Precision Drilling Corp (PDS) is a leading provider of oil and natural gas drilling and related services. They operate primarily in North America, providing services to major, intermediate, and junior oil and natural gas exploration and production companies. https://www.precisiondrilling.com/

Three key areas of their business include:

Contract Drilling Services: Precision Drilling provides contract drilling services, offering a range of specialized drilling rigs designed for various drilling applications, including horizontal, directional, and pad drilling.

Completion and Production Services: The company offers services related to well completion and production, such as well servicing, equipment rentals, and well site accommodations.

Technology and Innovation: Precision Drilling focuses on technological innovation to improve drilling efficiency and safety. They invest in advanced drilling technologies and automation to enhance performance and reduce environmental impact.

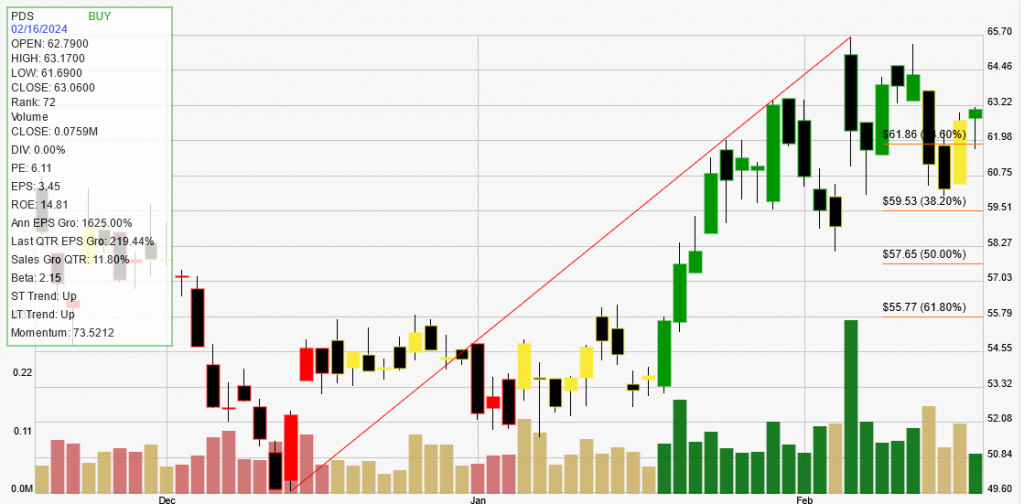

Precision Drilling Corp stock has shown a long-term upward trend for at least the past 180 trading days and a short-term upward trend over the past 7-10 days. The current signal for PDS is BUY.

Key financial metrics include a Return on Equity (ROE) of 14.81%, which is considered average, and an annual EPS growth rate of 1625%, significantly higher than the 30% average for strong trending, fundamentally sound companies.

The company’s quarterly sales growth is 11.8%, below the 25% average found in strong trending stocks. PDS does not currently pay a dividend.

In terms of trading characteristics, PDS has had 2 trades in the past year, with a total net profit of $4094.11, an average profit on winners of $2047.06, and a winning percentage of 100%. The average percentage gained on positive trades was 18.84%.

It’s important to note that past performance is not necessarily indicative of future results, but these statistics can provide valuable insights for investors.