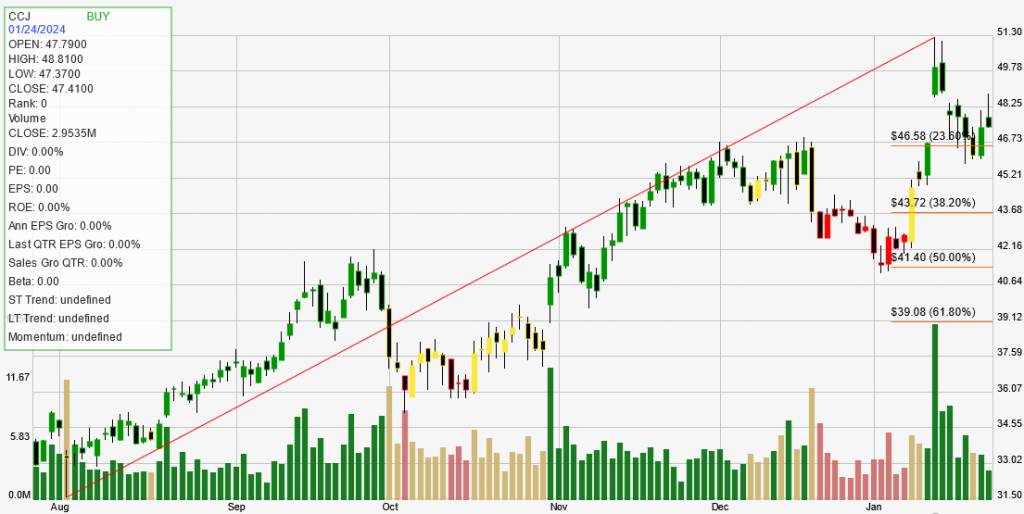

The detailed analysis of Cameco Corp (CCJ) provided offers a comprehensive look at the company’s stock performance, incorporating various metrics to evaluate its short-term and long-term trends, financial health, and market position. Here’s a breakdown of the key points:

Short-Term and Long-Term Trends

Long-Term Trend: UP, indicating a positive trend over the past 180 trading days, highlighting a strong path of least resistance for the stock’s price trend.

Short-Term Trend: UP, showing a positive trend over the past 7-10 days, suggesting ongoing upward momentum.

Signal and Strength Rank

Signal: BUY, suggesting that CCJ is currently advancing in its trend without extreme price levels, which might indicate a good buying opportunity based on trend analysis.

Strength Rank: 94, indicating CCJ is outperforming 94% of its peers, suggesting strong market performance.

Financial Efficiency and Growth Metrics

ROE (Return on Equity): 4.73%, indicating average financial efficiency.

Annual EPS Growth: 1100%, significantly higher than the 30% average of strong trending companies, indicating exceptional earnings growth.

Quarterly EPS Growth: 2500%, far exceeding the benchmark for identifying market leaders before major price advances.

Quarterly Sales Growth: 19.45%, showing solid revenue growth, although below the 25% threshold for strong trending stocks.

Dividend and Trading Characteristics

Dividend Yield: 0.18%, which is low, reflecting the company’s current strategy of reinvesting profits rather than paying high dividends.

Historical Trading Characteristics: The analysis provides detailed statistics on trade performance, including profit/loss, winning percentage, and expectancy values, which are crucial for understanding the stock’s trading dynamics and potential profitability.

Analysis and Implications

This analysis positions Cameco Corp as a strong performer with significant growth in earnings, showcasing its potential as a solid investment based on its current and historical trends. The BUY signal, supported by both short-term and long-term upward trends, suggests confidence in the stock’s future performance. However, the relatively low dividend yield and average ROE suggest that the company may be focusing more on growth and expansion rather than returning value to shareholders through dividends.

The extraordinary growth in EPS highlights the company’s success in significantly enhancing its profitability, making it an attractive option for investors looking for growth stocks. The strong rank also indicates that CCJ is likely to continue its outperformance relative to its peers, making it a compelling choice for inclusion in investment portfolios.

However, investors should consider the company’s financial efficiency and the sustainability of its growth rates. While the high EPS growth rates are impressive, they may not be sustainable in the long term. Additionally, the company’s strategy and market conditions should be monitored to ensure that the positive trends continue.

Overall, Cameco Corp presents a promising investment opportunity based on its current performance and market position, especially for those focused on growth and trend following. Nonetheless, like all investments, it carries risks, and continuous monitoring and analysis are advised to navigate these risks effectively.