When uncertainty is high in an industry, and you’re a bit of a contrarian, there’s a natural temptation to gravitate to the industry’s largest, most dominant companies.

It takes a contrarian mindset to focus on industries where uncertainty and fear are driving volatility higher – because in those situations most growth-oriented investors are certainly looking elsewhere for their own opportunities. In those situations, not only do I believe it’s natural to look first at the industry leaders, but there’s also some wisdom in that starting point.

That doesn’t mean that smaller companies in an industry won’t offer opportunities that might be just as attractive, or that the fundamentals of those companies are less than their larger brethren. It really just means that if you consider the entire industry as its own relative market, you try to recognize that certain parts of an industry may respond differently to volatile conditions than others.

The Banking industry is becoming a more and more interesting example of what I mean every day right now. The very publicized failures of large venture capital banks Silicon Valley Bank and Signature Bank, followed by the collapse of Swiss giant Credit Suisse in March, brought the entire industry crashing down. Shortly after, the failure of First Signature brought larger banking fears bubbling back to the surface after they had begun to wane in April. The broad reaction was sharp enough that it even prompted the Fed to acknowledge banking concerns in the monetary policy announcement in May.

In the wake of all of that uncertainty, a lot of information has come out from the industry showing that most of the worst problems that took down those three banks are relatively confined. Most of the largest banks in the U.S. are well-shielded from those extreme risks, and many regional banks are also proving in their latest financial reports to be on solid footing as well. For a bargain hunter like me, that means that over the last few months the Banking industry has been a useful place to mine for value.

That brings me to today’s highlight. Bank of America Corp (BAC) is the second largest national bank in the U.S., and absorbed as much of the banking sell off as the rest of the industry, falling from a yearly high at around $39 to a low at around $26 in mid-March. After consolidating for most of the next three months, the stock has picked up a lot of bullish momentum in just the last couple of weeks to its current price a little below $33. With healthy Free Cash Flow, massive liquidity, and a leading position in consumer and small business banking as well as wealth management, the next, natural question is about the stock’s value proposition. Has the latest rally pushed the stock past the point of useful value? Let’s dive in to the numbers.

Fundamental and Value Profile

Bank of America Corporation is a bank holding company and a financial holding company. Its segments include Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking and Global Markets. Consumer Banking segment offers a range of credit, banking and investment products and services to consumers and small businesses. The GWIM includes two businesses: Merrill Wealth Management, which provides tailored solutions to meet clients’ needs through a full set of investment management, brokerage, banking and retirement products and Bank of America Private Bank, which provides comprehensive wealth management solutions. Global Banking segment provides a range of lending-related products and services, integrated working capital management and treasury solutions, and underwriting and advisory services. Global Markets segment offers sales and trading services and research services to institutional clients across fixed-income, credit, currency, commodity, and equity businesses. BAC has a current market cap of $257.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by almost 20.55%, while sales grew a little more than 72%. In the last quarter, earnings declined about -6.4% while revenues were 7.24% higher. Their operating profile is very healthy, but showing some signs of weakness; Net Income as a percentage of Revenues was 19.97% over the last year, and narrowed slightly to 17.07% in the last quarter.

Free Cash Flow: Free Cash Flow is healthy, at about than $21.8 billion over the past twelve months. This number has also increased steadily over the past year, from $7.3 billion, but did drop from $27.8 in the prior quarter. The current number translates to a free cash flow yield of 8.38%.

Debt to Equity: the company’s debt to equity ratio is 1.12, which sounds high, but isn’t atypical for the Banking industry. It also doesn’t tell the real story about BAC’s balance sheet. Their balance sheet indicates operating earnings are more than sufficient to service their debt, with a little over $969 billion in cash and liquid assets against about $286.1 billion in long-term debt.

Dividend: BAC pays an annual dividend of $.96 per share, which translates to an annual yield of 2.94% at the stock’s current price. It’s also worth noting that management increased the dividend, from $.88 per share following the latest earnings announcement. An increasing dividend payout is a strong sign of management’s confidence in the path ahead.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $47.50 per share. That means that BAC is very undervalued, with a little more than 45% upside from its current price right now.

Technical Profile

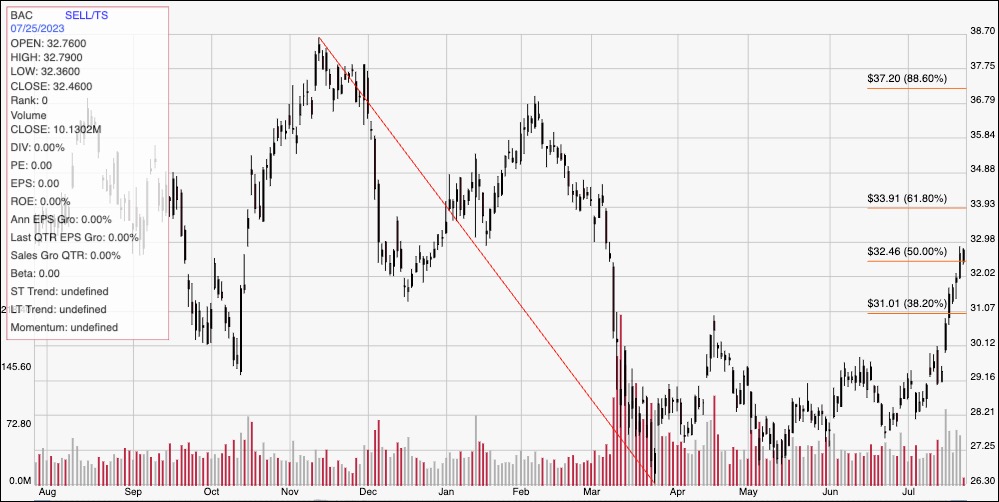

Here’s a look at the stock’s latest technical chart.

Current Price Action: The chart above displays the stock’s price action over the past year. The red diagonal line displays the stock’s downward turn from a $39 peak in November to its 52-week low, reached in the middle of March at around $26 per share. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After mostly hovering in a range between $28 and $30 through May and June, the stock picked up a lot of bullish momentum to start July, pushing above the 38.2% retracement line about a week ago and the 50% retracement line this week. That marks current support at around $32, a little below the 50% line, with immediate resistance sitting at around $34 where the 61.8% retracement line waits. A push above $34 should have additional upside to about $35.50 before finding next resistance, while a drop below $32 should find next support at around $31, inline with the 38.2% retracement line.

Near-term Keys: BAC boasts a number of useful fundamental strengths, with a very compelling value proposition at its current price. That doesn’t mean there aren’t risks to be considered – banks in general are highly sensitive to changes in interest rates, and a recession would imply slowdowns in the company’s lending business. Decreasing Free Cash Flow, as well as in Net Income right now is an additional concern. If you’re willing to take on those risks, the stock looks like an excellent value opportunity at its current price. If you prefer to work with short-term trading strategies, the stock’s latest push above $32 could be a good signal to consider buying the stock or working with call options, with $34 providing a useful profit target, and additional upside to about $35.50 if buying activity increases. A drop below $32 has limited downside, making a bearish trade—either by shorting the stock or buying put options—a very low-probability prospect.