Jakks Pacific Inc (JAKK) is a leading designer, manufacturer, and marketer of toys and consumer products. The company is known for its wide range of products including action figures, dolls, role play items, vehicles, and outdoor play equipment. Jakks Pacific also licenses popular brands and characters from movies, TV shows, and other entertainment media to create themed toys and merchandise. The top three drivers of growth for Jakks Pacific Inc are:

Licensing Agreements: Jakks Pacific’s partnerships with major entertainment companies for licensing popular characters and brands are a key driver of growth. These agreements allow the company to produce toys and products that are tied to popular movies, TV shows, and franchises, which can boost sales due to the popularity of these properties.

Product Innovation: The company’s ability to innovate and create new products that resonate with consumers is crucial for growth. Jakks Pacific invests in research and development to bring new and exciting toys to the market, which can attract customers and drive sales.

Global Expansion: Expanding its presence in international markets is another growth driver for Jakks Pacific. By tapping into new markets and increasing its global distribution network, the company can reach a wider audience and increase its revenue potential.

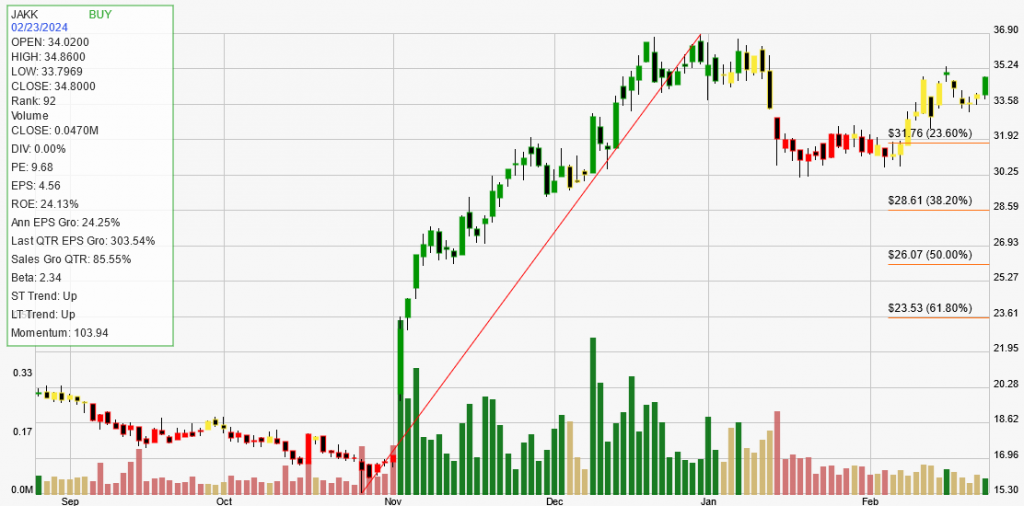

Jakks Pacific Inc (JAKK) is a consumer discretionary company with a strong performance in the stock market. The long-term and short-term trends for JAKK are both upward, indicating a consistent positive trajectory in its stock price. The current signal for JAKK is a BUY, suggesting that the stock may continue to advance in its trend. The company’s strength rank is impressive at 92, meaning it is outperforming 92% of its peers, which is a strong indicator of its market position.

Financially, JAKK is showing high efficiency with a Return on Equity (ROE) of 24.13%. Its annual EPS growth is 24.25%, and its quarterly EPS growth is an exceptional 303.54%, highlighting the company’s ability to increase its earnings significantly. Additionally, the quarterly sales growth of 85.55% further demonstrates the company’s strong revenue growth.

The stock’s historical trading characteristics are also noteworthy. Over the past year, the average percentage gained on positive trades was 14.93%, while the average percent loss on negative trades was 11.00%. The trade expectancy is 8.45%, with an annual trade expectancy of 33.8%, indicating a favorable outlook for future trades.

Overall, Jakks Pacific Inc presents a compelling investment opportunity with its strong upward trends, financial efficiency, and positive historical trading performance. https://www.jakks.com/