The Hartford Financial Services Group, Inc. (HIG) is a well-established insurance and financial services company headquartered in Hartford, Connecticut. It provides a range of services, including property and casualty insurance, group benefits, and mutual funds. The company’s core offerings include auto and homeowners insurance, small business insurance, and employee benefits such as disability and life insurance. Hartford also offers investment products, including annuities and mutual funds, which cater to both individual and institutional clients.

One of the key drivers of growth for Hartford is its focus on the small business sector. By providing tailored insurance solutions to small businesses, the company taps into a significant market with substantial growth potential. Another growth driver is Hartford’s commitment to digital transformation. The company has invested heavily in technology to enhance customer experience, streamline operations, and reduce costs. This includes online portals and mobile apps that make it easier for customers to manage their policies and claims. Additionally, Hartford’s strong underwriting performance and disciplined approach to risk management have helped maintain profitability and drive growth.

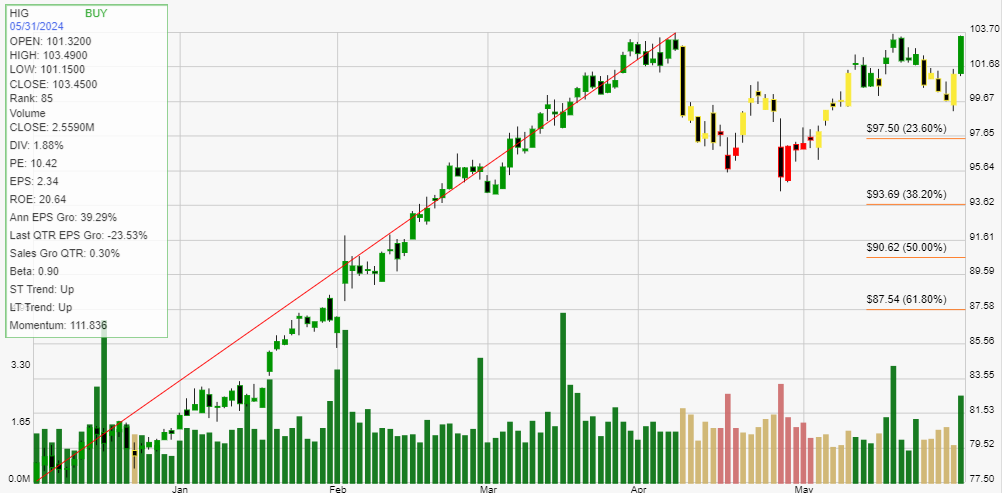

The stock of Hartford Financial Services Group has recently moved from a hold to a buy recommendation. This shift is due to its bullish momentum, as the stock has been breaking out to new highs. Investors are increasingly confident in the company’s ability to grow and deliver strong financial performance. The bullish sentiment is driven by Hartford’s solid financial health, consistent dividend payouts, and strategic initiatives aimed at expanding its market presence and improving operational efficiency.