Eli Lilly and Company (LLY) is a global pharmaceutical company that develops, manufactures, and markets a wide range of medicines in several therapeutic areas.

Oncology: The company is focused on developing innovative cancer treatments, including immunotherapies and targeted therapies, to address various types of cancers.

Diabetes: Lilly has a strong presence in the diabetes market and is continuously working on developing new treatments and delivery systems to improve the lives of people living with diabetes.

Immunology: The company is also investing in research and development of treatments for autoimmune diseases, such as rheumatoid arthritis and psoriasis, aiming to provide new therapeutic options for patients with chronic inflammatory conditions.

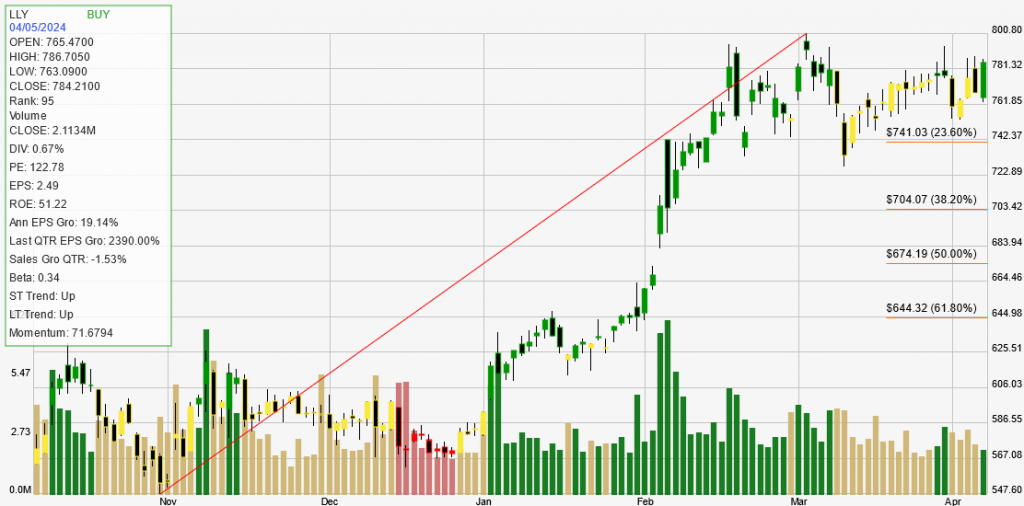

LLY has shown an upward trend in both short-term and long-term, indicated by a BUY signal. Key points to note are:

Exceptional Growth in Quarterly EPS: LLY has experienced an astonishing 2390% growth in quarterly earnings per share (EPS), which far exceeds the average growth rate found in strong trending stocks. This indicates a significant improvement in the company’s profitability and is a strong signal for potential investors.

High Return on Equity (ROE): The company’s ROE stands at 51.22%, showcasing high financial efficiency. This level of ROE is well above the 20% benchmark that distinguishes winning stocks from ordinary ones, suggesting that LLY is well-positioned to continue its solid earnings performance.

Strong Stock Performance: LLY‘s stock has outperformed 95% of its peers with a strength rank of 95. Additionally, the stock has seen a yearly increase of 121.14% and a year-to-date (YTD) increase of 34.53%, reflecting its strong momentum and attractiveness to investors.

Other notable metrics include a dividend yield of 0.67%, a price-to-earnings (PE) ratio of 122.78, and a market capitalization of $737 billion. However, it’s worth noting that the company has experienced a slight decline in quarterly sales growth by -1.53%, which could be an area to watch in the future. Overall, Eli Lilly and Company’s stock demonstrates robust financial health and strong growth potential, making it a compelling option for investors. https://www.lilly.com/