General Electric Company (GE) is a multinational conglomerate that operates in various sectors, including aviation, power, renewable energy, digital industry, and healthcare. The company focuses on developing and manufacturing products and services that range from jet engines and power generation equipment to medical imaging devices and digital solutions. https://www.ge.com/

Three main reasons for GE’s recent success include:

Strong Performance in Key Segments: GE has seen robust performance in its aviation and healthcare segments. The aviation segment, in particular, has benefited from the recovery in the commercial aviation industry as air travel demand rebounds post-pandemic. This recovery has led to increased demand for GE’s jet engines and services. The healthcare segment has also shown resilience, with growth driven by demand for medical imaging and diagnostic equipment.

Strategic Restructuring: GE has been undergoing a significant restructuring process to streamline its operations and focus on its core industrial segments. The company has been divesting non-core businesses and reducing debt, which has improved its financial health and allowed for more focused investments in high-growth areas. This strategic shift has been well-received by investors and has contributed to the positive sentiment around the stock.

Innovation and Technological Advancements: GE has continued to invest in research and development to drive innovation in its core areas. The company’s focus on developing advanced technologies, such as additive manufacturing in aviation and digital solutions in healthcare, has positioned it well to capitalize on future growth opportunities. These innovations have also helped GE maintain its competitive edge in the market.

Overall, GE’s recent success can be attributed to its strong performance in key business segments, strategic restructuring efforts, and ongoing commitment to innovation and technological advancements.

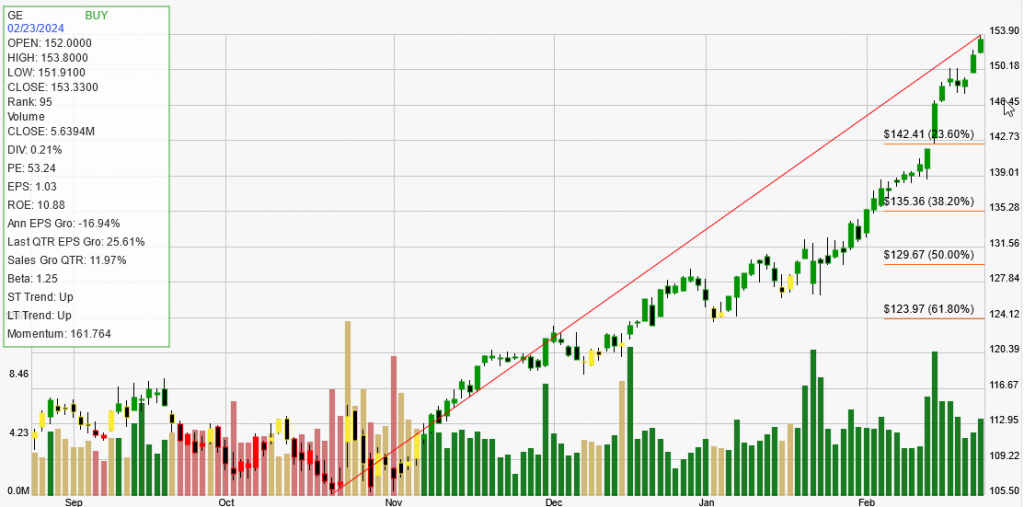

General Electric Company is currently experiencing an upward trend in both short-term and long-term perspectives, with the stock receiving a “BUY” signal. Over the past year, the stock has seen a significant increase of 84.31%, with a year-to-date (YTD) growth of 20.14%. The company is outperforming 95% of its peers, as indicated by its strength rank of 95.

Key financial metrics include a dividend yield of 0.21%, a price-to-earnings (PE) ratio of 53.24, earnings per share (EPS) of 1.03, and a return on equity (ROE) of 10.88%. However, the company’s annual EPS growth is currently negative at -16.94%, which is a concern. On the other hand, the quarterly EPS growth is positive at 25.61%, and quarterly sales growth is at 11.97%.

The backtesting data for GE shows that over the past year, the average percentage gained on profitable trades was 35.02%, while the average percent loss on losing trades was 3.46%. The trade expectancy is positive at 22.19%, with an annual trade expectancy of 66.57%. The average duration of a trade is 101 days, with an average of 5 days between trades.

In summary, General Electric Company is currently showing a strong upward trend in its stock price, with positive short-term and long-term signals. While there are concerns about its annual EPS growth, the company’s financial efficiency, as indicated by its ROE, and recent quarterly performance suggest potential for continued growth. Investors should consider these factors along with the company’s overall performance and market conditions when making investment decisions.