Super Micro Computer, Inc. (SMCI) is a global leader in high-performance, high-efficiency server technology and innovation. The company develops and provides end-to-end green computing solutions to data centers, cloud computing, enterprise IT, big data, high-performance computing (HPC), and embedded markets. Their products include servers, storage systems, workstations, and networking devices.

In the area of Artificial Intelligence (AI), Super Micro Computer is important because its high-performance servers and computing solutions are crucial for the development and deployment of AI applications. AI workloads require significant computational power and efficiency, and Super Micro’s products are designed to meet these demands. Their servers are often used for training complex neural networks, running machine learning algorithms, and processing large datasets, which are all essential tasks in the field of AI. https://www.supermicro.com/en/

Super Micro’s emphasis on energy-efficient and high-density server solutions also aligns with the growing need for sustainable and scalable computing infrastructure in AI research and development. As AI technology continues to advance and expand into various industries, the demand for robust and efficient computing solutions like those offered by Super Micro Computer is expected to increase.

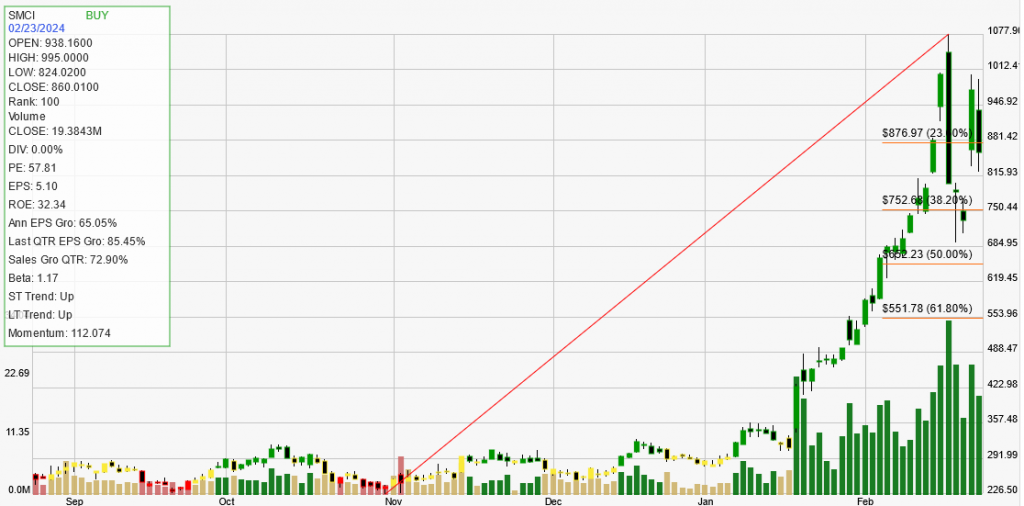

Super Micro Computer is in the Computer and Technology sector and the Computer – Storage Devices industry, and has shown impressive performance. Currently priced at $860.01, the stock has experienced a short-term upward trend over the past 7-10 days and a long-term upward trend for at least the past 180 trading days. Despite a recent daily decline of 11.84%, SMCI has seen significant growth with a monthly increase of 80.83%, a yearly increase of 891.82%, and a year-to-date increase of 202.54%.

The company’s strength is highlighted by its Strength Rank of 100, indicating that it is outperforming 100% of its peers. This is supported by its strong financial indicators, such as Return on Equity (ROE) of 32.34%. Furthermore, SMCI has demonstrated impressive growth with an Annual EPS Growth of 65.05%, a Quarterly EPS Growth of 85.45%, and a Quarterly Sales Growth of 72.9%.

The stock’s current signal is a BUY, suggesting that it may continue to advance in its trend. This is further supported by backtesting data, which shows a positive trade expectancy of 70.37% and an Annual Trade Expectancy of 281.49%. The average percentage gained on profitable trades was 146.2%, while the average percentage loss on losing trades was 5.45%.

In summary, Super Micro Computer has shown strong performance and growth, with a positive outlook supported by its upward trends, financial efficiency, and favorable backtesting results. This makes it a potentially attractive investment in the Computer and Technology sector.