When uncertainty is high in an industry, and you’re a bit of a contrarian, there’s a natural temptation to gravitate to the industry’s largest, most dominant companies.

It takes a contrarian mindset to focus on industries where uncertainty and fear are driving volatility higher – because in those situations most growth-oriented investors are certainly looking elsewhere for their own opportunities. In those situations, not only do I believe it’s natural to look first at the industry leaders, but there’s also some wisdom in that starting point.

That doesn’t mean that smaller companies in an industry won’t offer opportunities that might be just as attractive, or that the fundamentals of those companies are less than their larger brethren. It really just means that if you consider the entire industry as its own relative market, you try to recognize that certain parts of an industry may respond differently to volatile conditions than others.

The Banking industry is becoming a more and more interesting example of what I mean every day right now. The very publicized failures of large venture capital banks Silicon Valley Bank and Signature Bank, followed by the collapse of Swiss giant Credit Suisse in March, brought the entire industry crashing down. This month, the failure of First Signature brought larger banking fears bubbling back to the surface after they had begun to wane in April. From the start of February to now, the industry has dropped about -34.4%, as measured by the S&P Banking SPDR ETF (KBE). It even prompted the Fed to acknowledge banking concerns in their most recent rate increase announcement.

Over the last couple of months, a lot of information has come out from the industry showing that most of the worst problems that took down those three banks are relatively confined. Many of the largest banks in the U.S. are well-shielded from those extreme risks, and many regional banks in particular are proving in their latest financial reports to be on solid footing as well. For a bargain hunter like me, that means that, on a selective basis, this is looking more and more like an industry to pay attention to.

That brings me to today’s highlight. Bank of America Corp (BAC) is the second largest national bank in the U.S., and absorbed as much of the banking sell off as the rest of the industry, falling from a yearly high at around $39 to a low at around $26 in mid-March. After rebounding strongly in April, fresh banking concerns have pushed the stock back down, where it is now just a little above that 52-week low. With increasing Free Cash Flow, massive liquidity, and a leading position in consumer and small business banking as well as wealth management, the stock carries a compelling value proposition. Does that mean you should be considering BAC as a useful long-term opportunity? Let’s dive in to the numbers.

Fundamental and Value Profile

Bank of America Corporation is a bank holding company and a financial holding company. Its segments include Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking and Global Markets. Consumer Banking segment offers a range of credit, banking and investment products and services to consumers and small businesses. The GWIM includes two businesses: Merrill Wealth Management, which provides tailored solutions to meet clients’ needs through a full set of investment management, brokerage, banking and retirement products and Bank of America Private Bank, which provides comprehensive wealth management solutions. Global Banking segment provides a range of lending-related products and services, integrated working capital management and treasury solutions, and underwriting and advisory services. Global Markets segment offers sales and trading services and research services to institutional clients across fixed-income, credit, currency, commodity, and equity businesses. BAC has a current market cap of $219.2 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by almost 17.5%, while sales grew nearly 65%. In the last quarter, earnings grew about 10.6% while revenues where almost 16% higher. Their operating profile is also very healthy; Net Income as a percentage of Revenues was 21.85% over the last year, and narrowed slightly to 20.17% in the last quarter.

Free Cash Flow: Free Cash Flow is healthy, at a little more than $27.8 billion over the past twelve months. This number has also increased steadily over the past year, from $3.9 billion, and -$6.3 billion in the last quarter. The current number translates to an attractive free cash flow yield of 12.62%.

Debt to Equity: the company’s debt to equity ratio is 1.13, which sounds high, but isn’t atypical for the Banking industry. It also doesn’t tell the real story about BAC’s balance sheet. Their balance sheet indicates operating earnings are more than sufficient to service their debt, with a little over $1 trillion in cash and liquid assets against $283.8 billion in long-term debt.

Dividend: BAC pays an annual dividend of $.88 per share, which translates to an annual yield of 3.18% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $43 per share. That means that BAC is is undervalued, with about 56% upside from its current price right now.

Technical Profile

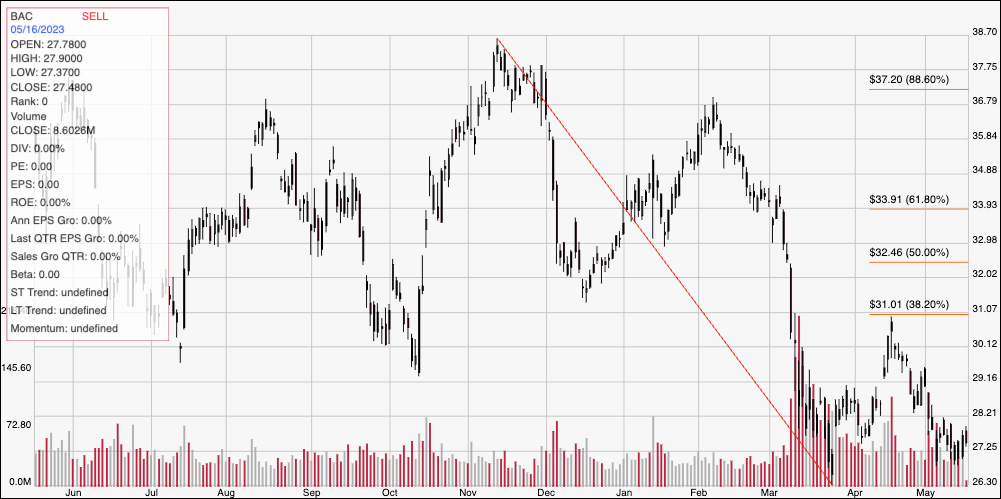

Here’s a look at the stock’s latest technical chart.

Current Price Action: The chart above displays the stock’s price action over the past year. The red diagonal line displays the stock’s downward turn from a $39 peak in November to its 52-week low, reached in the middle of March at around $26 per share. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After rallying to about $31 in mid-April, the stock hit resistance at the 38.2% retracement and dropped sharply back, finding its latest low at around $26.50, not far from the actual yearly low price to mark current support there. Immediate resistance is around $28.50 based on pivot high activity seen in late March at that level. A push above $28.50 should see room for the stock to test next resistance at the $31 level, while a drop below $26.50 could see the stock drop to about $24.50, using the current distance between support and resistance as a benchmark.

Near-term Keys: BAC boasts a number of useful fundamental strengths, with a very compelling value proposition at its current price. That doesn’t mean there aren’t risks to be considered – banks in general are highly sensitive to changes in interest rates, and a recession would imply slowdowns in the company’s lending business. If you’re willing to take on those risks, the stock looks like an excellent value opportunity at its current price. If you prefer to work with short-term trading strategies, a push above $28.50 could be a good signal to consider buying the stock or working with call options, with $31 providing a useful profit target. A drop below $26.50 could be an interesting signal to consider shorting the stock or buying put options, with next support at around $24.50 providing a practical profit target on a bearish trade.