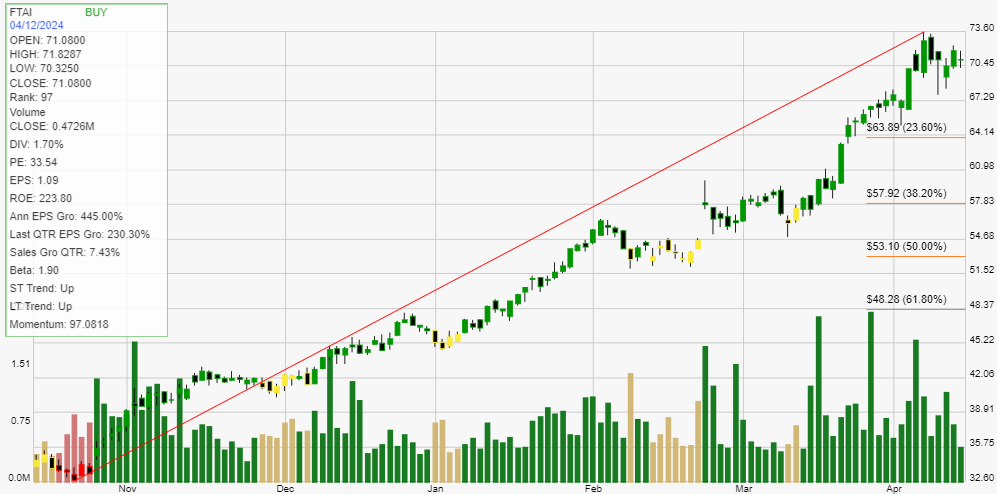

Ftai Aviation (FTAI), operating within the aerospace sector and specializing in aerospace-defense equipment, is demonstrating robust growth across multiple financial metrics. The company has seen its stock price appreciate significantly, underscored by a year-to-year increase of 156.14% and a year-to-date rise of 53.19%. These figures highlight the company’s strong market performance and investor confidence.

Three critical data points emphasize Ftai Aviation’s financial health and growth trajectory. Firstly, the Return on Equity (ROE) stands at an impressive 223.8%, indicating exceptional financial efficiency and the company’s ability to generate substantial profit relative to its shareholders’ equity. This level far exceeds the typical benchmark of 20% ROE, distinguishing Ftai Aviation as a potential leader in its industry.

Secondly, the Annual Earnings Per Share (EPS) growth rate is 445%, far surpassing the 30% growth rate observed in leading companies during their peak growth phases. This indicates that Ftai Aviation is not only growing but doing so at an accelerated pace that outstrips many of its competitors. Lastly, the Quarterly EPS Growth rate of 230.3% further validates the company’s upward trajectory, suggesting strong ongoing profitability that is likely to attract further investment.

While the company’s Quarterly Sales Growth of 7.43% did not meet the industry’s strong performance benchmark of 25%, it still represents positive growth. This discrepancy suggests a focus on profitability over volume, a strategy that may pay dividends in the long run but requires careful balance to sustain. Furthermore, Ftai Aviation’s market strategy and financial maneuvers are also evidenced by its dividend yield of 1.7%, providing a steady return to its investors albeit slightly below the optimal range for dividend-paying stocks.

In conclusion, Ftai Aviation Ltd has positioned itself as a formidable entity in the aerospace-defense sector through strategic growth, operational efficiency, and strong financial metrics. The company’s impressive ROE and EPS growth rates not only demonstrate its current financial health but also its potential for sustained growth. Despite some areas requiring attention, such as sales growth, the overall financial and market performance of Ftai Aviation suggests a promising outlook that likely will continue to attract investor interest and market confidence. https://www.ftaiaviation.com/p/1