For several years now, I’ve been writing about the wisdom in taking a defensive approach to your investing portfolio.

There are lot of ways you can get defensive. Pulling cash out of the market when you have opportunities to do so, and keeping it on the sidelines for the time being is one approach. Another is to redirect those funds to more conservative investment vehicles, like high-quality bonds. Rather than settling for bond yields that, even when rising, aren’t likely to match the pace of inflation, I prefer to be more conservative by looking for industries and businesses whose operations aren’t as sensitive to the and ebb and flow of economic growth.

Prepackaged food stocks like Hormel Foods Corp (HRL), CPB, and KHC have all been facing significant challenges over the last few years related to pandemic-driven challenges and opportunities as well as changing consumer preferences and, most recently, rising input costs in a broadly inflationary environment. HRL occupies a somewhat different niche than some of these other stocks, however because its products fit nicely into what has clearly been a multi-year shift towards healthier, organic choices, with a specific emphasis on proteins. That also fits into related reports regarding China, which has been increasing protein imports to make up for domestic supply shortages from the swine flu pandemic in 2018 that ravaged its pork capacity and is expected to continue impacting that area for the next few years. HRL has specifically noted increasing orders for SPAM to China. This is a company that is also taking advantage of opportunities to diversify its business. The $2.8 billion acquisition in 2021 of KHC’s Planters-branded snack business also gives it a way to begin moderating some of the commodity-driven risk associated with its heavy emphasis on protein products.

A lot of prepackaged food companies have distinct business segments dedicated to foodservice – primarily referring to supply to restaurants – and grocery. One of the interesting ways a number of companies in this industry were forced to adjust in 2020 was to de-emphasize foodservice channels, where forced shutdowns across the globe shuttered restaurants and social dining and focused more on grocery delivery. The recovery of foodservice provides a good tailwind that should continue to work in HRL’s favor, as economic trends have signaled an increasing desire by consumers to eat out. There is a counter to that idea right now, of course, coming from the reality that inflation and increasing interest rates are also raising consumer prices as suppliers and restaurants are forced to pass their costs through the supply chain. This is a factor that can be expected to blunt consumer demand more the longer inflationary conditions persist.

HRL’s fundamental profile showed some signs of struggle in the first few quarters of 2021, and that contributed to a downward trend in the stock that didn’t find bottom until late September of 2021 at around $40.50 before rallying into a upward trend that peaked in April of last year above $55. Since then, however, broad market momentum pushed the stock into a clear downward trend that saw the stock bottom this year at around $38. The stock appears to be building some new bullish momentum since their latest earnings announcement, and could be poised to stage a useful, new upward trend. What does that mean for the stock’s fundamentals and value proposition? Are they both improving enough to make the stock a good bargain in the current environment? Let’s find out.

Fundamental and Value Profile

Hormel Foods Corporation is a global manufacturer and marketer of branded food products. The Company develops, processes, and distributes a range of food products in a variety of markets. The Company operates through three segments: Retail, Foodservice, and International. The Retail segment is primarily engaged in the processing, marketing, and sale of food products sold predominantly in the retail market. This segment also includes the Company’s MegaMex Foods, LLC joint venture. The Foodservice segment is primarily engaged in the processing, marketing, and sale of food and nutritional products for foodservice, convenience store, and commercial customers. The International segment processes, markets, and sells its products internationally. Its products include Hormel Black Label bacon, Columbus charcuterie, Hormel chili, Hormel pepperoni, Applegate breaded chicken, Herdez products, Hormel Square Table entrees, Cafe H sliced meats, Austin Blues sliced meats and Mary Kitchen hash. HRL’s market cap is about $22.6 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined about -16.7%, while sales decreased by -3.84%. In the last quarter, earnings growth was flat, at exactly 0%, while sales were 0.22% higher. The company’s margin profile is generally healthy, but has narrowed in the latest quarter. Over the last twelve months, Net Income was 7.61%, and moderated to 7.3% in the most recent quarter.

Free Cash Flow: HRL’s free cash flow was a little over $734 million over the past twelve months and translates to a modest Free Cash Flow Yield of 3.26%. It should be noted that Free Cash Flow increased from about $694.5 million in the last quarter, but remains below the $1 billion from a year ago.

Dividend Yield: HRL’s dividend is $1.10 per share, and translates to a yield of 2.67% at its current price. It is also noteworthy that HRL increased their dividend in 2020, 2021 as well as in the last quarter of 2022; it was $.84 per share on an annualized basis until the end of 2020, $.98 in 2021, and $1.04 at the end of 2022. HRL is one of a select list of S&P 500 “dividend aristocrats,” having increased its dividend every year for the last 57 years.

Debt to Equity: HRL has a debt/equity ratio of 0.43. This is a conservative number that I think is a little misleading; more revealing is the fact that this ratio increased from 0.16 in 2021, coincident to the $2.8 billion acquisition of KHC’s Planters snack business. HRL’s balance sheet also shows about $598.03 million in cash (versus about $1.77 billion at the end of 2020, and $868.66 million a year ago) and liquid assets against about $3.3 billion in long-term debt.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $47 per share. That suggests that the stock is modestly undervalued right now, with 13.5% upside from its current price. It’s also worth pointing out that in the first quarter of this year, this same analysis yielded a fair value target price of $53 per share.

Technical Profile

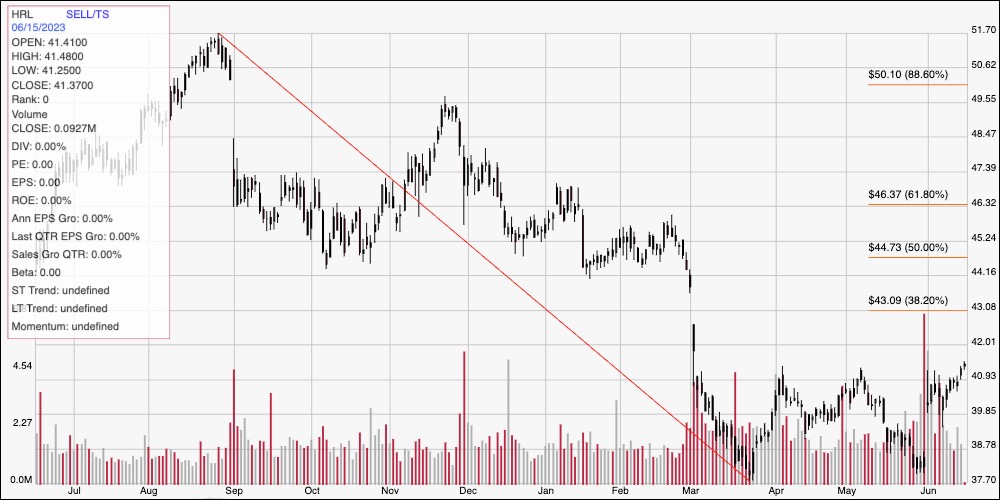

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart traces the stock’s movement over the last year. The diagonal red line traces the stock’s downward trend from from its high point in July of last year at around $52 to its low, reached in March at around $38. It also acts as the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock retested its yearly low at the end of May, but has rallied strongly from that point, pushing this week above previous resistance at around $41 to establish current support at that level. Immediate resistance is expected to lie at around $43, where the 38.2% retracement can be seen. A push above $43 should find next resistance at around $44.50, with additional upside to about $46 if buying momentum accelerates. A drop below $41, on the other hand should find next support at around $38.50 based on pivot low activity from mid-April of this year.

Near-term Keys: HRL’s fundamentals are generally solid, even as the stock has sustained its long, downward trend. Decreasing liquidity, along with narrowing operating margins, however are concerns that are worth paying attention to in the quarters ahead. The stock’s value proposition is modest, but not quite interesting enough in my opinion to warrant taking a long-term position in the stock. That means that the best probabilities of success lie in short-term trading strategies. The stock’s new push above $41 could offer a signal to think about buying the stock or working with call options, using $43 as a useful, initial exit target for a short-term bullish trade, and $44.50 to $46 possible if buying activity increases. A drop below $41, on the other hand, could offer a signal to consider shorting the stock or buying put options, with a practical profit target at around $38.50 per share on a bearish trade.