Hovnanian Enterprises Inc (HOV) is a well-known homebuilding company in the United States. They primarily engage in the design, construction, and sale of residential homes. The company’s operations include the construction of single-family detached homes, townhouses, condominiums, and attached homes. They cater to a wide range of customers, including first-time homebuyers, move-up buyers, and active adult homebuyers.

In addition to building homes, Hovnanian Enterprises often provides mortgage financing and title services to facilitate the home buying process for its customers. This integration of services allows them to offer a more streamlined and comprehensive experience for those purchasing homes.

The company operates in various regions across the United States and is known for its focus on quality construction, customer satisfaction, and innovative home designs. They may also be involved in land development, preparing land for homebuilding and selling developed land to other builders.

Hovnanian Enterprises’ business model typically involves acquiring and developing land, constructing homes, and then selling these homes directly to customers. Their projects can range from small developments to large-scale planned communities. The company’s success is tied to the health of the real estate market, interest rates, and economic factors that influence homebuying decisions.

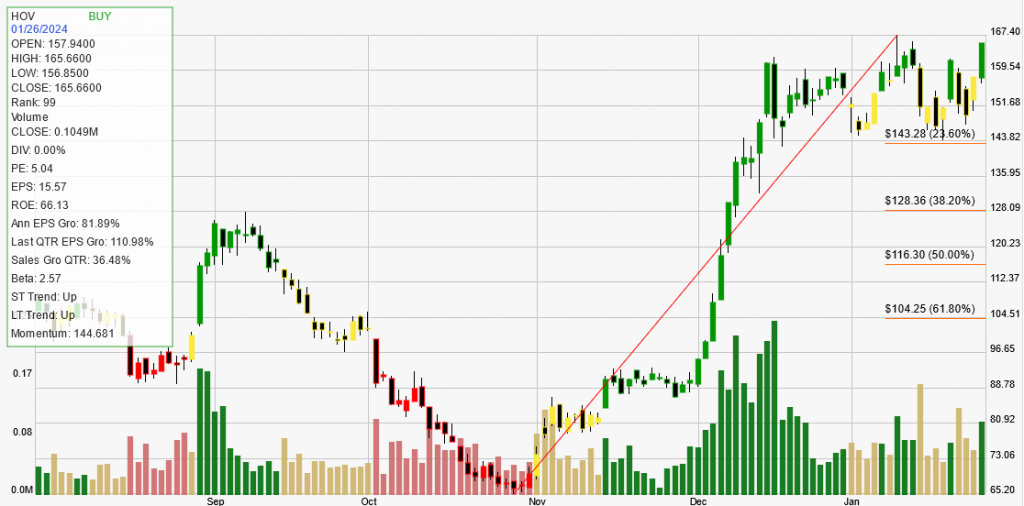

Hovnanian Enterprises Inc, a company in the Construction sector, is experiencing a notable positive trajectory in its stock performance. The company’s stock is currently valued at $165.66, with a significant upward trend in both short-term and long-term perspectives. The signal for the stock is a ‘BUY’, and it has shown impressive growth percentages daily, weekly, monthly, and yearly.

Three key positive aspects of Hovnanian Enterprises Inc include its high strength rank, remarkable earnings growth, and substantial sales growth. The company holds a strength rank of 99, meaning it is outperforming 99% of its peers, indicating a strong competitive position in the market. This high ranking is supported by its impressive financial performance metrics.

The company’s Annual EPS Growth is at 81.89%, significantly higher than the average for strongly trending, fundamentally sound companies. This is complemented by an even more extraordinary Quarterly EPS Growth of 110.98%, showcasing the company’s ability to not only maintain but also accelerate its earnings growth.

Additionally, Hovnanian Enterprises Inc’s Quarterly Sales Growth stands at 36.48%, exceeding the typical 25% benchmark for strong trending stocks. This indicates a successful expansion in the company’s business activities and its capability to increase revenue at a robust rate.

In summary, Hovnanian Enterprises Inc presents a strong investment profile characterized by its market leadership, exceptional earnings growth, and substantial sales increases. These factors collectively suggest a company well-positioned for future growth and success in its sector.