Nkarta Inc (NKTS) is a biotechnology company focused on the research, development, and commercialization of natural killer (NK) cell therapies for the treatment of cancer. NK cells are a type of immune cell that can identify and destroy cancerous or infected cells in the body. Nkarta’s innovative approach involves harnessing and enhancing the innate power of NK cells to target and kill cancer cells more effectively. https://www.nkartatx.com/

The company’s technology platform is designed to develop engineered NK cell therapy products that can be produced in large quantities, potentially offering a more accessible and cost-effective alternative to other types of cell therapies, such as CAR-T cell therapies, which are personalized and can be very expensive. Nkarta’s therapeutic candidates aim to improve patient outcomes in various cancers by offering a potentially safer and more effective treatment option.

By leveraging the natural biology of NK cells, Nkarta Inc is exploring treatments for multiple types of hematologic malignancies and solid tumors, aiming to address the unmet medical needs of patients with hard-to-treat cancers. Their research and development efforts include the engineering of NK cells to enhance their tumor-killing capabilities, improving their persistence in the body, and increasing their ability to home to the tumor microenvironment.

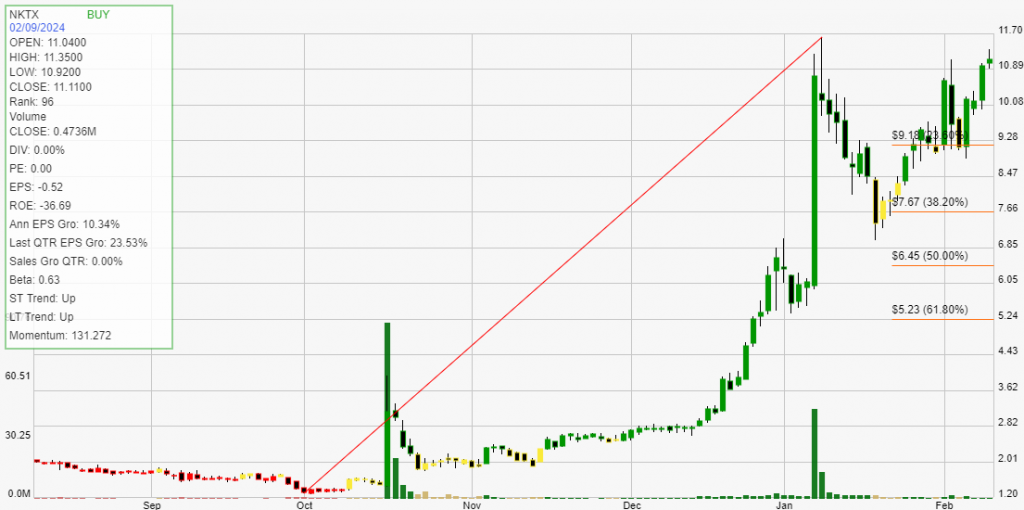

The summary for Nkarta Inc (NKTX) presents a detailed analysis of the company’s stock performance, market trends, and financial metrics, as outlined below:

Current Stock Price and Performance: NKTX is trading at $11.11, with a recent increase of $0.15 or 1.37% in a day. Over time, the stock has shown significant growth: 15.01% weekly, 14.42% monthly, 99.46% yearly, and 68.33% year-to-date (YTD).

Market Position and Ratings: The stock operates in the Medical sector, specifically within the Biomedical industry. It has a strong strength rank of 96, indicating that it outperforms 96% of its peers. The stock is currently rated as a BUY, with both short-term and long-term trends pointing upwards.

Financial Metrics and Performance Indicators: Despite a negative return on equity (ROE) of -36.69% and an EPS (Earnings Per Share) of -0.52, indicating financial inefficiency and losses per share, the company shows potential growth. It has an annual EPS growth of 10.34% and a quarterly EPS growth of 23.53%. However, its quarterly sales growth is 0.00, reflecting a lack of revenue growth in the recent quarter.

Dividend Yield and Trading Characteristics: NKTX does not offer a dividend, with a yield of 0.00. The trading statistics reveal a balanced performance with an equal number of winning and losing trades, leading to a net profit/loss of $8,894.56 from four trades over the past year. The company’s trading strategy has resulted in an average profit of 128.59% on winning trades and an average loss of 26.90% on losing trades, with a reward to risk ratio of 4.78.

Backtesting Results: The backtesting over the past year with four trades shows a significant positive trade expectancy of 50.84%, translating into an annual trade expectancy of 203.37%. The average duration of a trade was 21 days, with an average interval of 7 days between trades.

This comprehensive analysis highlights Nkarta Inc’s strong market position and promising stock performance trends despite its financial inefficiencies and lack of revenue growth. The high strength rank and positive trade expectancy suggest potential for future growth, making it an attractive option for investors, especially those focusing on biomedical sector stocks with a high tolerance for risk and an eye for long-term growth opportunities.