Over the last three years, one of the sectors of market that experienced major shifts in its business models was the Healthcare sector.

Every facet of the entire system, it seems, from local clinics, to hospitals, and more was forced to shift its focus through practically all of 2020 and 2021 from regular operations, and even delay or defer things like elective procedures to deal with the massive demand imposed by the pandemic. Public and market focus, especially since late 2021 has shifted away from COVID discussions and to other weighty matters, like inflation, interest rates, and the war between Russia and Ukraine and its global impact.

No matter how much folks want to put COVID in the rear-view mirror, however the truth is that COVID has continued to be a concern. That reality has not only limited hospitals and health care providers to accommodate important procedures, but also put major pressure on staffing shortages at medical facilities and exacerbated supply and demand disruptions. Recent months indicate that some of those headwinds have begun to fade, accommodating greater procedure volumes. That’s good news for medical device and health care equipment manufacturers.

The Medical Specialities industry of the health care sector includes medical equipment manufacturers and suppliers, who are generally considered to be pretty safe, defensive-oriented investments to think about when economic conditions are difficult. In the current environment, with interest rates climbing, consumers are likely to have to curb discretionary spending – but that doesn’t mean that health care needs can take a back seat. For companies like Medtronic PLC (MDT), who adapted to meet demand for useful equipment to combat COVID, bringing their focus back to innovating new, useful devices for a variety of treatment methods should help them meet increased demand for “traditional” healthcare products and solutions. MDT’s balance sheet has been resilient throughout the past three years and continues to be a source of strength. The stock experienced a downward trend that fell from a high in April of 2022 at around $114.50 to find its 52-week low point at around $76 in December. The stock has staged a couple of rallies in 2023, with sharp drawdowns against those rallies that saw the stock sitting at around $81 to start this month. In just the last few days, the stock has rebounded sharply again, and is now sitting at around $88 per share.

For growth-oriented investors, that kind of rapid increase sounds exciting, and makes tempting fodder for placing a new trade. For bargain hunters, however, the strength of that rally automatically raises the question about what it means for the stock’s value price. Has it already surged past the point of useful value, or could the company’s underlying fundamentals be strong enough to suggest there is more upside in sight? Let’s dive in to the numbers.

Fundamental and Value Profile

Medtronic Public Limited Company is an Ireland-based company, which provides healthcare technology solutions. The Company’s products category includes Advanced Surgical Technology; Cardiac Rhythm; Cardiovascular; Digestive & Gastrointestinal; Ear, Nose & Throat; General Surgery; Gynecological; Neurological; Oral & Maxillofacial; Patient Monitoring; Renal Care; Respiratory; Spinal & Orthopedic; Surgical Navigation & Imaging; Urological; Product Manuals; Product Ordering & Inquiries; and Product Performance & Advisories. Its products include Cardiac Implantable Electronic Device (CIED) Stabilization, Aortic Stent Graft Products, CareLink Personal Therapy Management Software, CareLink Pro Therapy Management Software. Its services and solutions include Ambulatory Surgery Center Resources, Care Management Services, Digital Connectivity Information Technology (IT) Support, Equipment Services and Support, Innovation Lab, Medtronic Healthcare Consulting, and Office-Based Sinus Surgery.MDT has a current market cap of about $117.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 3.29%, while sales grew by 5.62%. In the last quarter, earnings rose by 20.77%, while revenues increased by about 10.6%. MDT is a company that operates with a healthy margin profile; in the last twelve months, Net Income was 12.03% of Revenues, and strengthened to 13.8% in the last quarter.

Debit/Equity: MDT’s debt to equity ratio is .47, which is conservative. Their balance sheet shows a little less than $8 billion in cash and liquid assets, with $24.3 billion in long-term debt. Their operating profile indicates that servicing their debt is not a problem. It’s also worth noting that cash was around $11.1 billion in the prior quarter.

Free Cash Flow: MDT’s free cash flow is $4.58 billion over the last year. This number has dropped from $5.7 billion over the past year, but increased from $4.16 billion in the quarter prior. The current number translates to a modest Free Cash Flow yield of 4.01%.

Dividend: MDT’s annual divided is $2.76 per share and translates to a yield of 3.22% at the stock’s current price. MDT has also increased its dividend payout over the last three years, from $2.32 in June of 2020, with the latest increase, from $2.72 per share, coming after the company’s latest earnings report. An increasing dividend is a strong indication of management confidence in the quarters and years ahead.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $86 per share, which means that MDT is a bit overvalued, with -2.1% downside from its current price, and a practical discount at around $69 per share. It’s also worth noting that after the first quarter of this year, this same analysis yielded a fair value target price of $96 per share.

Technical Profile

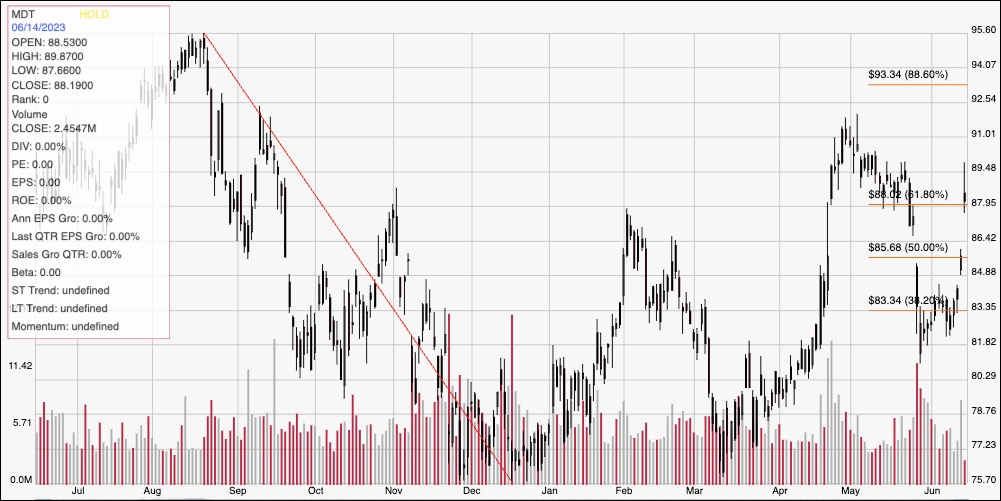

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s downward trend from its August 2022 high at around $95.50 to its low, reached in early December at around $76. It also provides the baseline for the Fibonacci retracement lines on the right side of the chart. After rallying to a late April peak at around $91, the stock dropped back to find its latest major pivot low point at around $82 in late May, where it started to consolidate until this week. It’s picked up a lot of bullish momentum since Monday, pushing above all three retracement lines and now sitting right around $88, where new, current support should lie based on the 61.8% retracement line as well as pivot high activity seen in late October 2022 and early February. Immediate resistance is around $91, at the stock’s late April high. A push above $91 could give the stock enough momentum to test its 52-week high at around $96, while a drop below $88 should find next support at around $85 per share.

Near-term Keys: MDT has some solid fundamental strengths, however the stock’s new rally has pushed it past the point of useful value. That means that the best probabilities for success right now lie in short-term, momentum-driven strategies. The stock’s latest push above resistance at $88 could offer a signal to to buy the stock or to work with call options, with $91 acting as a practical, initial exit target on a bullish trade and $96 possible if buying momentum remains strong. A drop below $88, on the other hand, could be a good opportunity to consider shorting the stock or buying put options, with $85 offering a practical profit target on a bearish trade.