Western Digital Corporation (WDC) is a leading global provider of data storage solutions, playing a pivotal role in the digital world by enabling the collection, storage, management, and access to vast amounts of data.

The company’s product portfolio includes hard disk drives (HDDs), solid-state drives (SSDs), and network-attached storage (NAS) devices, catering to a wide range of customers from individual consumers to large enterprises. These products are essential for various applications, including personal computing, enterprise data centers, cloud storage, and surveillance systems. Western Digital also offers cutting-edge solutions in the emerging fields of artificial intelligence and big data analytics, ensuring that businesses and individuals can manage their data efficiently and securely.

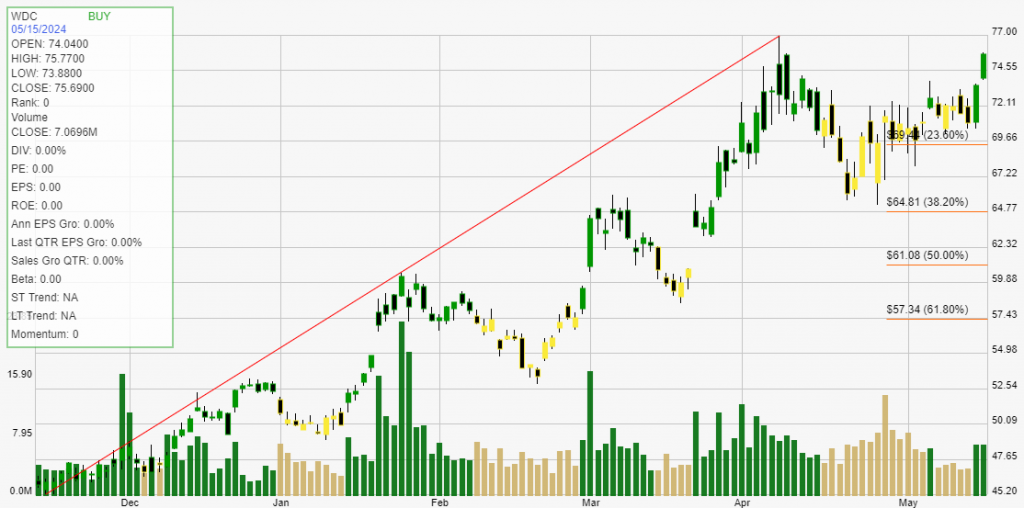

Currently, Western Digital’s stock is in the buy zone, indicating a bullish momentum location that suggests a favorable time for potential investors. The stock has been finding significant support at the Fibonacci .236 support zone, a technical analysis indicator that many traders use to identify potential reversal points in a stock’s price.

This support level signifies a strong base, suggesting that the stock may have limited downside risk and potential for upward movement. As a company with a solid market position and innovative products, Western Digital is well-positioned to capitalize on the increasing demand for data storage solutions in an increasingly digital world.