Uber Technologies Inc (UBER) is a multinational ride-hailing company that offers services such as peer-to-peer ridesharing, ride service hailing, food delivery (Uber Eats), and a micro-mobility system with electric bikes and scooters. The company is based in San Francisco and has operations in over 900 metropolitan areas worldwide. Uber’s platform can be accessed via its websites and mobile apps. Three significant drivers of growth for Uber Technologies Inc include:

Expansion into New Markets: Uber has been continuously expanding its geographic footprint by entering new cities and countries. This expansion not only increases its customer base but also diversifies its revenue streams. As the company penetrates new markets, it can capitalize on untapped demand for ride-hailing and delivery services.

Diversification of Services: Uber has been diversifying its service offerings beyond traditional ride-hailing. The launch of Uber Eats, a food delivery service, and the expansion into freight and logistics (Uber Freight) are examples of how the company is leveraging its technology platform to tap into new revenue sources. This diversification helps reduce dependency on any single service and can drive growth in different segments of the market.

Technological Innovation: Uber invests heavily in technology and innovation to improve its services and operational efficiency. The development of autonomous driving technology, for example, has the potential to significantly reduce costs and increase safety in the long term. Additionally, Uber’s use of data analytics and machine learning to optimize pricing, routing, and matching of riders and drivers enhances the user experience and can lead to increased usage and customer loyalty.

These drivers, along with a focus on improving profitability and regulatory compliance, are key to Uber’s growth strategy as it aims to maintain its position as a leading player in the global mobility and delivery markets.

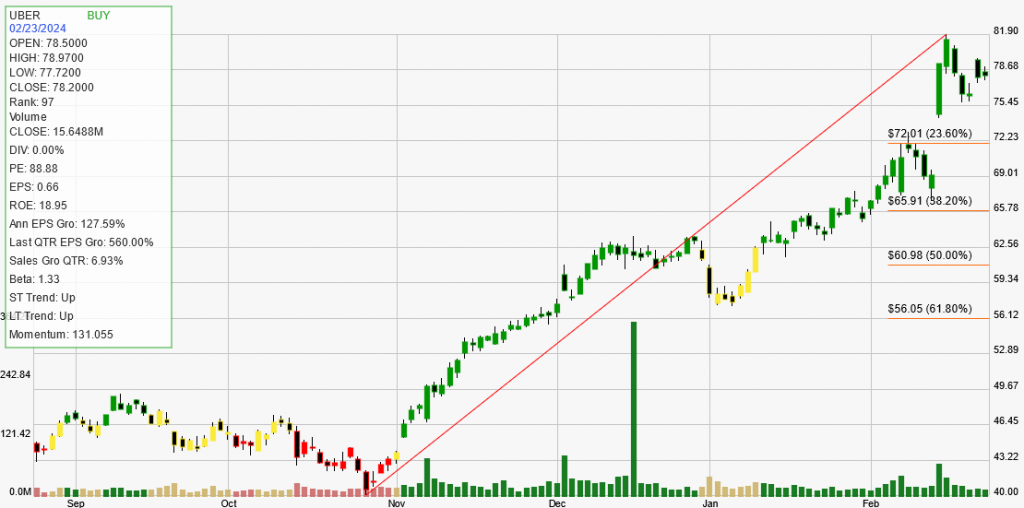

Uber Technologies Inc (UBER) is currently trading at $78.20, with a short-term upward trend and a long-term upward trend. It has a current signal of “BUY,” indicating potential advancement in its trend. Uber has shown a notable performance with a daily increase of 0.22%, a weekly decrease of 3.92%, a monthly increase of 18.48%, a yearly increase of 126.4%, and a year-to-date increase of 27.01%. The company’s strength rank is 97, indicating that it is outperforming 97% of its peers.

The annual earnings per share (EPS) growth is an impressive 127.59%, and the quarterly EPS growth is 560%, indicating strong recent performance. However, the quarterly sales growth is only 6.93%, which is below the desired 25% threshold for strong trending stocks.

Historically, Uber has had three trades, with two winners and one loser, resulting in a net profit of $9,517.22 and a winning percentage of 66.67%. The average profit on winning trades was 45.44%, while the average loss on losing trades was 5.73%. The trade expectancy is 28.39%, with an annual trade expectancy of 85.16%.

In conclusion, Uber Technologies Inc is showing strong upward trends in both the short and long term, with impressive earnings growth and a high strength rank. However, its sales growth is below the desired level, and it does not pay dividends. Investors should consider these factors and the company’s historical trading characteristics when making investment decisions. https://www.uber.com/