Janux Therapeutics Inc (JANX) is a biopharmaceutical company focused on developing innovative cancer immunotherapies. The company aims to harness the power of the immune system to target and eliminate cancer cells. Their approach involves creating novel therapeutics that can stimulate the body’s immune response against tumors, potentially leading to improved outcomes for patients with various types of cancer. Three main drivers of growth for Janux Therapeutics Inc are:

Innovative Pipeline: A key driver of growth for Janux is its pipeline of innovative cancer immunotherapies. By developing novel treatments that address unmet medical needs in oncology, Janux can potentially capture significant market share in the rapidly growing field of cancer immunotherapy.

Strategic Partnerships and Collaborations: Collaborations with larger pharmaceutical companies or research institutions can provide Janux with additional resources, expertise, and access to new technologies. These partnerships can accelerate the development and commercialization of its therapies, driving growth and expanding its market presence.

Regulatory Milestones and Clinical Trial Success: Advancing its drug candidates through clinical trials and achieving regulatory milestones are crucial for Janux’s growth. Positive clinical trial results can lead to regulatory approvals, which would enable the company to bring its therapies to market and generate revenue. Additionally, successful trial outcomes can attract further investment and partnerships, fueling continued growth.

Overall, Janux Therapeutics Inc’s growth is driven by its focus on developing innovative cancer immunotherapies, strategic partnerships, and success in clinical development and regulatory achievements.

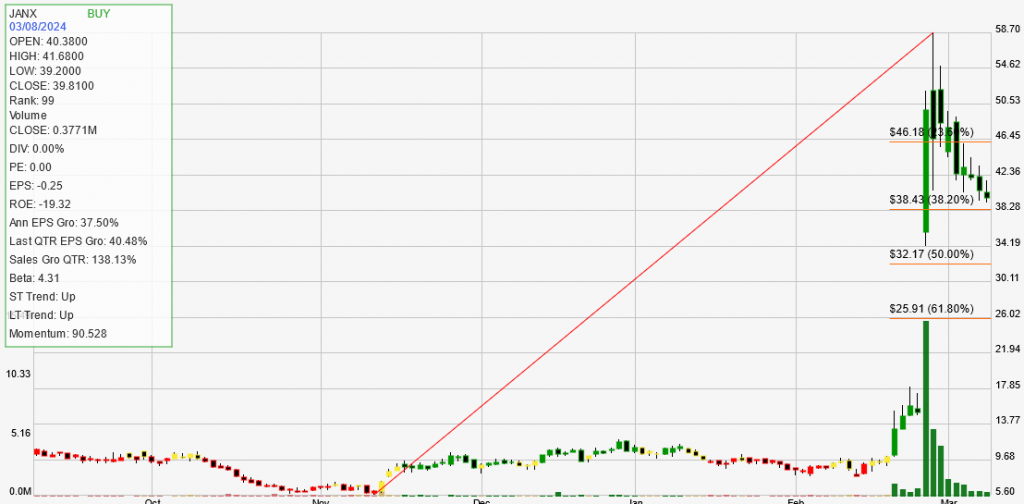

Janux Therapeutics Inc (JANX) has shown impressive performance metrics in recent times. The company’s stock is currently in an upward trend in both short-term and long-term perspectives, with a BUY signal indicating potential advancement in its trend. The stock has experienced a substantial year-to-year increase of 152.28%, with a remarkable year-to-date growth of 271.02%. Three key points that highlight the company’s improving performance are:

Annual EPS Growth: JANX has demonstrated a robust annual EPS growth of 37.5%, surpassing the 30% average found in strong trending, fundamentally sound companies. This indicates a healthy and growing company that is outpacing many of its peers in terms of earnings.

Quarterly EPS Growth: The company’s quarterly EPS growth stands at 40.48%, which is significantly higher than the 25% average found in strong trending stocks. This suggests that JANX is not only maintaining but also accelerating its earnings growth, which is a positive sign for investors.

Quarterly Sales Growth: JANX has shown an impressive quarterly sales growth of 138.13%, far exceeding the 25% average found in strong trending stocks. This indicates a substantial increase in revenue, which is essential for the sustained growth and success of the company.

Overall, Janux Therapeutics Inc exhibits strong financial performance and growth potential, making it an attractive option for investors looking for opportunities in the biomedical sector. https://www.januxrx.com/