than when it is trading near historical highs.

For growth investors, that sounds odd since growth investing puts an emphasis on upward trends and stocks trading at or near their yearly highs. Sometimes a long decline in a stock’s price can be attributed to significant problems in a company’s profitability and operations, which is why most growth-oriented investor automatically shun downward-trending stocks. However, if the market inflates a stock’s price faster than a company builds its profits, the inevitable fall from grace that almost always follows also often depresses a stock’s price much faster, and much further than a company’s book of business suggests. That creates the kind of bargain opportunity that a deliberate, analytical value investor looks for. The point where that long, downward trend reverses can provide a nice opportunity for value and growth investors to be aligned at the same time, if all of the conditions I’ve just described are still in place.

Broad market conditions can contribute to the perception of value or growth as well. As the economy cycles from expansion and growth to contraction and even recession, different sectors and industries experience their own, separate cycles from prosperity to scarcity. That’s why a smart investor, no matter their method, also takes the time to keep track of sector-based analysis. Industries and sectors that may be following strongly bearish patterns can provide clues about where to find some of the strongest companies in those sectors at opportune times.

For most of the past three or four years, one of the most useful sectors that I have put a lot of focus on is the Consumer Staples sector. This is where you’ll find the companies that make a lot of the products you’ll find all over your house – in your pantry, refrigerator and freezer, as well as the household goods in your bathrooms, kitchens and bedrooms. The products made by these companies are needed in just about all economic conditions, which is why they are considered “staples” – you’ll always have a need for those products in your home.

McCormick & Company Inc. (MKC) is a company in this sector that makes a lot of the products that you might not realize make up such a big part of what we use to feed our families. Spices, condiments, and seasonings are this company’s core. While the past year has generally been good for the company’s bottom line, the stock has been following a downward trend since peaking in March of last year at around $107, bottoming in March at around $70 before picking up bullish momentum after the company’s last earnings report that has pushed the stock more than 21% higher. That’s attractive for a growth-focused investor, but what does it mean for bargain hunters? Let’s find out.

Fundamental and Value Profile

McCormick & Company, Inc is engaged in manufactures, markets and distributes spices, seasoning mixes, condiments and other flavorful products to the food industry-retailers, food manufacturers and foodservice businesses. The Company also partners with various companies that are involved in the manufacture and sale of flavorful products. The Company operates in two business segments: Consumer and Flavor Solutions. The Company’s sales, distribution and production facilities are located in North America, Europe and China. Additional facilities are based in Australia, India, Central America, Thailand and South Africa. MKC has a market cap of $23.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined -6.35%, while revenues increased by almost 3%. In the last quarter, earnings were more than -19% lower, while sales declined by -7.68%. The company operates with a healthy margin profile that has narrowed in the last few months. Over the last twelve months, Net Income was 10.42% of Revenues, and slipped in the last quarter to 8.89%.

Dividends: MKC pays a dividend of $1.56, which translates to an annualized yield of 1.81% at the stock’s current price. It is worth noting that in 2021, MKC’s dividend was $1.36 per share, and that MKC is among an elite group of companies that are considered “dividend aristocrats,” having maintained and increased their dividend every year for the past 39 years (they have paid a dividend every year since 1925), with the most recent increase coming just before the end of 2022.

Free Cash Flow: MKC’s free cash flow is $457.2 million and translates to a Free Cash Flow Yield of 1.98%. That is a decline from a year ago at around $487.2 million, and more than $600 million about a year and a half ago.

Debt to Equity: MKC has a debt/equity ratio of .74. This is a relatively low number that signals a conservative management approach to leverage. Their balance sheet indicates that in the last quarter, cash and liquid assets were $358.8 million, versus $3.6 billion in long-term debt. The company’s operating profile suggests that servicing their debt isn’t a problem, however their modest, declining Free Cash Flow and limited liquidity also imply the company has little margin for error.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $70 per share, which means that MKC is overvalued, with about -19% downside from its current price, and a useful discount price at around $56. It also bears mentioning that in the first quarter of this year, this same analysis yielded a long-term, fair value target price at around $64 per share.

Technical Profile

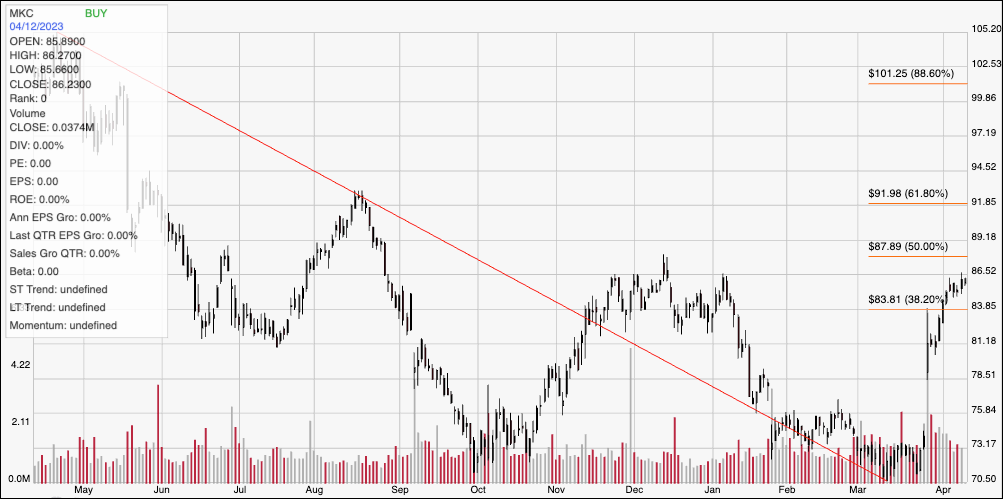

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart traces the stock’s movement over the last year. The diagonal red line traces the stock’s downward trend from an April 2022 peak at around $105 to its low, reached in March at around $70.50. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The company’s latest earnings announcement provided the basis for investors start buying the stock on a large-scale basis, prompting the overnight jump from around $73 to more than $80, with the stock building on that momentum in the last couple of weeks. Current support is around $84, where the 38.2% retracement line sits, with immediate resistance at around $87, based on a December 2022 peak in that region as well as the 50% retracement line. A push above $87 should see upside to about $92, where the 61.8% retracement line sits, while a drop below $84 should find next support at around $79, based on pivot activity in January as well as last November, and roughly the bottom of last month’s overnight jump.

Near-term Keys: While I am a fan of a lot of the stocks in the Food Products industry, MKC unfortunately doesn’t fit the description of a stock that is trading at a useful value price. That means that if you’re interested in working with this stock, the best approach is to leverage the latest surge with short-term trading strategies. A push above $87 could offer an interesting signal to buy the stock at its current price, or to work with call options, using $92 as a good bullish profit target. A drop below $84, on the other hand could be a signal to consider shorting the stock or buying put options, with $79 acting as a useful profit target on a bearish trade.