Sometimes, trying to find a positive story thread for the stock market might seem a bit like looking for a needle in a haystack.

That’s only true, however if your strategy for the markets relies exclusively on looking for growth. In bear market conditions, or amidst the kind of broad certainty the market has seen for most of the past year and a half, it’s easy to pass off the stock market as a bad place to put your money. The most skeptical alarmists would suggest moving everything to cash and waiting for a year or more before looking for any new investing opportunities in the stock market. That mindset ignores the fact that even in bear market conditions, there are always pockets of the economy and the market that continue to provide useful opportunities. That’s the needle in the haystack, and it’s the reason value-focused investors like me tend to think about bear markets as a growing pool of opportunity.

The Energy sector has not been immune from the effect of inflation. However, the net effect of supply chain constraints that existed before the start of 2022, and that have been further exacerbated by Russia’s war in Ukraine and its resultant global, geopolitical and economic isolation is that crude and natural gas prices rose during the summer to levels not seen in at least eight years. Prices have dropped from those highs, but still remain elevated well above pre-pandemic levels. While that implies that gas at the pump is also going to remain high for consumers, it should also provide a headwind to stocks in the sector. That’s why many of the best values that I’m uncovering in the stock market right now are found among Energy stocks.

In the Oil and Natural Gas industries, companies are broken into additional categories depending on where in the supply chain they tend to operate. Downstream companies are those that are closer to the consumer – for example, refineries, local and regional utility providers, and filling stations – while upstream companies are those that operate closer to the extraction and production of raw energy materials. Between the two extremes are a lot of different processes and operations, and companies at every possible point along the way but that are usually called midstream. These are the companies that are usually involved in transportation and storage of raw materials.

Halliburton Company (HAL) is a pretty well-known name to even a casual observer of energy prices and their dynamics. Most of the company’s operations lie in working with companies at the upstream stage of the energy supply chain; the companies that primarily reside at this end of the supply chain are also usually the most immediate benefactors of rising raw material prices. In the second quarter of 2022, the company recorded a charge of $344 billion on its books associated with the company’s exist from Russia. That’s put pressure on HAL to make up the difference from its U.S. operations as well as other parts of the world. After falling to an September 2022 low at around $23, the stock picked up bullish momentum to peak at around $44 in January of this year. The stock has dropped back again since then, falling a little over -34% to its current price at around $29. Does that mean that HAL could be offering a good bargain-based opportunity right now? Let’s find out.

Fundamental and Value Profile

Halliburton Company provides services and products to the upstream oil and natural gas industry throughout the lifecycle of the reservoir, from locating hydrocarbons and managing geological data, to drilling and formation evaluation, well construction and completion, and optimizing production throughout the life of the field. It operates through two segments: the Completion and Production segment, and the Drilling and Evaluation segment. The Completion and Production segment delivers cementing, stimulation, intervention, pressure control, specialty chemicals, artificial lift and completion services. The Drilling and Evaluation segment provides field and reservoir modeling, drilling, evaluation and wellbore placement solutions that enable customers to model, measure, drill and optimize their well construction activities. It serves national and independent oil and natural gas companies. As of December 31, 2016, it had conducted business in approximately 70 countries around the world. HAL has a current market cap of about $26 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 106%, while revenues grew by 32.5%. In the last quarter, earnings growth was flat, at exactly 0% while sales increased by about 1.7%. HAL’s margin profile is historically pretty narrow, but has seen marked improvement over the last year. In the last twelve months, Net Income as a percentage of Revenues was 9.04%, and strengthened to 11.47% in the last quarter.

Free Cash Flow: HAL’s free cash flow is modest, as Free Cash Flow was $1.5 billion in the last quarter versus about $979 million a year ago. The improvement over the last year is also confirmed from the last quarter, when Free Cash Flow was $1.4 billion. It is also worth noting this number was about $415 million in the last quarter of 2019. The current number translates to a Free Cash Flow Yield of 5.87%.

Debt to Equity: HAL’s debt to equity is .94. The company’s balance sheet shows about $1.9 billion in cash and liquid assets against about $7.9 billion in long-term debt. The company should have no problem servicing their debt, and it should be noted that the company has retired approximately $600 million of long-term debt over the past year.

Dividend: HAL’s annual divided was $.72 per share prior to the onset of the COVID-19 pandemic, which prompted management to reduce the dividend to about $.18 per share, per year. Management increased the dividend to $.48 per share at the start of 2022, and to $.64 per share at the beginning of this year. The current number translates to an annualized yield of about 2.25% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $30 per share. That suggests that the stock is pretty fairly valued, with about 3.4% upside from its current price right now, with a practical discount price sitting at around $24. It should also be noted that at the end of 2022, this same analysis yielded a fair value target price at around $18 per share.

Technical Profile

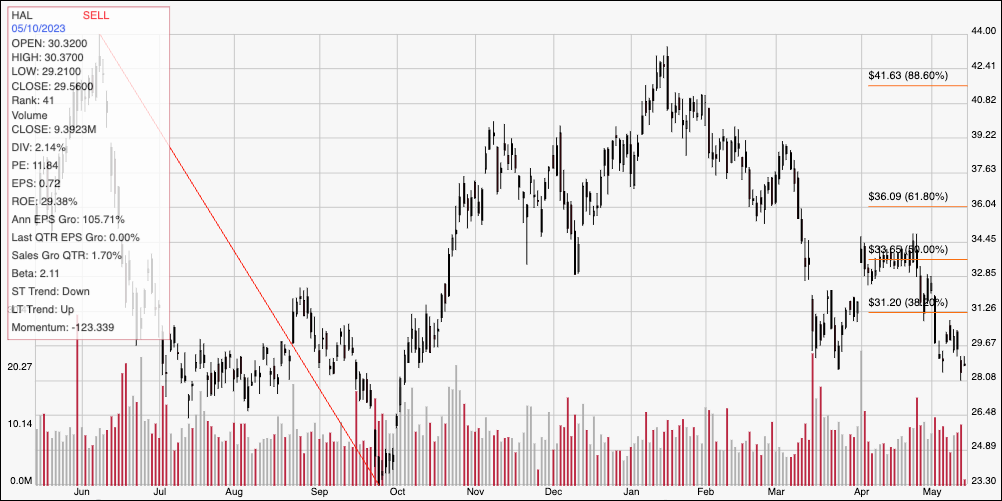

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red diagonal line traces the stock’s downward trend from its high at around $44 in May of last year, to its low in September at $23. It also informs the Fibonacci retracement lines shown on the right side of the chart. After peaking in January of this year near its $44 high, the stock dropped back to hit a low at around $29 in March, then rebounded again to peak at around $34 in April. The stock has dropped back again and appears to be sitting right on current support at around $28, with immediate resistance at around $31 where the 38.2% retracement line sits. A push above $31 will see next resistance at that April peak around $34, with additional upside to about $36 if buying activity increases. A drop below $28 should find next support at around $26.50; however if that level doesn’t hold, the stock could retest its 52-week lows at around $23 per share.

Near-term Keys: HAL is a company with a fundamental profile that is showing measurable signs of improvement, which is a positive in the current market environment. For a value hunter like me, that is an encouraging sign; however the fact is that even with the stock’s drop since January, it still doesn’t offer a useful value proposition. That means that for now, the best probabilities with this stock lie in short-term trading strategies. Use a push above $31 as a signal to consider buying the stock or working with call options, with $34 offering a useful short-term profit target on a bullish trade, and $36 possible if buying activity increases. A drop below $28 could be a good signal to think about shorting the stock or buying put options, using $26.50 as an initial bearish profit target, and $23 possible if selling pressure accelerates.