Spire Global Inc. (SPIR) is a space-to-cloud data analytics company that specializes in the collection, analysis, and provision of valuable insights from a wide array of data sources, primarily through its constellation of satellites. The company’s offerings are used in various sectors, including maritime, aviation, weather, and climate, to enhance operational efficiency, mitigate risks, and unlock new opportunities. Three main drivers of growth for Spire Global Inc. are:

Expanding Satellite Constellation: As Spire continues to expand its satellite constellation, the company can gather more data, covering a broader range of frequencies and geographies. This expansion enables Spire to offer more comprehensive and detailed data products, attracting a wider customer base and opening up new markets.

Diversification of Data Services: Spire is actively diversifying its data services to cater to different industries, such as maritime, aviation, and weather forecasting. By providing tailored solutions that address specific industry needs, the company can tap into new revenue streams and strengthen its market position.

Strategic Partnerships and Collaborations: Spire has been engaging in strategic partnerships and collaborations with other companies, governments, and research institutions. These partnerships help Spire to access new markets, leverage complementary technologies, and enhance its product offerings, driving growth and expanding its customer base.

Overall, Spire Global Inc.’s growth is driven by its ability to leverage its satellite technology to provide valuable data and insights, its focus on diversifying its services, and its strategic collaborations that enhance its market reach and capabilities.

Spire Global Inc (SPIR) has shown significant improvements in various areas, as evidenced by its recent performance metrics. Three key points highlight the company’s positive trajectory:

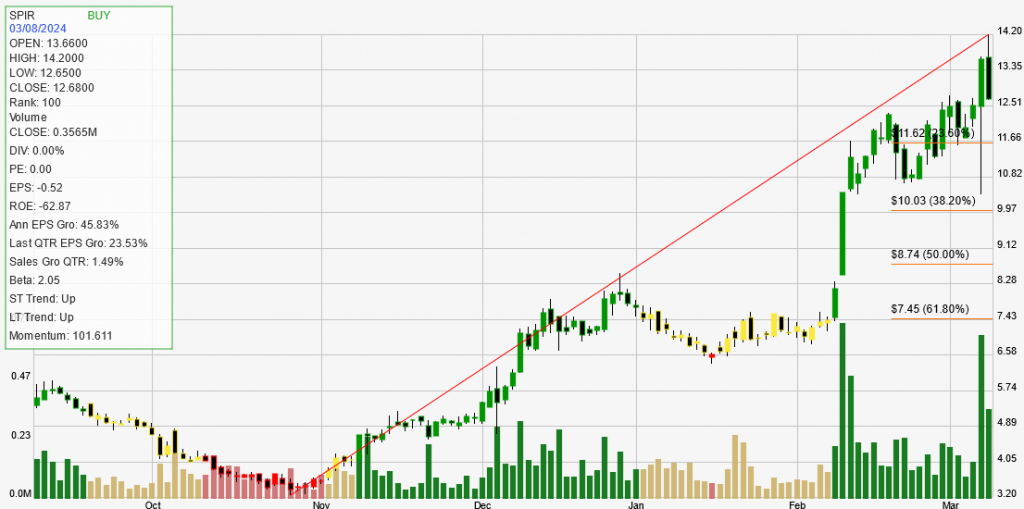

Strong Long-Term and Short-Term Trends: SPIR has exhibited a robust upward trend in both the short term and long term. The short-term trend is up over the past 7-10 days, while the long-term trend indicates an upward trajectory for at least the past 180 trading days. This consistent upward movement signals a healthy and potentially sustainable growth trajectory for the company.

Impressive Annual EPS Growth: The company has achieved an annual EPS (Earnings Per Share) growth rate of 45.83%, which is significantly higher than the 30% average typically found in strong trending, fundamentally sound companies. This indicates that Spire Global is not only growing its earnings but doing so at a rate that outpaces many of its peers, which is a positive sign for potential investors.

High Strength Rank: Spire Global has a strength rank of 100, meaning it is outperforming 100% of its peers. This exceptional ranking suggests that the company is in a strong position relative to its competitors and is likely to continue advancing its trend.

While there are areas for improvement, such as the relatively low quarterly sales growth of 1.49% and a negative return on equity (ROE) of -62.87%, the overall picture for Spire Global Inc is positive. The company’s strong performance in terms of EPS growth, strength ranking, and consistent upward trends in both the short and long term are promising indicators for its future prospects. https://spire.com/