The quest for useful value in the stock market is one of those things that applies to any market condition – bull, bear, or none.

The current state of the market and the economy in general is what tends to shift the value focus from one sector to another. The last year and a half has been dominated by questions about inflation, interest rates, and the global, geopolitical concerns that continue to constrain supply and keep prices high. Inflation has remained strong enough to keep interest rising, which has had a downward effect on energy prices. Benchmark prices for U.S. and global crude have dropped for most of the past year from peaks early last summer at around $124 per barrel, but remain above early 2021 levels. Industry experts predict crude price will reach an average price of $81 in 2024, suggesting that there is little downside to the commodity right now.

Some of the issues keeping oil prices elevated compared to 2020 and 2021 levels are global in nature, with serious geopolitical concerns. Russia’s war with Ukraine doesn’t have a near-term end in sight; that is putting a lot of pressure on the price not only of crude oil but also natural gas, as Russia is a major global exporter of both commodities, and with a significant amount of pipeline capacity to get those products out of Russia and to the rest of the world running through Ukraine. Along with still-healthy levels of demand, and a U.S. administration that is reluctant to increase drilling and exploration capacity, that suggests that oil prices are likely to remain elevated for some time.

Increasing energy prices can be a bit of a mixed bag for stocks in the energy sector. On the one hand, they imply that demand is high, which should contribute to increased revenues; but when demand isn’t addressed by increased capacity, it can also have a reverse effect, especially on the companies that focus on exploration and production. Rising inflation also generally implies rising input costs in areas that affect just about all sectors. Rising labor costs are a good example of one of the things that a lot of businesses have been forced to contend with in the last two years in order to attract and keep workers.

Suncor Energy Inc. (SU) is an integrated energy company, based in Canada, with health cash flow and profitability metrics in place, but has also absorbed some impact from rising costs that have affected other areas like available cash. The stock saw an impressive rally from an August 2021 low at around $16 to a peak in June above $42. From that point, the stock has dropped back into its own bear market, but appears to be finding a current bottom for that downward trend. If that bottom holds, it could provide a good launch point for a new bullish rally. Does that suggest that the stock’s most recent price activity could translate to a useful opportunity for long-term oriented investors? Let’s find out.

Fundamental and Value Profile

Suncor Energy Inc. is a Canada-based integrated energy company. The Company’s segments include Oil Sands, Exploration and Production (E&P), and Refining and Marketing. The Oil Sands segment includes the Company’s owned operations in the Athabasca oil sands in Alberta to explore, develop and produce bitumen, synthetic crude oil and related products, through the recovery and upgrading of bitumen from mining and in situ operations. The E&P segment includes offshore activity in East Coast Canada, with interests in the Hibernia, Terra Nova, White Rose and Hebron oilfields, the exploration and production of crude oil and natural gas at Buzzard and Golden Eagle Area Development in the United Kingdom, and exploration and production of crude oil and gas at Oda. The Refining and Marketing segment includes the refining of crude oil products, and the distribution, marketing, transportation and risk management of refined and petrochemical products, and other purchased products. SU has a current market cap of $39.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by more than 87.3%, while revenues grew by about 15.3%. In the last quarter, earnings decreased by -7.64% while sales were -11.6% lower. The company’s margin profile is healthy, and strengthening; over the last twelve months, Net Income as a percentage of Revenues was 15.52%, and increased to 19.74% in the last quarter.

Free Cash Flow: SU’s free cash flow is very strong, at nearly $8.4 billion over the last twelve months. That marks an increase from $7.7 billion in the last quarter, and from $6.4 billion a year ago. The current number translates to a Free Cash Flow Yield of 21.53%.

Debt to Equity: SU’s debt to equity is .25, which is a conservative number. The company’s balance sheet indicates that operating profits are more than adequate to service their debt, with good liquidity. Cash and liquid assets were about $1.5 billion in the last quarter, while long-term debt was about $7.5 billion.

Dividend: SU’s annual divided is $1.53 per share, and translates to a yield of about 5.22% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $38 per share. That means that SU is undervalued right now, with about 29% upside from its current price. It is also worth noting that at the end of 2022, this same analysis yielded a fair value target at $41.60 per share.

Technical Profile

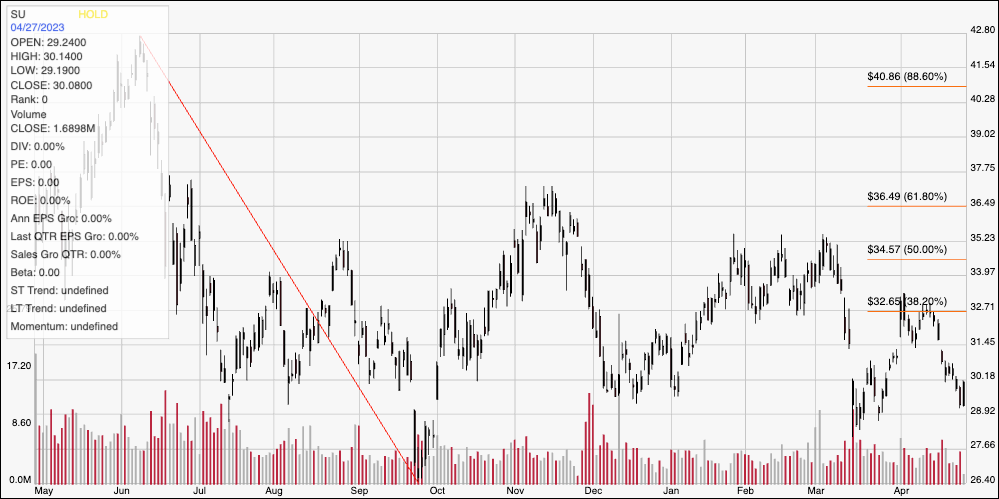

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red diagonal line traces the stock’s downward trend from a 52-week high at around $43 per share in June 2022 to its low in September at around $26.50. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock appeared to be building a new upward trend from January through the start of March of this year before falling sharply back to its last major pivot low at around $29 per share, which also lines up with the stock’s current support. The stock rallied temporarily to hit $32.50 at the start of this month before dropping back again. Immediate resistance is around $31.50. A push above $31.50 will see next resistance at $32.50, but a push above that point could see the stock rally to about $34.50 if buying activity is strong enough. A drop below $29 should see the stock test its 52-week low at around $26.50 as next support.

Near-term Keys: SU is an interesting stock in a sector that offers an interesting value proposition right now. This is a company with healthy free cash flow, and increasing profitability working in its favor. That makes SU a stock that could offer a good long-term opportunity for a value-focused investor. If you prefer to work with short-term trading strategies, you could use a push above $31.50 as a signal to think about buying the stock or working with call options, using $32.50 as a very quick-hit, bullish profit target and $34.50 possible if bullish momentum increases. A drop below $29, on the other hand would be a good signal to consider shorting the stock or buying put options, with a practical profit target at around $26.50 per share on a bearish trade.