Inflation, rising interest rates, and all of the economic uncertainty that comes with them puts a lot of pressure on industries that are associated with consumer demand. That includes the Auto industry.

The last few years have seen a lot of turmoil for auto manufacturers. The pandemic shuttered economic activity, and collapsed oil prices as well as demand for new autos. Unprecedented economic stimulus during the pandemic also gave consumers a lot of extra cash to burn, so when economic activity began to reopen, those same consumers began looking for new purchases, including autos. That increase in demand, however contrasted against supply chain challenges to push new and used auto prices higher in 2021 and most of 2022.

Another intriguing element at play for automakers in general, and certainly for the biggest U.S. players is the shift towards electrical vehicles. Both Ford and General Motors (GM) are shifting their focus away from traditional combustion engines over time to all-electrical vehicles only. That is a shift that makes sense given the big push in consumer preferences in that direction as well as the emergence of EV manufacturers like Tesla, Lucid, Rivian, and others.

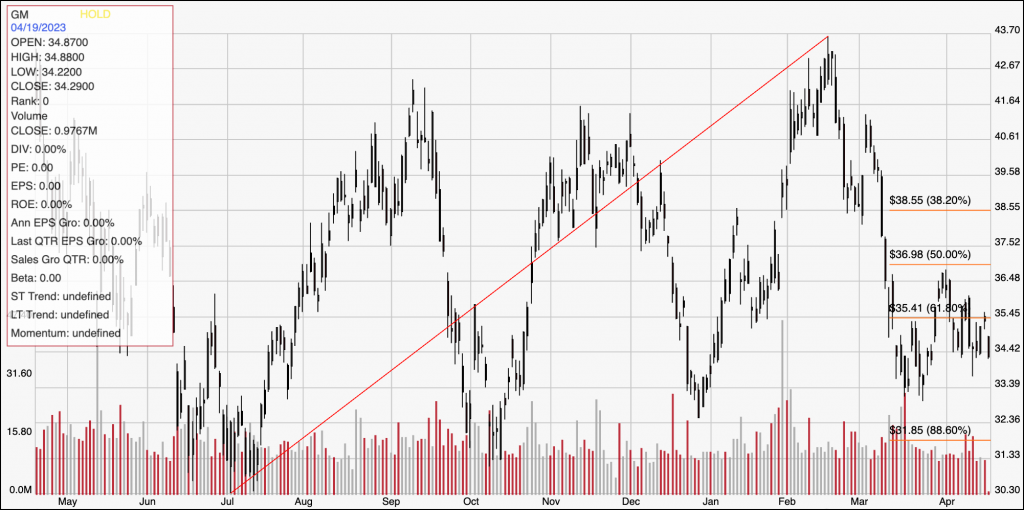

For GM, 2022 marked some major improvements in its fundamental profile that have diverged from the market’s treatment of its stock price, and that have carried over into 2023. From a January 2022 peak at around $67, the stock tumbled more than -50% to a July 2022 low at around $30 per share. The stock staged an upward trend into mid-February that peaked at around $44 before dropping back again, where the stock now appears to be consolidating at around $34.50 per share. What does its divergence between fundamental strength and price mean for the stock’s value proposition? Let’s dive in.

Fundamental and Value Profile

General Motors Company designs, builds and sells trucks, crossovers, cars and automobile parts and provides software-enabled services and subscriptions worldwide. The Company provides automotive financing services through its General Motors Financial Company, Inc. (GM Financial) segment. GM North America (GMNA) and GM International (GMI) develops, manufactures and/or markets vehicles under the Buick, Cadillac, Chevrolet and GMC brands. The Company’s segments include GMNA, GMI, Cruise and GM Financial. Its Cruise segment is engaged in the development and commercialization of autonomous vehicle technology. It offers OnStar and connected services to approximately 22 million connected vehicles globally through subscription-based and complimentary services. It is also developing hydrogen fuel cell applications across transportation and industries, including mobile power generation, class seven/eight truck, locomotive, aerospace and marine applications. GM’s current market cap is $48 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by more than 57%, while sales were about 28.4% higher. In the last quarter, earnings declined by about -5.8% while sales were about 2.9% higher. GM’s margin profile is showing signs of weakness. Net Income over the last twelve months was 6.34% of Revenues, and decreased in the last quarter to 4.63%.

Free Cash Flow: GM’s free cash flow is healthy, at about $9.1 billion for the trailing twelve month period. That translates to a Free Cash Flow yield of 18.45%. That does represent a steep drop from the quarter prior, when Free Cash Flow was $24.6 billion, but above the $5.7 billion mark of a year ago.

Debt to Equity: GM has a debt/equity ratio of 1.06, a high number that indicates that, like most companies in this industry, the company operates with a high degree of leverage. GM’s balance sheet is a source of strength, with cash and liquid assets of about $31.3 billion (up from $30.3 billion in the last quarter and $26.3 billion a year ago) against $75.9 billion in long-term debt. The company’s Free Cash Flow and healthy cash position indicate that while their debt is high, servicing it isn’t a problem. The decline in operating efficiency reflected by weakening Net Income is a concern, but could simply be cyclical in nature.

Dividend: GM pays a dividend of $.36 per share, per year, and which translates to an annualized dividend yield of 1.02% at the stock’s current price. Management suspended the dividend in 2020 in response to COVID and reinstated it after the third quarter of 2022, which is a sign of confidence on the part of management in their path ahead.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $57 per share. That means that GM is significantly undervalued, with about 65% upside from its current price.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price activity over the last year. The red diagonal line traces the stock’s upward trend from its July 2022 low at around $30 to its February peak at around $44. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock dropped sharply off that $44 high, finding bottom in mid-March at around $33.50 to mark current support at that level, with immediate resistance at around $35.50 around the 61.8% retracement line. A push above $35.50 could see the stock rise to about $38.50, where the 38.2% retracement line sits before finding next resistance. A drop below $33.50 should see downside to about $31 to next support, with the stock’s 52-week low just a little below that level at $30 if selling pressure increases.

Near-term Keys: While GM has some very interesting fundamental strengths in its favor, and a value proposition that looks very tempting, I think the current economic climate (high inflation, still-rising interest rates) adds a level of uncertainty that adds a level of risk, about which average investors should exercise caution. Even with those economic concerns in mind, I think GM is a stock that is worth putting in a watchlist and coming back to If you prefer to work with short-term trading strategies, you could use a break above $35.50 could be a signal to buy the stock or to work with call options, using $38.50 as a useful target price on a bullish trade. A drop below $33.50 could offer a signal to think about shorting the stock or working with put options, using $31 as a practical initial profit target on a bearish trade.