Nu Holdings Ltd, often associated with its flagship brand Nubank, is a financial technology company that aims to disrupt traditional banking through digital solutions. Founded in Brazil, it has rapidly expanded across Latin America, becoming one of the largest digital banking platforms in the region. Nubank offers a range of financial products and services designed to simplify and improve the banking experience for its customers. These services typically include no-fee credit cards, digital savings accounts, personal loans, and more, all managed through a user-friendly mobile app. Nubank’s mission is to tackle the complexities and inefficiencies of traditional banking, providing accessible, transparent, and low-cost financial services to millions of people who were previously underserved by conventional banks.

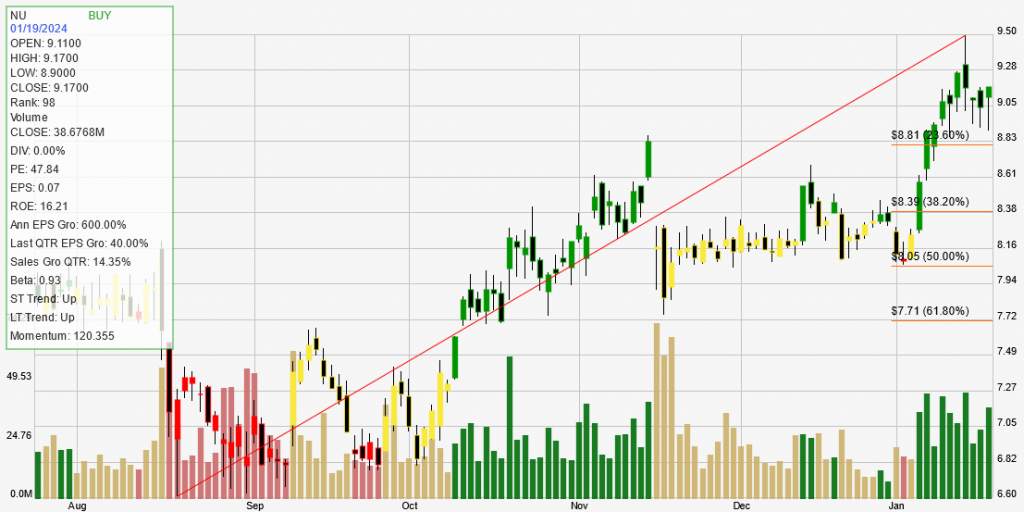

Nu Holdings Ltd Cl A, operating in the business services and technology services industries, is currently positioned favorably with a BUY signal, showing upward trends both in the short and long term. Its stock price stands at $9.17, having increased by 1.33% on the day, with consistent gains over various time frames, including a remarkable yearly increase of 151.92% and a year-to-date improvement of 10.08%. The company has a high strength rank of 98, indicating it outperforms 98% of its peers, supported by a PE ratio of 47.84 and an EPS of 0.07. With an ROE of 16.21%, it demonstrates average financial efficiency.

Significant growth metrics include a 600% annual EPS growth, 40% last quarter EPS growth, and a 14.35% quarterly sales growth. Despite its growth, the dividend yield stands at 0.00, signaling no current dividend payments. Nu Holdings has a market cap of $42 billion, with notable trading volume, and operates under a beta of 0.93, suggesting slightly lower volatility than the overall market.

The company’s stock performance is also highlighted by its backtesting results, showing a 100% win rate across four trades, with an average gain of 18.05%. These trades have contributed to a net profit of $7992.24, demonstrating the stock’s profitability and the effectiveness of its trading strategy over time. This historical performance, alongside its strong fundamentals, positions Nu Holdings as a compelling choice for investors looking for growth and stability within the technology services sector.