Coinbase Global Inc (COIN) is a leading cryptocurrency exchange platform that provides a secure and user-friendly platform for buying, selling, and storing digital currencies such as Bitcoin, Ethereum, and many others. The company also offers a range of financial services and products related to cryptocurrencies, including institutional-grade solutions for larger investors, a wallet service for retail users, and various other tools for developers and merchants. Three main factors for the growth of Coinbase Global Inc (COIN) are:

Expansion of the Cryptocurrency Market: As the cryptocurrency market continues to grow and gain mainstream acceptance, Coinbase stands to benefit significantly. The increasing interest in digital currencies from both retail and institutional investors drives demand for Coinbase’s services, leading to higher trading volumes and revenue.

Diversification of Services: Coinbase has been expanding its service offerings beyond just a trading platform. The company has ventured into areas such as staking, lending, and offering cryptocurrency-related financial services, which can provide additional revenue streams and attract a broader range of customers.

Regulatory Compliance and Security: Coinbase has a reputation for prioritizing regulatory compliance and security, which is crucial in the cryptocurrency industry. As regulations around cryptocurrencies continue to evolve, Coinbase’s proactive approach to compliance can provide a competitive advantage and build trust with users, potentially leading to increased market share and growth.

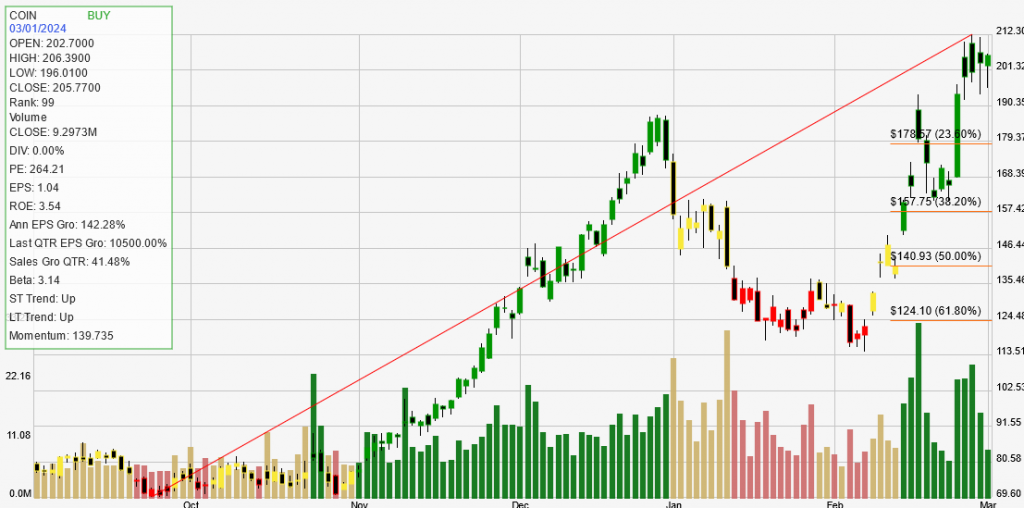

Coinbase Global Inc (COIN) has demonstrated impressive performance in both the short-term and long-term, with its stock trending upwards. The company’s recent statistics highlight a strong buy signal, indicating potential for further advancement in its price trend. Over various timeframes, COIN has shown remarkable gains: 1.09% daily, 23.97% weekly, 59.57% monthly, and an astounding 218.18% annually, with a year-to-date increase of 18.31%.

The company’s strength rank is exceptional at 99, meaning it outperforms 99% of its peers. This is supported by its solid fundamentals, including a high annual EPS growth of 142.28% and a quarterly EPS growth of 10,500%. Additionally, COIN’s quarterly sales growth is robust at 41.48%. However, its return on equity (ROE) is modest at 3.54%, indicating average financial efficiency.

Backtesting results for COIN show a balanced risk-reward ratio, with an average profit of 35.26% on winning trades and an average loss of 15.69% on losing trades. The trade expectancy is positive at 9.78%, with an annual trade expectancy of 48.91%. The average duration in a trade is 34 days, indicating a relatively short holding period for investors.

In summary, Coinbase Global Inc presents a compelling investment opportunity, especially for those looking for growth stocks in the finance and technology sectors. Its strong upward trend, high growth rates, and solid market performance make it a standout choice, albeit with inherent risks due to its high volatility and valuation. https://www.coinbase.com/