MicroStrategy Inc. (MSTR) is a global leader in enterprise analytics and mobility software. The company provides software solutions and expert services that empower organizations to make informed decisions based on data-driven insights. MicroStrategy’s analytics platform delivers high-performance business intelligence, including data mining, predictive analytics, and interactive dashboards, to help companies analyze trends, patterns, and relationships within their data. Three main areas of growth for MicroStrategy Inc. include:

Cloud-Based Solutions: As more businesses move their operations to the cloud, MicroStrategy has been focusing on expanding its cloud-based analytics offerings. This includes providing secure, scalable, and flexible solutions that can be deployed on various cloud platforms, such as AWS, Azure, and Google Cloud. Growth in this area allows MicroStrategy to tap into the increasing demand for cloud services and provide customers with more agile and cost-effective analytics solutions.

Advanced Analytics and Artificial Intelligence (AI): MicroStrategy is investing in advanced analytics capabilities, including AI and machine learning, to enhance its analytics platform. By integrating AI-driven insights and predictive analytics into its software, MicroStrategy can offer more sophisticated tools for data analysis and decision-making. This area of growth enables the company to stay competitive in the rapidly evolving analytics market and meet the growing demand for intelligent and automated business insights.

Mobility Solutions: MicroStrategy’s focus on mobility solutions is another key area of growth. The company provides mobile analytics apps that enable users to access and interact with business data from anywhere, at any time, using their smartphones or tablets. As remote work and mobile access become increasingly important for businesses, MicroStrategy’s investment in mobility solutions positions the company to capitalize on this trend and provide more flexible and accessible analytics tools to its customers.

Overall, MicroStrategy’s growth strategy centers around leveraging cloud technology, enhancing its analytics capabilities with AI, and expanding its mobile offerings to meet the evolving needs of businesses in the digital age.

MicroStrategy Inc. has made significant investments in Bitcoin as part of its corporate treasury strategy. The company began purchasing Bitcoin in August 2020, citing its belief in the cryptocurrency as a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash.

Under the leadership of CEO Michael Saylor, MicroStrategy has continued to acquire Bitcoin in subsequent months and years, making it one of the most prominent publicly-traded companies to hold a substantial amount of the cryptocurrency on its balance sheet. The company’s strategy involves using Bitcoin as a primary treasury reserve asset, and it has financed some of its purchases through debt offerings, further indicating its commitment to the digital asset.

MicroStrategy’s involvement in Bitcoin has attracted significant attention from both the cryptocurrency community and traditional investors. The company’s aggressive accumulation of Bitcoin has been viewed as a major endorsement of the cryptocurrency’s potential as an investment and a store of value. As a result, MicroStrategy’s stock price has become increasingly correlated with the price movements of Bitcoin, leading some investors to view the company’s shares as a way to gain exposure to Bitcoin through the stock market.

MicroStrategy Inc. (MSTR), a company in the computer and technology sector, specializing in computer software. The report highlights several areas of improvement and strengths in the company’s performance:

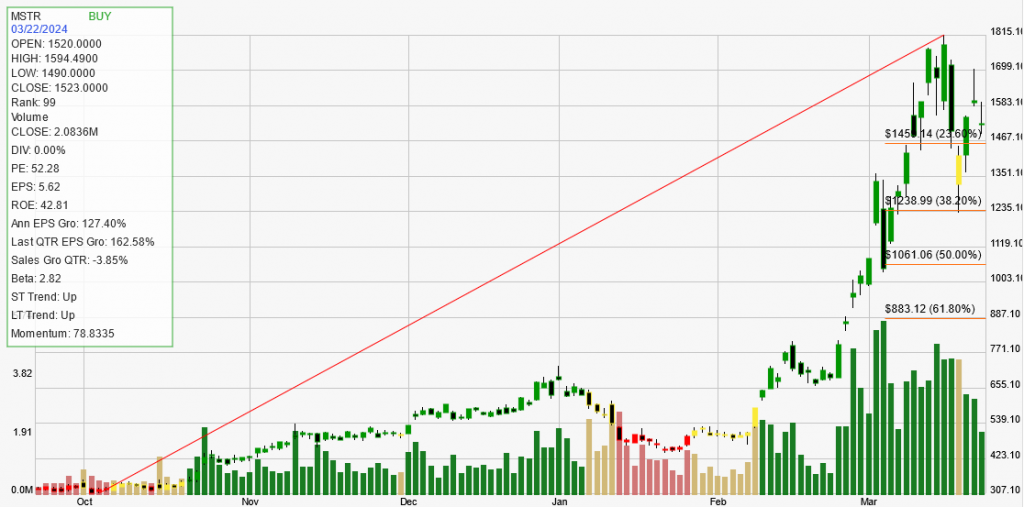

Long-Term and Short-Term Trends: Both the long-term and short-term trends for MSTR are positive, indicating that the stock has been experiencing upward momentum over the past 180 trading days as well as the last 7-10 days. This suggests a consistent growth trajectory and investor confidence in the stock’s future performance.

Strength Rank: MSTR has a strength rank of 99, meaning it is outperforming 99% of its peers. This high rank indicates that MSTR is a strong performer in its industry, and its stock is likely to continue advancing in the trend.

Annual and Quarterly EPS Growth: The company’s annual EPS growth is 127.4%, and its quarterly EPS growth is 162.58%, both of which are significantly higher than the average benchmarks for strong trending companies. This indicates that MicroStrategy has been experiencing robust earnings growth, which is a key driver of stock price appreciation.

The report also notes that the company has a high Return on Equity (ROE) of 42.81%, further showcasing its financial efficiency. However, it’s important to note that the Quarterly Sales Growth is at -3.85%, which is below the desired benchmark and could be an area for improvement.

Overall, MicroStrategy Inc. appears to be in a strong position, with positive trends, high ranking compared to peers, and impressive earnings growth. Investors and analysts might view these factors as indicative of a sustainable upward trend in the stock’s future performance. https://www.microstrategy.com/