Amneal Pharmaceuticals Inc (AMRX) is a pharmaceutical company that develops, manufactures, markets, and distributes generic and specialty pharmaceutical products. They focus on providing high-quality, affordable medicines across a wide range of therapeutic areas, including oncology, central nervous system disorders, cardiovascular diseases, and more. Amneal Pharmaceuticals aims to improve the health and quality of life of patients by offering a diverse portfolio of pharmaceutical products. https://amneal.com/

Three key aspects of Amneal Pharmaceuticals Inc’s business include:

Generic and Specialty Pharmaceuticals: Amneal focuses on developing and manufacturing both generic and specialty pharmaceutical products. This diversification allows the company to cater to a broad range of healthcare needs and market segments.

Quality and Affordability: A key aspect of Amneal’s business is its commitment to providing high-quality pharmaceuticals at affordable prices. This approach helps improve access to essential medicines for patients while maintaining stringent quality standards.

Therapeutic Focus: Amneal Pharmaceuticals concentrates on several therapeutic areas, such as oncology, central nervous system disorders, cardiovascular diseases, and others. This focus allows the company to deepen its expertise in these areas and develop innovative solutions for patients.

Amneal Pharmaceuticals Inc (AMRX) is a pharmaceutical company in the Medical – Drugs industry. Here’s a summary of its current status:

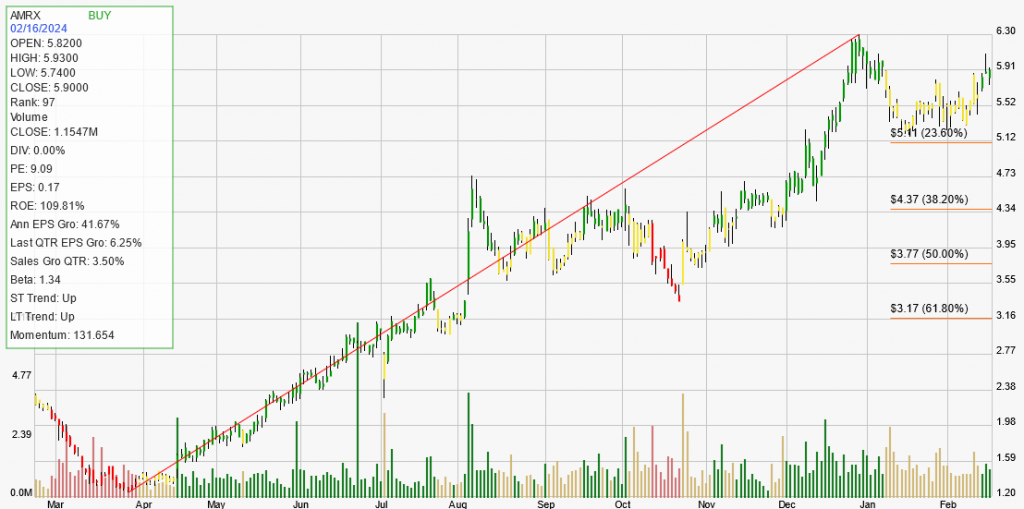

- Stock Performance: AMRX’s stock has been on an upward trend, with short-term and long-term trends both indicating an upward movement. The stock has shown gains of 0.17% for the day, 5.92% for the week, 9.26% for the month, 135.06% for the year, but a year-to-date loss of 2.8%.

- Strength Rank: AMRX has a strength rank of 97, indicating that it’s outperforming 97% of its peers.

- Financials:

- ROE: Return on equity for AMRX is 109.81%, indicating high financial efficiency.

- Annual EPS Growth: AMRX’s current annual EPS growth is 41.67%, which is higher than the 30% average found in strong trending, fundamentally sound companies.

- Quarterly EPS Growth: The current quarterly EPS growth for AMRX is 6.25%, lower than the 25% average found in strong trending stocks.

- Quarterly Sales Growth: The current quarterly sales growth for AMRX is 3.5%, lower than the 25% average found in strong trending stocks.

- Dividend Yield: AMRX does not currently offer a dividend yield.

- Trading Characteristics:

- Number of Trades: AMRX has had 2 trades in the past year.

- Trade Profit/Loss: The net profit/loss for these trades is $21,954.58, with an average profit on winners of $10,977.29.

- Trade Expectancy: The trade expectancy % for AMRX over the past year is 84.61%, with an Annual Trade Expectancy of 169.22%.

- Average Days in Trade: The average days in a trade for AMRX is 178.

Overall, AMRX seems to be performing well, with strong financial indicators and positive trading characteristics. However, past performance is not indicative of future results, so it’s important to consider other factors before making investment decisions.