Camtek Ltd (CAMT) is a leading provider of inspection and metrology solutions for the semiconductor manufacturing and advanced packaging industries. The company designs, develops, manufactures, and markets automated optical inspection (AOI) systems and related products that are used to enhance both production processes and yield for manufacturers in the electronics industry, particularly in the fabrication of semiconductor wafers and devices, printed circuit boards (PCBs), and integrated circuits (ICs). https://www.camtek.com/

Camtek’s systems are designed to detect defects in the manufacturing process, which are critical for quality control and ensuring the reliability of the final products. These defects can range from physical anomalies to functional failures. By identifying such defects early in the manufacturing process, Camtek’s solutions help reduce waste, improve efficiency, and increase the overall yield, which is crucial for maintaining competitiveness in the fast-paced semiconductor industry.

The company’s product portfolio includes a wide range of inspection and metrology systems that cater to various stages of the semiconductor manufacturing process, from the initial wafer fabrication to the final packaging and assembly stages. Camtek’s solutions are known for their advanced imaging capabilities, precision, and ability to adapt to new and evolving semiconductor technologies.

In addition to its core semiconductor market, Camtek’s technologies are also applicable to other sectors that require high precision and quality control, such as the micro-electromechanical systems (MEMS), LED, and other emerging electronics sectors.

Headquartered in Israel, Camtek serves a global customer base, including major semiconductor manufacturers and electronics assemblers, through its offices and support centers around the world. The company is focused on continuous innovation and development of its technologies to meet the evolving needs of its customers and the industry.

This summary provides an in-depth analysis of Camtek Ltd (CAMT), a company in the Computer and Technology sector, specifically within the Electronics – Measuring Instruments industry. Here’s a concise breakdown:

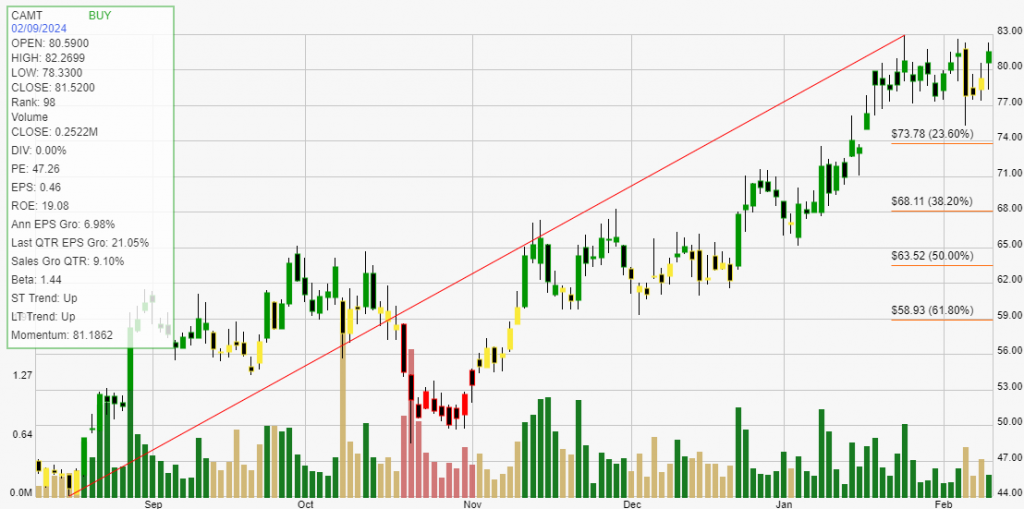

Current Performance: CAMT is currently priced at $81.52, showing a significant positive performance across various time frames: daily (2.94%), weekly (1.2%), monthly (13.44%), yearly (196.76%), and year-to-date (17.5%). The stock exhibits a strong upward trend in both short and long term, supported by a BUY signal.

Strength and Rankings: The strength rank of Camtek Ltd is high at 98, indicating it outperforms 98% of its peers. This rank highlights its superior performance in the market.

Financial Metrics: Key financial indicators of CAMT include a dividend yield of 0.00%, a PE ratio of 47.26, EPS of 0.46, and a return on equity (ROE) of 19.08%. While the annual EPS growth is 6.98%, below the desired 20%, the last quarter showed a more promising EPS growth of 21.05%. Quarterly sales growth stands at 9.1%.

Market Position: With a market capitalization of $3 billion and a beta of 1.44, CAMT shows a solid market presence. The book value per share is $8.65, indicating the intrinsic value based on its financials.

Trading Statistics: Historical trading data reveals an average gain of 62.73% on winning trades and an average loss of 3.44% on losing trades, resulting in a net profit/loss ratio of 126.97%. The trade expectancy is 23.03%, with an annual expectancy of 92.12%, demonstrating the stock’s potential profitability over time.

Recent Trading History: The detailed trading history over the past year shows a mix of wins and losses, with significant gains noted in the longer-term trades, reflecting the stock’s volatility and potential for substantial returns.

In summary, Camtek Ltd has demonstrated strong financial performance and market strength, with notable growth and profitability indicators. Its upward trends in both the short and long term, coupled with solid earnings growth and an impressive strength rank, make it a potentially attractive investment. However, investors should consider the company’s lower than ideal annual EPS growth and the inherent risks of investing in the stock market.