FTAI Aviation Ltd. (FTAI) is a dynamic company specializing in aviation-related services and infrastructure. The company focuses on providing a wide range of services including aircraft leasing, engine leasing, and other aviation-related assets. Their key products include leasing commercial aircraft and engines, which are critical components for airline operations.

FTAI’s innovative approach allows them to offer flexible and cost-effective solutions to their clients, making them a preferred choice in the aviation industry. The company’s engine leasing business is particularly noteworthy, providing airlines with essential equipment without the upfront costs and maintenance hassles.

FTAI’s growth is driven by several factors, including the increasing demand for air travel and the subsequent need for more aircraft and engines. As airlines expand their fleets to accommodate more passengers, the demand for FTAI’s leasing services rises. Additionally, the company benefits from the aging aircraft fleets of many airlines, which require more frequent maintenance and engine replacements, further boosting their leasing services. The company’s strategic acquisitions and investments in high-demand aviation assets also play a crucial role in driving growth.

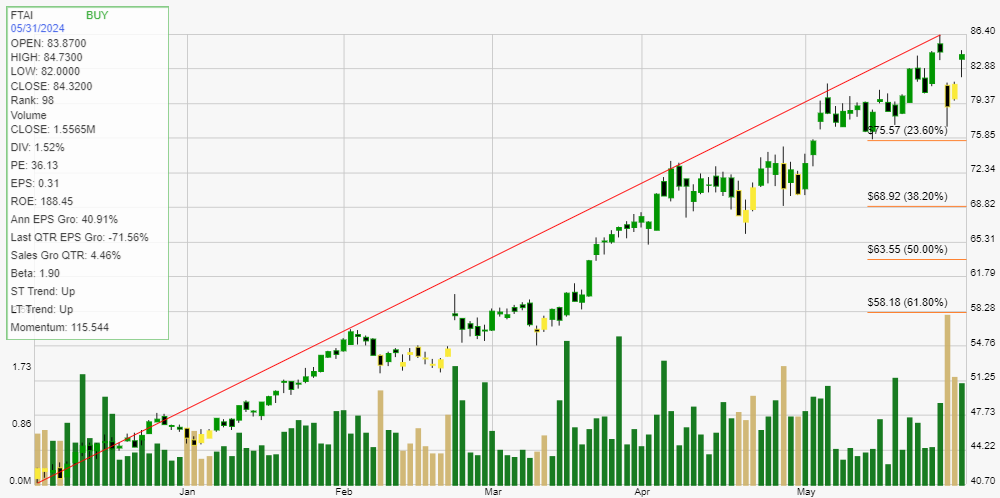

Recently, the stock of FTAI Aviation Ltd. has shown impressive performance, transitioning from a hold to a buy rating and entering the bullish momentum zone. This shift is fueled by the company’s strong financial performance, strategic growth initiatives, and the robust recovery of the aviation sector post-pandemic. Investors are increasingly confident in FTAI’s ability to capitalize on the growing aviation market, making it an attractive investment opportunity. With its solid business model and strategic focus, FTAI Aviation Ltd. is well-positioned to continue its upward trajectory in the aviation industry.