Universal Technical Institute Inc. (UTI) is a premier provider of technical education in the United States, specializing in automotive, diesel, collision repair, motorcycle, and marine technician training. Founded in 1965, UTI has built a reputation for delivering high-quality, industry-aligned education that prepares students for successful careers in the transportation and related industries.

With a network of campuses across the country, UTI offers hands-on training in state-of-the-art facilities, ensuring that students gain practical experience and skills that are in demand by employers.

Three key areas of growth for UTI include expanding program offerings to cover emerging technologies, enhancing partnerships with industry leaders, and increasing student enrollment through targeted marketing and outreach efforts.

By staying ahead of industry trends and incorporating new technologies into its curriculum, UTI can attract a broader range of students interested in cutting-edge fields such as electric vehicles and autonomous systems.

Strengthening relationships with industry partners not only provides students with valuable networking opportunities but also ensures that the training remains relevant to employers’ needs. Additionally, by reaching out to potential students through various channels and highlighting the benefits of a career in the technical trades, UTI can continue to grow its student base and meet the increasing demand for skilled technicians. Five key data points for Universal Technical Institute are:

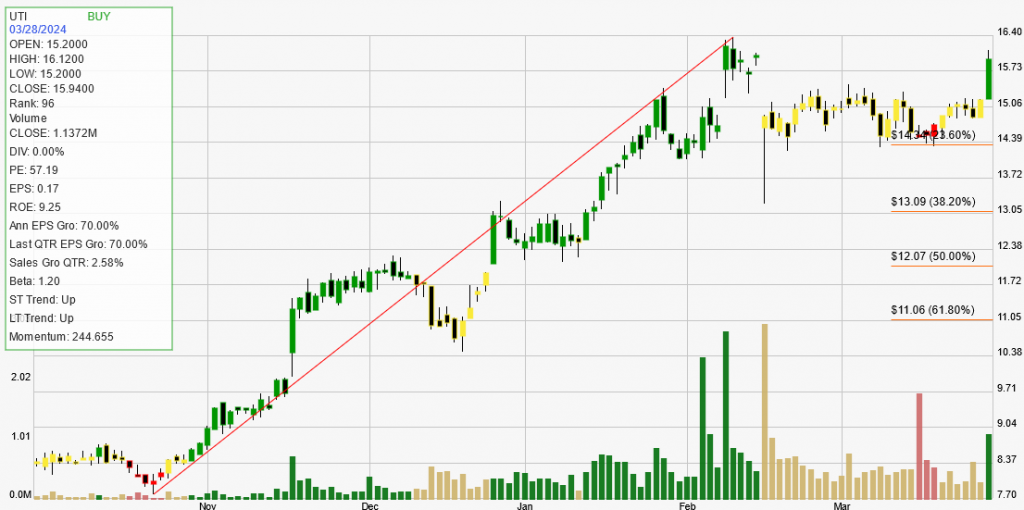

Stock Price: The current stock price of $15.94, with a recent increase of 5.01%, reflects investor confidence in UTI’s growth potential and financial performance.

Market Capitalization: With a market capitalization of $506 million, UTI is a significant player in the education sector, indicating its stability and potential for future growth.

Price-to-Earnings (P/E) Ratio: A P/E ratio of 57.19 suggests that investors are willing to pay a premium for UTI’s earnings, anticipating continued growth and profitability.

Return on Equity (ROE): An ROE of 9.25% indicates that UTI is efficiently generating profits from its shareholders’ equity, showcasing its financial health.

Annual Earnings Growth: A remarkable annual earnings growth rate of 70% highlights UTI’s ability to increase its profitability and adapt to changing market conditions.

These data points provide valuable insights into UTI’s financial health, market position, and growth potential. The stock price and market capitalization give an overview of the company’s value and investor confidence. The P/E ratio helps assess the stock’s valuation relative to its earnings. The ROE indicates the company’s efficiency in generating profits, and the annual earnings growth rate showcases its ability to expand and increase profitability over time.

Focusing on the backtest data, several key points emerge regarding UTI’s stock performance. The backtesting results show a total of three trades, with two winners and one loser, resulting in a net profit of $6,761.93. The average profit on winning trades was $4,244.60, while the average loss on losing trades was $1,727.27. This leads to a total net percentage gain of 67.62%.

The trade expectancy is $2,407.67, with a trade expectancy percentage of 24.08%, indicating that a trader should expect to make money over time based on these results. The annual trade expectancy is $7,223, with an annual trade expectancy percentage of 72.23%. The average days in a trade is 78, and the average days between trades is 24. These backtesting results provide a probabilistic look at UTI’s stock price activity characteristics over time, suggesting a positive performance trend. https://www.uti.edu/