CleanSpark (CLSK) is America’s Bitcoin Miner™. They own and operate data centers that primarily run on low-carbon power. Their infrastructure responsibly supports Bitcoin, the world’s most important digital commodity and an essential tool for financial independence and inclusion. www.cleanspark.com.

Cleanspark has expanded its operations into the cryptocurrency mining sector, specifically Bitcoin mining. The company uses its expertise in energy management to run energy-efficient Bitcoin mining operations. They leverage their advanced microgrid and energy solutions to reduce the electricity costs associated with the energy-intensive process of mining Bitcoin.

By optimizing energy usage and utilizing renewable energy sources where possible, Cleanspark aims to make its Bitcoin mining operations more sustainable and cost-effective compared to traditional mining setups. This diversification into Bitcoin mining allows Cleanspark to capitalize on the growing cryptocurrency market while aligning with its core focus on energy efficiency and sustainability.

This summary provides an analysis of Cleanspark Inc (CLSK), a company in the finance sector, specifically in miscellaneous financial services. Here are the key points:

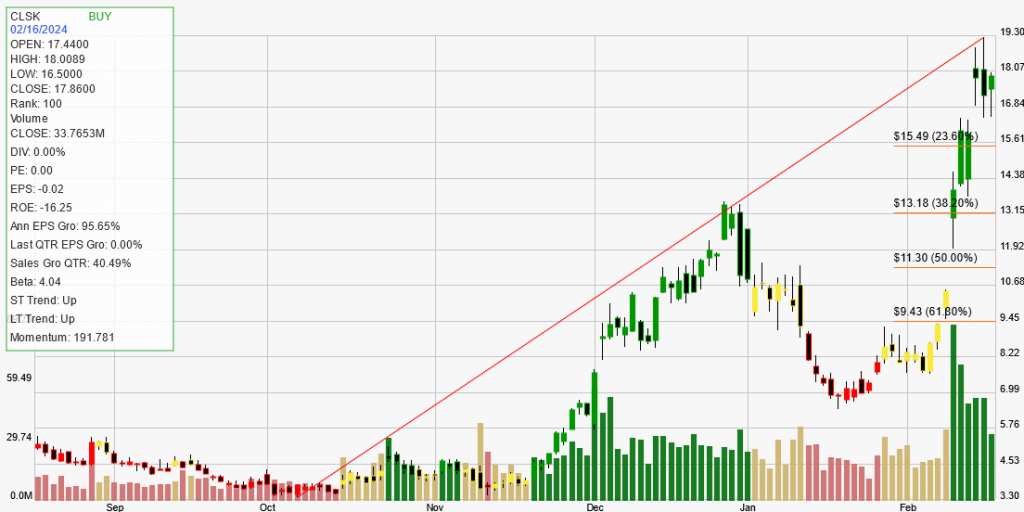

Stock Performance: The stock has shown strong performance with a daily increase of 3.66%, a weekly increase of 28.03%, a monthly increase of 159.97%, a yearly increase of 401.69%, and a year-to-date increase of 61.92%.

Trends: The long-term and short-term trends are both upward, indicating a consistent positive trajectory for the stock.

Signal: The current signal is a BUY, suggesting that the stock may be advancing in its trend. However, it’s noted that stocks in extreme levels of price trend should be allowed to move out of the extreme range before a buy or sell decision is made.

Strength Rank: Cleanspark Inc has a strength rank of 100, meaning it is outperforming 100% of its peers.

Financial Efficiency: The company has a negative return on equity (ROE) of -16.25%, indicating low financial efficiency.

Earnings Growth: The annual EPS (Earnings Per Share) growth is 95.65%, which is significantly higher than the 30% average found in strong trending, fundamentally sound companies.

Quarterly Performance: The company has a quarterly EPS growth of 0.00% and a quarterly sales growth of 40.49%.

Dividend Yield: Cleanspark Inc does not currently offer a dividend, with a yield of 0.00%.

Trading Characteristics: The stock has had a total of 5 trades with an average profit on winners of $4026.93 and an average loss on losers of $3220.08. The net profit/loss is $12887.64 with a winning percentage of 80.00%.

Backtesting: The trade expectancy over the past year is 22.52%, with an annual trade expectancy of 90.09%. The average days in a trade is 48, and the average days between trades is 30.

Overall, Cleanspark Inc appears to be a strong performer in the stock market with a solid upward trend and significant earnings growth. However, its negative ROE indicates some financial inefficiency, and the lack of dividends may be a drawback for income-focused investors.