XPO, Inc. (XPO) is a global provider of transportation and logistics services. The company operates in two primary segments:

Transportation: This segment includes freight brokerage, which involves arranging the transportation of goods for customers through various carriers; intermodal services, which involve the use of multiple modes of transportation, such as trucks and trains, to move freight; and expedited transportation services, which provide fast delivery for time-sensitive shipments.

Logistics: This segment encompasses contract logistics, which involves managing the supply chain operations for customers, including warehousing and distribution services; and last-mile delivery, which focuses on the final delivery of goods to consumers’ homes, particularly for heavy or bulky items like furniture and appliances. Three main areas of growth XPO is focused on are:

E-commerce Fulfillment: With the rise of online shopping, XPO is expanding its capabilities in e-commerce fulfillment to meet the growing demand for efficient and reliable logistics services, including last-mile delivery and reverse logistics.

Technology Investment: XPO invests heavily in technology to enhance its service offerings and operational efficiency. This includes the development of proprietary platforms and tools for freight brokerage, transportation management, and warehouse automation.

Global Expansion: XPO is focused on expanding its geographic footprint to tap into new markets and customer segments. This includes growing its presence in key regions such as Europe and Asia, as well as exploring opportunities in emerging markets.

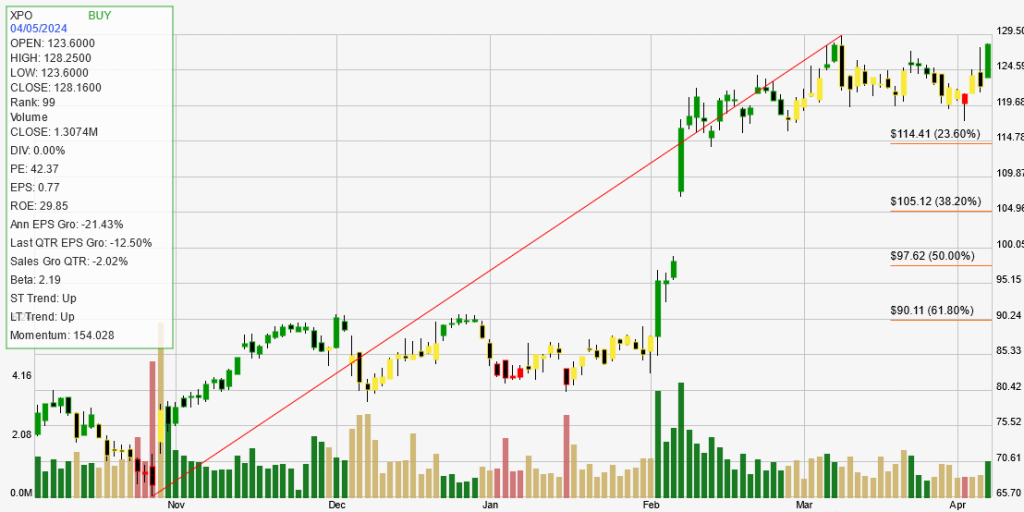

Strong Long-Term and Short-Term Trends: XPO’s long-term trend is upward, suggesting that the stock has been on an upward trajectory for at least the past 180 trading days. Similarly, the short-term trend is also upward, indicating that XPO has been experiencing a positive trend over the past 7-10 days. This consistency in positive trends is a good sign for potential investors.

High Strength Rank: XPO’s current strength rank is 99, meaning it is outperforming 99% of its peers. This high rank indicates that XPO is a strong performer in its sector, which could be a result of effective management, competitive advantages, or other factors that contribute to its superior performance.

Impressive Return on Equity (ROE): XPO’s current ROE is 29.85%, which is significantly higher than the 20% level that typically sets apart winning stocks from ordinary ones. A high ROE suggests that the company is efficient in generating profits from its equity, which is a positive sign for investors looking for financially efficient companies.

While there are areas for improvement, such as the negative annual EPS growth and quarterly sales growth, the overall performance of XPO Inc appears to be strong, making it a potentially attractive option for investors looking for growth in the transportation sector. https://www.xpo.com/