Denison Mines Corp. is a leading uranium exploration and development company, focused primarily on the Athabasca Basin region in northern Saskatchewan, Canada. The company is involved in the acquisition, exploration, and development of uranium properties.

Denison’s key assets include its flagship Wheeler River project, which is considered one of the largest undeveloped high-grade uranium projects in the world, and its significant interests in the McClean Lake mill, one of the world’s most advanced uranium processing facilities.

The key products and services provided by Denison Mines revolve around uranium production and development. Their core focus is on advancing the Wheeler River project towards production, which includes both the Phoenix and Gryphon deposits. The Phoenix deposit is particularly notable for its high-grade ore, making it one of the most economically viable uranium resources globally. In addition, Denison offers services related to the reclamation of decommissioned mine sites through its Closed Mines operations.

The key drivers of growth for Denison Mines include the rising global demand for clean energy sources, as nuclear power is increasingly viewed as a vital component in reducing carbon emissions. This demand is coupled with a limited supply of high-grade uranium deposits, positioning Denison favorably in the market. Additionally, strategic partnerships and joint ventures with other industry leaders enhance their operational capabilities and financial strength, further propelling their growth.

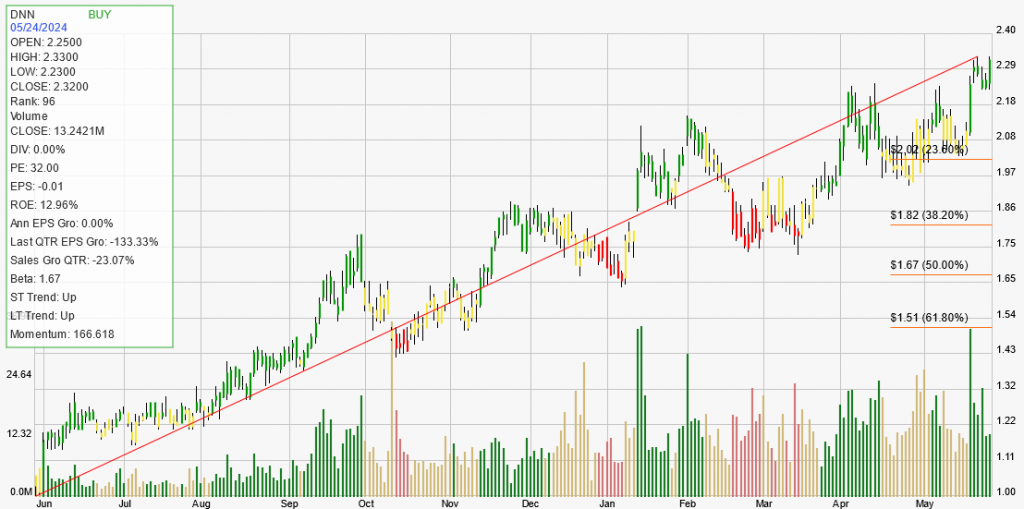

Denison Mines has recently exhibited a new buy signal and entered the momentum zone, indicating a favorable trend in its stock performance. The stock found robust price support around the $2.25 level, suggesting investor confidence and potential for upward movement. This momentum is likely fueled by positive developments in their key projects and a favorable outlook for the uranium