Uncertain market conditions make it harder for average investors like you and me to find winning stocks – at least in the short term.

As a contrarian-minded, value-oriented investor, I actually like these kinds of market conditions, because it keeps pressure on most sectors and industries in the market. That means that finding stocks trading at attractive valuations starts to become a little bit easier. The same uncertainties that put the broad market on edge, however, can act against a useful value proposition. Rising interest rates, for example, come about because inflation is increasing, which means that the cost of doing business is also rising, which is why it’s careful not to assume that just because a stock is trading at or near historical lows, that it must be a great value.

Understanding that price action isn’t always an automatic indicator of value works in the opposite fashion, too, and that’s why I’ve also learned to take notice when I find a stock that diverges from uncertain market conditions and shows its own strength. Some industries are more resistance to economic downturns than others, but even so, when the entire market is on uneven footing, stocks whose prices don’t follow the herd are noteworthy in their own right. It isn’t unusual in these cases to find that even with their positive price action, their fundamentals are strong enough to make them viable candidates for useful new, value-oriented investing opportunities.

That brings me to today’s highlight. Fastenal Co. (FAST) is a company that distributes industrial and construction supplies – market spaces that I would normally consider to be as sensitive, if not more so, to inflationary pressures and changes in monetary policy. Despite that expectation, the stock has been a winner so far this year, rallying from its January start a little over 15% to its current price around $55 per share. Could the stock also offer a useful value proposition? Let’s find out.

Fundamental and Value Profile

Fastenal Company is engaged in the wholesale distribution of industrial and construction supplies. The Company is a distributor of threaded fasteners, bolts, nuts, screws, studs, and related washers, as well as miscellaneous supplies and hardware. Its customers are in the manufacturing and non-residential construction markets. The manufacturing market includes sales of products for both original equipment manufacturing (OEM), where its products are consumed in the final products of its customers, and manufacturing, repair, and operations (MRO), where its products are consumed to support the facilities and ongoing operations of its customers. The non-residential construction market includes general, electrical, plumbing, sheet metal and road contractors. Other users of its products include farmers, truckers, railroads, oil exploration companies, oil production and refinement companies, mining companies, federal, state, and local governmental entities, schools, and certain retail trades. FAST has a current market cap of $31.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by more than 10.6%, while sales grew a little over 9%. In the last quarter, earnings grew almost 21% while revenues where about 9.6% higher. It’s hard for a company to grow earnings faster than sales, and generally not sustainable over time. I do take the difference, however as a good sign that management is doing a good job of maximizing their business operations. Their operating profile is also very healthy, and stable; Net Income as a percentage of Revenues was 15.59% over the last year, and 15.87% in the last quarter.

Free Cash Flow: Free Cash Flow is healthy, at a little more than $929.3 million over the past twelve months. This number has also increased steadily over the past year, from $541.8 million, and translates to a modest free cash flow yield of 3.01%.

Debt to Equity: the company’s debt to equity ratio is .06, which is a low, very manageable number. Their balance sheet indicates operating earnings are more than sufficient to service their debt, with $240 million in cash and liquid assets and $200 million in long-term debt.

Dividend: FAST pays an annual dividend of $1.40 per share, which translates to an annual yield of 2.56% at the stock’s current price. The dividend payout also increased, from $1.24 per share two quarters ago, which is also a sign of management confidence and company strength.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $52 per share. That means that FAST is is overvalued by about -5% right now, with a useful discount price at around $41.50 per share.

Technical Profile

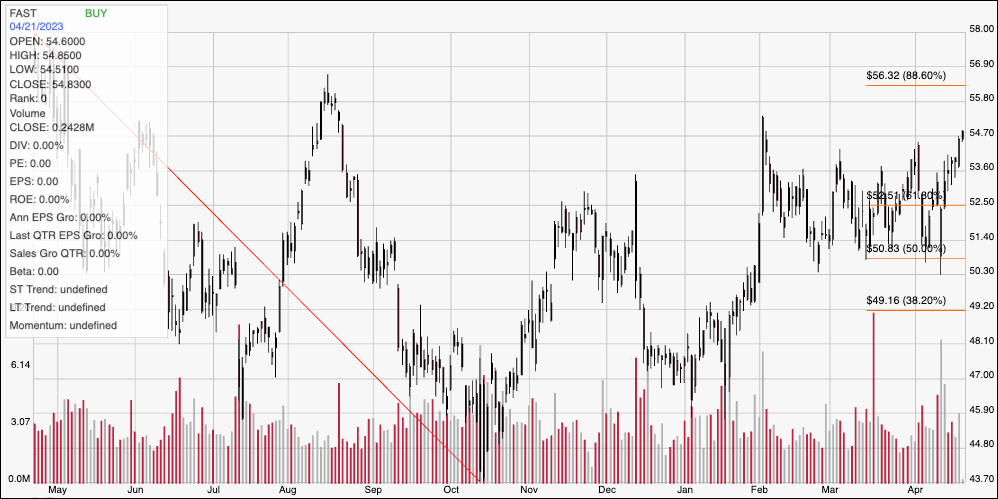

Here’s a look at the stock’s latest technical chart.

Current Price Action: The chart above displays the stock’s price action over the past year. The red diagonal line displays the stock’s downward trend from a $58 peak a year ago to its 52-week low, reached in October at around $44 per share. It also defines the Fibonacci retracement lines shown on the right side of the chart. The stock has followed a strong upward trend from that point, and as of this writing is nearing immediate resistance at around $55 from previous pivot highs shown in February of this year, and June of 2022. Current support is around $52.50, where the 61.9% retracement line sits. A push above $55 should find next resistance at around $56.50, with additional upside to the stock’s yearly high at $58 if buying activity increases. A drop below $52.50, on the other hand should find next support at around $51, right around the 50% retracement line and consistent with a lot of pivot activity in February and March.

Near-term Keys: While FAST boasts a number of useful fundamental strengths, it unfortunately can’t be argued that it offers an attractive value proposition at its current price. That means that the best opportunities lie with short-term trades. A push above $55 could be a good signal to consider buying the stock or working with call options, with $56.60 providing a useful initial profit target, and $58 possible if bullish momentum increases. A bounce off of current resistance, on the other hand, could be an interesting signal to consider shorting the stock or buying put options, with immediate support at around $52.50 providing a practical bearish profit target, and $51 within reach if selling pressure accelerates.