Sometimes, answering the question of whether a stock represents a legitimate, attractive value opportunity is more art than science.

Strict, quantitative value and fundamental analysis would dictate that you stick to the numbers, and to distrust anything but what the numbers tell you. As often as not, however, I find it necessary to look beyond the numbers my favorite fundamental metrics give me, because the truth is that business isn’t always just about the numbers. A company could be struggling to grow its business, and as a result be forced to restructure its business in a way that makes most of the traditional measurables investors like to use look very unfavorable. Sometimes, much broader concerns, upon which a company can exercise absolutely zero control, carry an impact on a company’s ability to grow. The last few years have proven the truth in that idea, as the coronavirus pandemic forced companies in every sector of the market to find new ways to survive, let alone to thrive.

It isn’t that the numbers – sales, earnings, free cash flow, debt, and so on – aren’t important, because of course they always are. They help to frame a company’s business over any given period of time in a useful context. Sometimes, however, you also need to be able to look beyond what that potentially limited context may describe. It can be important to remember that the numbers that make up fundamental and value-based metrics are almost always historical in nature; even forward-looking measurements and estimates are generally forced to rely to some extent on past performance to provide a framework for what a company might be able to do in the future. This is really where one of the challenges of stock market and value-based analysis is the greatest, as finding useful opportunities to put your money to work for you becomes even more subjective.

To add even more complication to the mix, broader economic conditions naturally play a role in this analysis. Some segments of the economy are more sensitive to the ebb and flow of economic growth, and so a smart investor tries to understand where the stock you may be considering fits into the overall economic picture. If you’re paying attention to stocks in the Energy sector, for example, you need to understand that in the broadest sense, these stocks are tied directly to crude oil, natural gas, and other energy-related commodity prices. Stocks in the Consumer Staples sector, on the other hand, like Food Products tend to be a bit less sensitive to economic fluctuations simply because even when the economy may be contracting, consumers still have to stock their pantries and fridges.

With the idea of economic cyclicality in mind, let’s think about the Consumer Discretionary sector. This is a sector that tends to be more sensitive to broad economic conditions, and if you drill down into some of the industries in the sector, that fact starts to make sense. The Specialty Retail industry takes in a pretty wide swath of company types that includes the kinds of focused, specialized retail stores you’ll commonly find at the mall. Even more to the point, when you start thinking about specialists like jewelers, I think the picture becomes even more clear. When factors like unemployment are high, and incomes are dropping, shopping for diamond jewelry becomes a lot harder for the average consumer.

2022 marked a change from the very accommodative monetary policy the Fed used to start this decade to support the economy during the worst of the pandemic. As consumer activity has increased, consumer prices have risen faster than many expected, marking inflationary levels last year that hadn’t been seen in the last 40 years and prompting the Fed to take an increasingly aggressive approach to raising interest rates. Most of those inflationary factors remain in place today, albeit on a flattening basis that has some experts speculating the Fed might press pause on further rate increases following this week’s governor’s meeting.

For specialty retailers like Signet Jewelers Ltd (SIG), a prolonged, high interest rate environment, along with the looming spectre of economic recession means that these stocks may be exposed to a higher level of broad market risk than stocks in other industries. Despite that risk, this is a stock that enjoyed a strong upward trend from June of last year to a peak in February, but has dropped sharply back from that high at around $83.50. This is a company with a very strong balance sheet that features very low, manageable debt, healthy liquidity as well as Free Cash Flow. The stock has dropped into a downward trend that now has the stock sitting around $59.50, with strong bearish momentum that could see it drop even more. The real question now is whether the strength in the stock’s balance sheet is enough make the stock a good bargain you should consider taking advantage of under current market conditions? Let’s try to find out.

Fundamental and Value Profile

Signet Jewelers Limited is a Bermuda-based retailer of diamond jewelry. The Company operates approximately 2,800 stores primarily under the name brands of Kay Jewelers, Zales, Jared, H.Samuel, Ernest Jones, Peoples Jewellers, Banter by Piercing Pagoda, JamesAllen.com, Diamonds Direct and Rocksbox. It offer clients an unmatched range of products in rounds, pears, marquise, princess, emerald, cushion and heart shaped diamonds.SIG’s current market cap is about $2.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by about -37.75%, while sales were -9.26% lower. In the last quarter, earnings slide even more sharply, by-67.75%, while sales were -37.44% lower. The company’s historically narrow operating profile has weakened in the last quarter. Over the last twelve months, Net Income was 7.27% of Revenues, and narrowed in the last quarter to 5.84%.

Free Cash Flow: SIG’s free cash flow is healthy, at $406.4 million for the trailing twelve month period; that translates to a Free Cash Flow yield of 15.13%. It does mark a decline from $659 million in the last quarter, as well as the $528.3 million mark of a year ago.

Debt to Equity: SIG has a debt/equity ratio of .09, which indicates the company applies a conservative philosophy about leverage and speaks in part to the company’s fortress-level balance sheet. For perspective, consider that in late 2018, SIG held only about $134 million in cash and liquid assets versus $671.1 million in long-term debt. As of the last quarter, cash and liquid assets were $655.9 billion while long-term debt was just $147.5 million – compared to $1.03 billion to begin 2021.

Dividend: SIG suspended its dividend in early 2020 to preserve cash, but reinstated it in mid-2021 at a rate of $.72 per share, and increased it to $.80 per share, per annum in 2022, and $.92 at the beginning of this year. That is modest, translating to an annualized yield of 1.55%, but the reinstatement, followed by subsequent increases is still a declaration of management’s confidence in the future.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $42 per share. That suggests that the stock is quite overvalued right now, with -30% downside from its current price, and a practical discount at around $33. It’s also worth noting that at the start of 2023, this same analysis yielded a fair value target price at around $54.50 per share.

Technical Profile

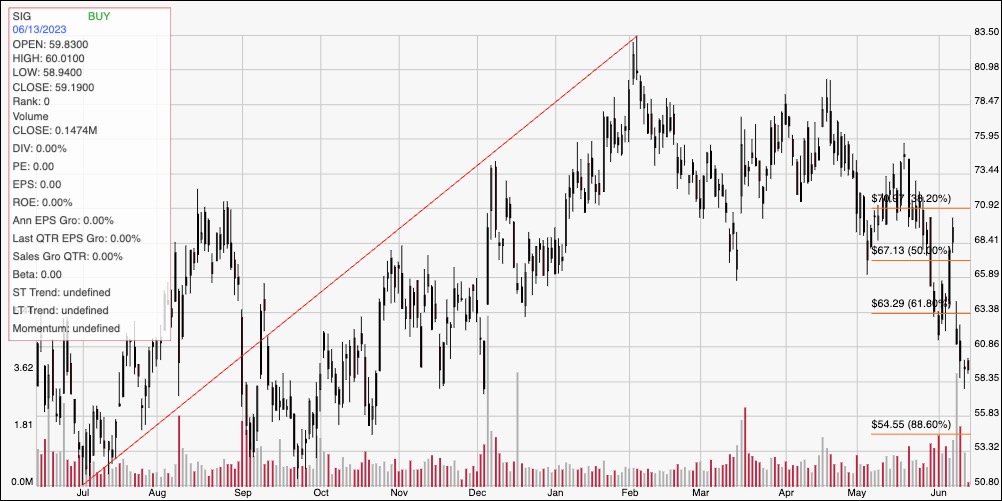

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above traces the stock’s price activity over the last year. The red diagonal line traces the stock’s upward trend from its low at $51 last July to its February peak at around $83.50. It also provides the baseline for the Fibonacci retracement lines on the right side of the chart. The stock faded back from that high, and really started picking up bearish momentum in mid-May, sliding from a peak at around $74 to its current level below $60. Immediate resistance is at around $61, based on the stock most recent pivot low at the start of June, with current support expected at around $58 based on pivot activity seen at multiple points in late 2022. A push above $61 has limited upside, with next resistance at the 61.8% retracement, which sits around $63 per share. A drop below $58 should find next support at around $55, not far from the 88.6% retracement line and where additional, late-2022 pivot activity can be seen.

Near-term Keys: Despite its healthy balance sheet, SIG’s downward trend hasn’t pushed the stock the low enough to mark it as a useful value as of yet. That means that the best probabilities for working with this stock lie in short-term trading strategies; however, I would mark any kind of bullish trade right now as extremely aggressive and entirely speculative. The best signal to work with SIG on a short-term basis would come from a drop below $58; in that case, consider shorting the stock or buying put options, with a useful profit target sitting within reach at $55.